The Bitcoin hash rate continues trending upwards, having experienced a spike last weekend(May 27-28, 2023) that puts it on track to re-test its all-time high of 400 TH/s.

The hash rate quantifies the computing power within a Proof-of-Work (PoW) network. In addition, it serves as an indicator to gauge a network’s general health and security.

A higher hash rate shows increasing attempts to solve the target hash and win the block. This indicates more miners participating in the network or more powerful mining equipment coming online.

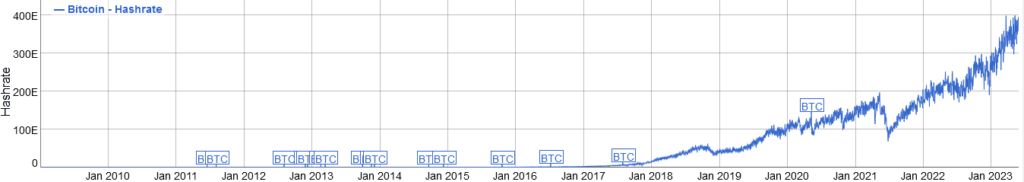

Bitcoin hash rate

The chart above shows a sustained upward trajectory of the Bitcoin hash rate. Although a temporary decline occurred around May 2021 due to the China PoW mining ban, a recovery from late June 2021 onwards saw a notable acceleration of the overall upward trend.

In March, Bitcoin community members commented on the unprecedented rise in hash rate – offering their theories to explain the matter.

Seb Gouspillou, the CEO of mining firm BigBlock DC Bitcoin, said it was due to a flood of miners upgrading outdated equipment. However, River Financial Analyst Sam Wouters attributed the hash rate jump to positive BTC price action, which saw the leading cryptocurrency spike from $22,000 to $28,300.

In March, the hash rate reached a new all-time high of 398 TH/s. However, after a brief decline, it surpassed this level on May 11 when it hit 400 TH/s. Three weeks later, the hash rate is shaping to re-test this level with a current reading of 396 TH/s.

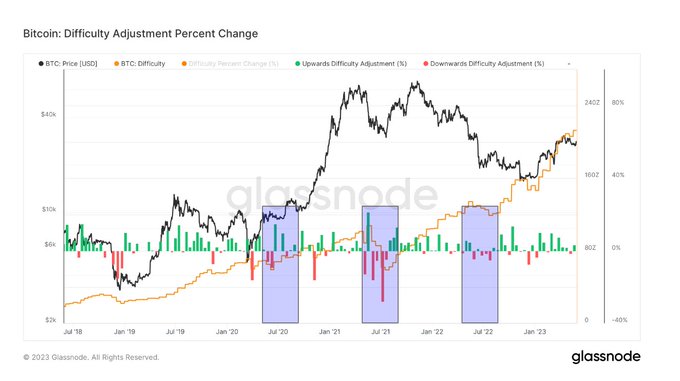

Difficulty adjustment

There is an ongoing debate on whether the Bitcoin price follows the hash rate or if the opposite is true.

The Co-founder of Reflexivity Research, Will Clemente, hinted at the former by pointing out that during the 2019 bear market, the hash rate did not reach an all-time high until Bitcoin tripled in price from its lows. This time, there has been a doubling in hash rate from the May 2021 lows, but the BTC price is up only 75% from its low.

Similarly, the Host of the Orange Pill Podcast, Max Keiser, said, “Hashrate is more important to follow than price,” – adding that the price has a “mathematically guaranteed” higher probability of increasing with a rising hash rate.

Analyzing the difficulty trend, CryptoSlate Researcher James Van Straten noted that the rising hash rate would warrant an adjustment higher. However, since 2020, the summer period is usually characterized by lower difficulty adjustments – which has not happened this year.

Mining difficulty refers to an algorithmic function that regulates the timing of solving the block. For example, a rising hash rate will lessen the time to solve the target hash, but the block time must remain at around 10 minutes, requiring difficulty to adjust higher.

The post Bitcoin hash rate resumes uptrend – poised to retest 400 TH/s ATH appeared first on CryptoSlate.