Quick Take

- “A mortgage-backed security (MBS) is an investment secured by a collection of mortgages bought by the banks that issued them. Mortgage-backed securities are bought and sold on the secondary market. An MBS is a type of asset-backed security”.

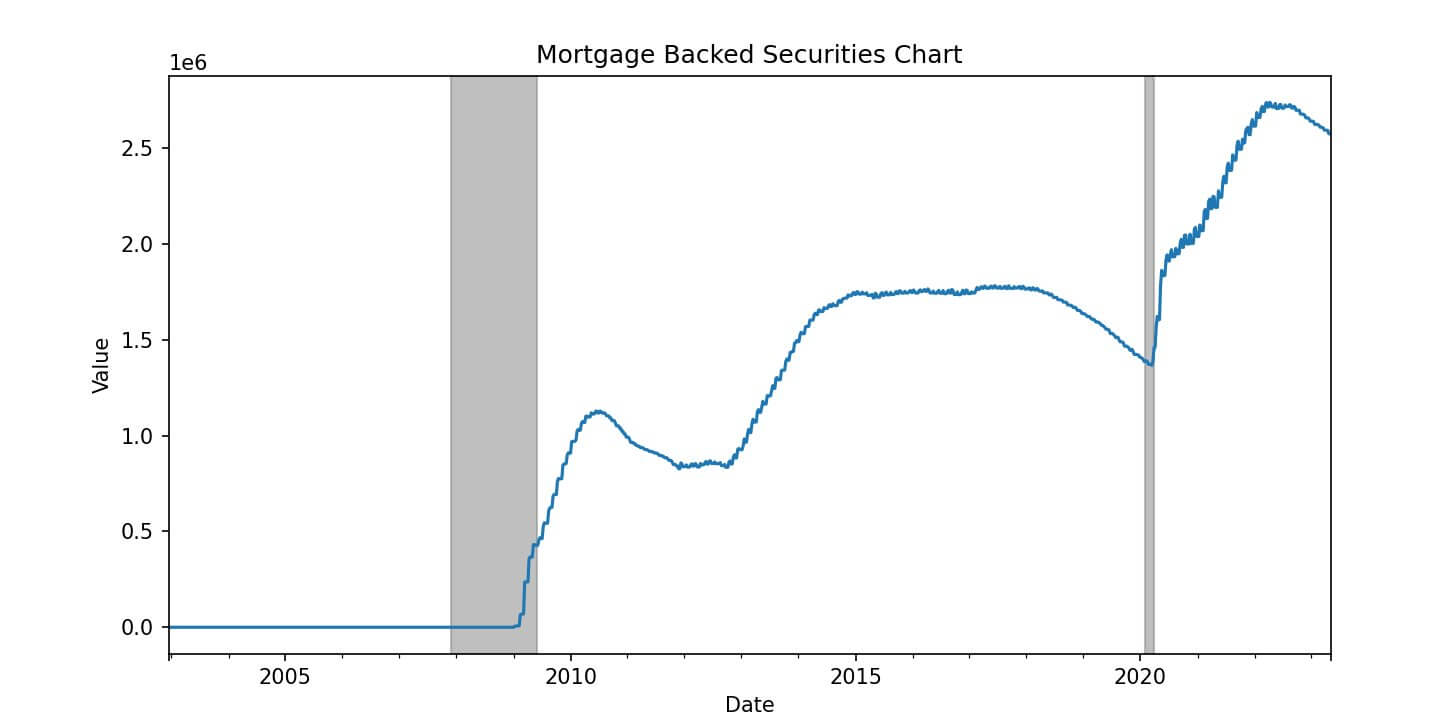

- 2008 during the GFC, the Federal Reserve had to step in and buy MBSs to support the economy, add liquidity to the market, and keep interest rates low.

- Fast forward 15 years, and FED now holds $2.6 trillion worth of MBS.

- These MBS will not be worth $2.6 trillion with rising interest and mortgage rates. Selling below par for the FED would see huge losses on their portfolio and “mark to market losses.”

- What would the new value of these securities be? Substantially less.

- It would make more sense for the FED to offload these securities before a higher % becomes more underwater.

- Each time the FED tries to offload these MBS, they have to keep buying them up over the long term.

The post Fed’s $2.6T MBS dilemma – rising rates could trigger massive portfolio losses appeared first on CryptoSlate.