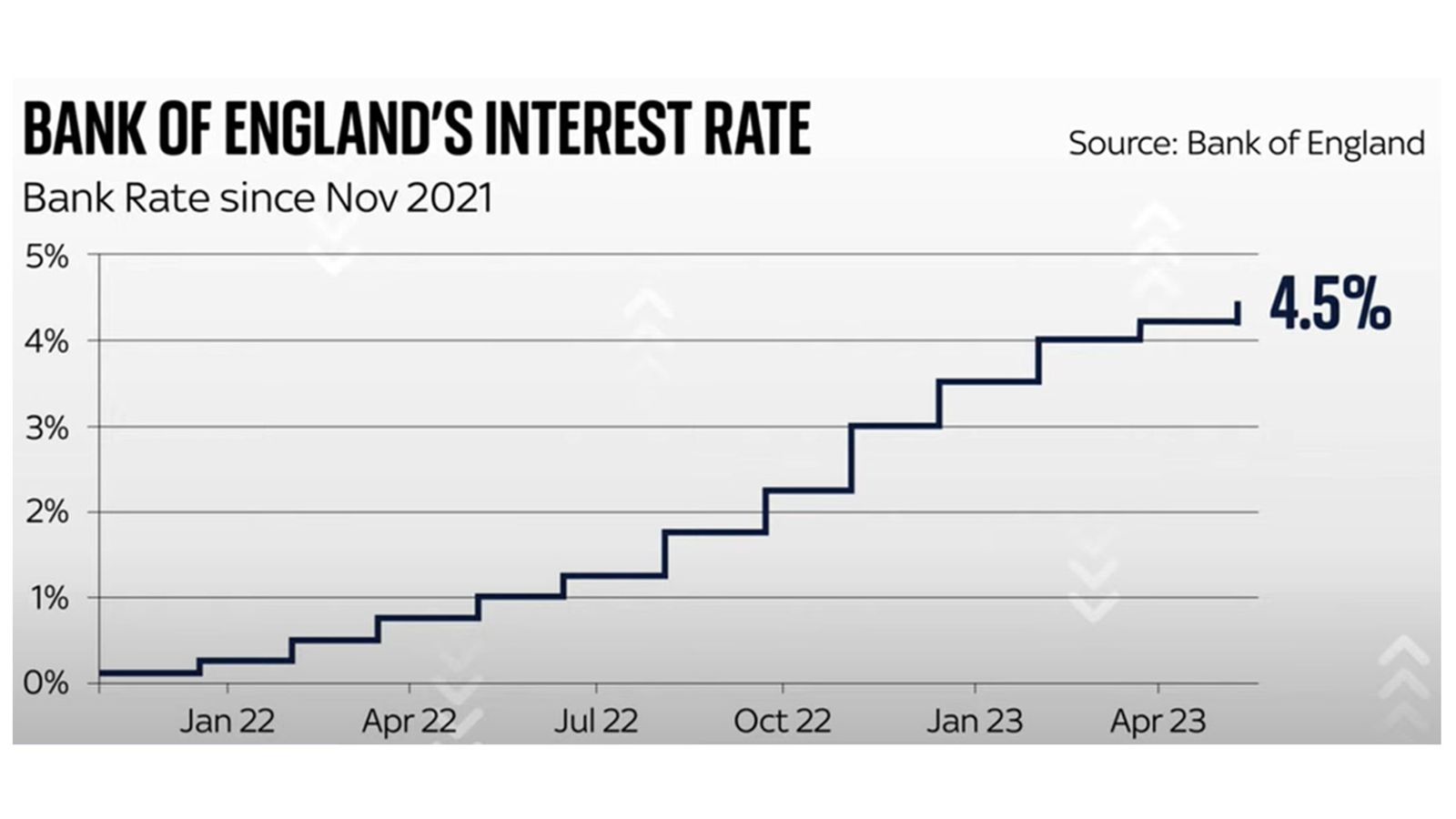

The Bank of England has raised interest rates for a record-breaking 12th successive meeting, lifting the cost of borrowing to 4.5% and warning that inflation would be higher this year than it previously anticipated.

The bank’s Monetary Policy Committee said that there would be no recession this year, upgrading its economic growth forecasts by more than in any of its previous reports.

It is a dramatic change from only a few months ago, when it was predicting the longest-lived recession in modern British history. However, it still only results in relatively lacklustre economic growth this year and next.

While it signalled that interest rates may now be at their peak, the bank also said that it had been surprised by the rate at which food prices are rising, and that meant that wider inflation – the speed at which prices are rising each year – would be stickier this year and next.

The bank is now forecasting that inflation will be around 5% at the end of this year, rather than the 4% level it previously forecast.

That means the prime minister may come within a whisker of missing his target of halving inflation this year – though the bank’s forecasts imply he will narrowly squeak what previously looked like a somewhat unambitious target.

With interest rates now at the highest level since 2008, an increasing number of households are feeling the impact of rising borrowing costs, but the bank says only a third of the pain from higher mortgage payments had yet trickled into the economy.

Cost of living pain still to come for millions despite Bank of England’s rosier outlook

Inflation rate rises – and why we’re still paying more on our mortgages

Cost of living: Higher wage growth suggests another interest rate rise is on the way

Be the first to get Breaking News

Install the Sky News app for free

The vote to change interest rates was split, with seven members voting for the quarter percentage point increase but two MPC members, Silvana Tenreyro and Swati Dhingra, voting to leave them unchanged.

The new MPC forecasts suggest the economy will grow by around a quarter percentage point this year, compared with a previous forecast of a half percentage point contraction.

That will be followed in 2024 by a three-quarter point increase in gross domestic product, compared with previous forecasts for a quarter percentage point fall.