On-chain data shows Bitcoin is slowly moving from the old holders to new investors, a sign that could be positive for the market.

Bitcoin RHODL Ratio Has Been Climbing Up In Recent Days

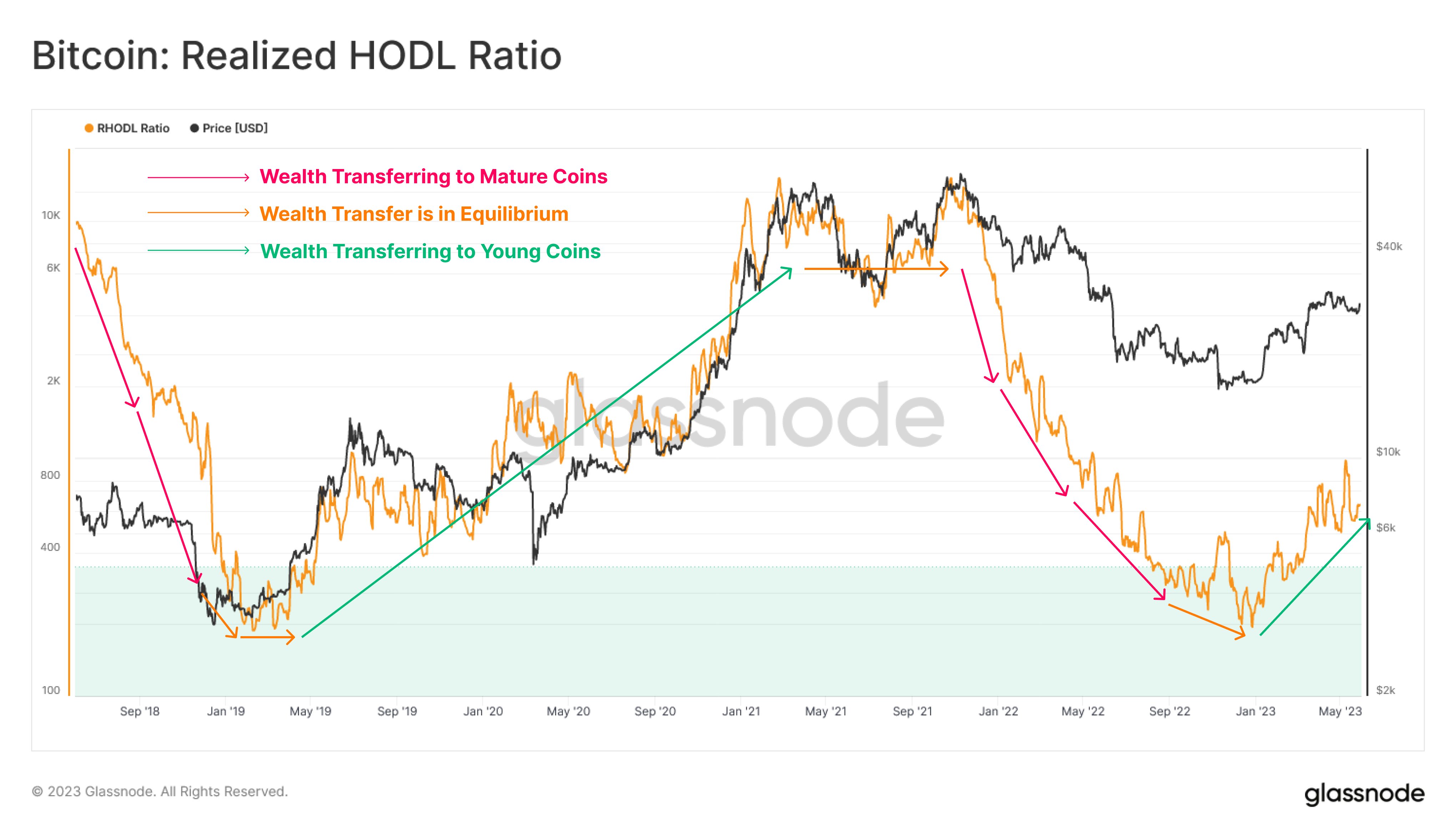

According to data from the on-chain analytics firm Glassnode, this kind of trend is usually seen in the middle of cycle transitions. The “Realized HODL (RHODL) ratio” is an indicator that tells us the ratio between the supplies held by the 1-week-old holders and the 1 to 2 years old investors.

To be more specific, this indicator doesn’t simply measure the amount of market cap held by these groups, but rather the “realized cap.” This capitalization method calculates the value of the supply by assuming that each coin is worth not the current spot price, but the price at which it was last moved on the blockchain.

Here, the 1-week old investors represent the youngest of the BTC participants, who have just bought their coins. Thus, the realized cap held by them provides hints about the wealth owned by the newcomers.

The 1-2 years old BTC investors, on the other hand, are a segment of the long-term holders, meaning that they are the more experienced players in the market.

Since the RHODL ratio compares the supplies of these young and old holders (though, only some segments of them), it can deliver insight into how these supplies are changing relative to each other.

Now, here is a chart that shows the trend in the Bitcoin RHODL ratio over the last few years:

As you can see in the above graph, Glassnode has marked the wider trends that the indicator has followed during the previous cycle as well as in the current Bitcoin cycle.

It seems like during the bear markets in both the previous and the current cycles, the indicator had been observing a constant downtrend. This means that the young investors had been leaving the market while the long-term holders had been accumulating.

This trend makes sense, as the young investors would constantly get into losses during a bear market downtrend, so a lot of them would quickly sell their holdings.

Following the bear market bottom formation in the last cycle, the Bitcoin RHODL ratio stopped its decline and soon reversed the trend when some fresh bullish momentum came in the form of the April 2019 rally.

A similar trend has also been observed during the current cycle, implying that the bottom after the FTX crash back in November 2022 may have been the bottom after all.

Just like during the April 2019 rally, the indicator has been moving up during the current rally. This suggests that new participants are once again interested in accumulating the cryptocurrency.

Such a signal has historically been constructive for Bitcoin, with this kind of market shift from the long-term holders towards new hands often leading to full-blown bull markets.

BTC Price

At the time of writing, Bitcoin is trading around $27,000, up 1% in the last week.