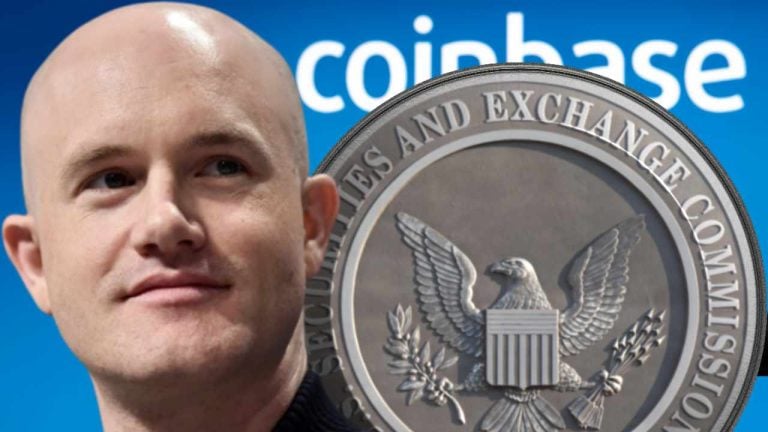

Coinbase CEO Brian Armstrong has responded to the lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against his cryptocurrency exchange. The securities regulator charged Coinbase with “operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency,” as well as selling unregistered securities “in connection with its staking-as-a-service program.”

Coinbase CEO Brian Armstrong Addresses SEC Charges

The chief executive of the Nasdaq-listed cryptocurrency exchange Coinbase, Brian Armstrong, took to Twitter Tuesday to address the lawsuit filed against his exchange by the U.S. Securities and Exchange Commission (SEC).

The securities regulator charged Coinbase with “operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency,” as well as selling unregistered securities “in connection with its staking-as-a-service program.”

Armstrong tweeted: “Regarding the SEC complaint against us today, we’re proud to represent the industry in court to finally get some clarity around crypto rules.” The Coinbase executive proceeded to outline a number of factors affecting his exchange’s alleged securities law violations. He detailed:

There is no path to ‘come in and register’ — we tried, repeatedly — so we don’t list securities. We reject the vast majority of assets we review.

Coinbase similarly stated in March, after it received a Wells notice from the SEC, that it tried to register with the regulator but the securities watchdog “will not let crypto companies ‘come in and register.’”

Furthermore, Armstrong pointed out in his Tuesday tweet that the SEC and the Commodity Futures Trading Commission (CFTC) “have made conflicting statements, and don’t even agree on what is a security and what is a commodity.” One of the key topics that the two regulatory agencies disagree on is the classification of ether (ETH). While SEC Chair Gary Gensler claims that all crypto tokens, other than bitcoin (BTC), are securities, the chairman of the CFTC, Rostin Behnam, has insisted that the second-largest cryptocurrency is a commodity.

Emphasizing the lack of regulatory clarity in the crypto space, the Coinbase boss stressed:

This is why the U.S. Congress is introducing new legislation to fix the situation, and the rest of the world is moving to put clear rules in place to support this technology.

“Instead of publishing a clear rule book, the SEC has taken a regulation by enforcement approach that is harming America. So if we need to avail ourselves of the courts to get clarity, so be it,” the Coinbase CEO added.

Armstrong also noted: “The SEC reviewed our business and allowed us to become a public company in 2021.” However, multiple people have pointed out on Twitter that the lawsuit clearly states that “Declaring effective a Form S-1 registration statement does not constitute an SEC or staff opinion on, or endorsement of, the legality of an issuer’s underlying business.”

After the securities watchdog announced its action against Coinbase, many people took to social media to slam the SEC for regulating the crypto industry by enforcement. Senator Bill Hagerty (R-TN) wrote: “The SEC is weaponizing their role to kill an industry. Allowing a company to list publicly and then stonewalling their attempts to register is indefensible.” Senator Cynthia Lummis (R-WY) opined: “The SEC has failed to provide a path for digital asset exchanges to register, and even worse has failed to provide adequate legal guidance on what differentiates a security from a commodity.”

One day prior to charging Coinbase, the SEC filed 13 charges against Binance and its CEO, Changpeng Zhao (CZ). In addition, the regulator filed an emergency action application, requesting a temporary restraining order to freeze the assets of Binance US customers.

What do you think about Coinbase CEO Brian Armstrong’s statements regarding the SEC lawsuit? Let us know in the comments section below.