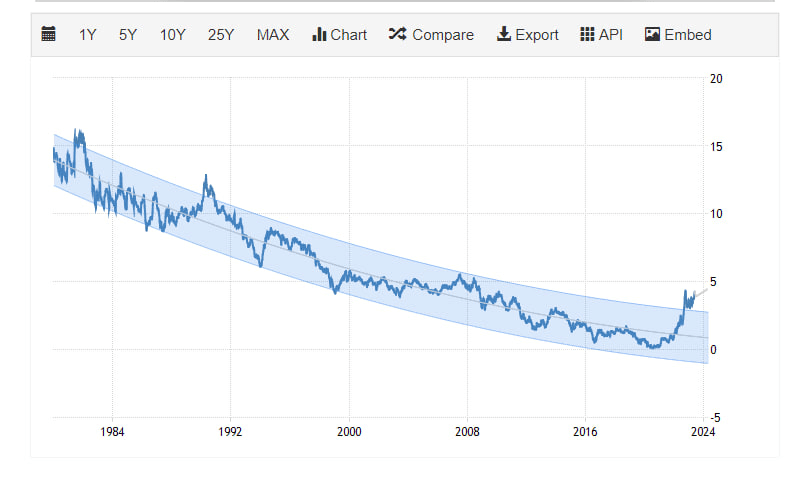

The United Kingdom’s core inflation reached 6.8% in April, its highest level since 1992, as CryptoSlate reported in a recent insight. This surge in inflation has occurred alongside a backdrop of declining interest rates for over 40 years, which has inflated asset bubbles across the board.

Core inflation represents the fluctuation in the cost of goods and services, excluding items within the food and energy sectors. It remains more persistent than overall headline inflation, as the U.K. experienced its most constricted labor market in more than 25 years, with an unemployment rate under 4%.

The rapid increase in core inflation has led to skyrocketing bond yields, breaking a 40-year trend line for 10-year government bond yields. This has raised concerns about the consequences for the financial markets, primarily as debt levels have surpassed 100% of GDP. In this context, examining the potential impact of the U.K.’s accelerating inflation on the cryptocurrency market, specifically Bitcoin (BTC), is crucial.

Inflation uncertainty pushing Bitcoin adoption

Throughout the past year, investors have preferred Bitcoin over fiat currencies in times of uncertainty. For instance, Turkey’s lira has continuously declined since 2018, with cumulative inflation surpassing 100% over the past three years. This devaluation prompted Turkish investors to diversify their assets, significantly increasing BTC/TRY trading volume.

Similarly, the British pound experienced a flash crash on September 26, 2022, losing 4.3% of its value against the U.S. dollar in a single day. Bank of England’s emergency intervention in the bond market led to a record-breaking BTC/GBP trading volume, soaring over 1,200% in just 24 hours.

These examples indicate a growing trend among investors worldwide: in times of macro uncertainty, inflation, and debased fiat currencies, Bitcoin is increasingly perceived as a safe haven.

Leveling the playing field on volatility

Given the U.K.’s skyrocketing core inflation, investors in the region may adopt a similar approach, turning to Bitcoin as a hedge against rising consumer prices. This shift could boost BTC trading volume and overall interest, particularly among investors seeking to protect their wealth from dwindling value.

The mounting volatility in fiat currencies, primarily driven by inflation, could effectively equalize the field regarding the traditionally perceived volatility of cryptocurrencies. Consequently, the distinction between the stability of traditional currencies and the fluctuations of digital assets is becoming less pronounced, reshaping how investors perceive and approach both financial realms.

The post UK core inflation hits 28-Year high, boosting Bitcoin adoption as safe haven appeared first on CryptoSlate.