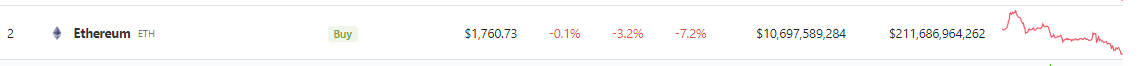

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, has been experiencing a period of volatility in recent days.

After hitting the $2,000 mark last month, the price of Ethereum has dropped sharply, falling below the $1,800 level on multiple occasions.

This has left investors wondering whether the bulls will step in to save the day and push the price back up.

The cryptocurrency market as a whole has been experiencing a period of uncertainty, with many investors questioning the sustainability of the recent bull run.

Despite these challenges, Ethereum has remained a key player in the cryptocurrency ecosystem, with many investors remaining bullish on its long-term prospects.

Ethereum (ETH) Value Drops As Market Volatility Persists

According to CoinGecko, Ethereum’s current price has taken a sharp dive, plunging to $1,760. This marks a significant 24-hour decline of 3.2% and a week-long decrease of 7.2%. This comes after Ethereum made a new high in mid-April, surpassing $2,100.

Although it experienced a retracement, the $1,800 support level prevented further decline and has remained stable for the past two weeks, provided Bitcoin does not drop below $27,000.

If Ethereum experiences aggressive demand at its current levels, the $1,800 support level may come to the bulls’ rescue. However, if Bitcoin drops to $26,000, Ethereum’s support level could crack, exposing it to further selloffs.

In such a scenario, Ethereum could retreat to lower support levels at $1,700 or even $1,500. It’s worth noting that upper resistance levels to consider are at $2,000 and $2,100.

Market-Wide Selloff Blamed For ETH Retreat

As the cryptocurrency market continues to experience volatility, investors are keeping a close eye on Ethereum’s price movements. With the current drop below $1,800, many are wondering where Ethereum is heading next.

Some analysts believe that Ethereum’s decline is a result of a market-wide sell-off, driven by concerns over Bitcoin’s regulatory crackdowns.

Others suggest that the recent decline in Ethereum’s price could be attributed to concerns over its high transaction fees and network congestion.

Looking ahead, its current support level remains a critical factor in Ethereum’s price trajectory. If the bulls step in to save the day and push the price back up, Ethereum could reclaim its previous support levels and continue its upward trend.

However, if the bears continue to dominate the market and push the price below the $1,800 support level, Ethereum could experience further declines.

The cryptocurrency market remains unpredictable, and investors should exercise caution when making investment decisions.

While Ethereum’s long-term prospects remain positive, short-term price movements are subject to a range of factors that could impact its value in the near term.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk)

-Featured image from BuzzFeed