The U.S. Securities and Exchange Commission (SEC) sued Binance and Coinbase earlier this week, introducing considerable volatility into the crypto market.

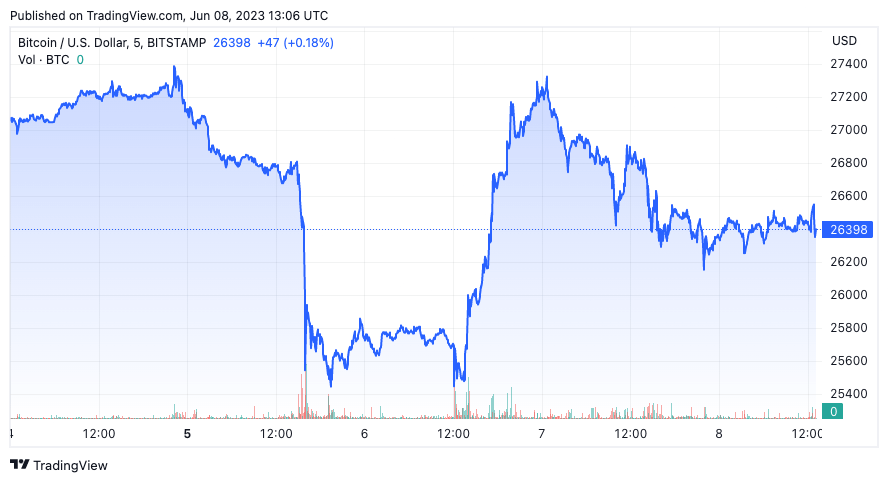

Bitcoin reacted strongly to these events — on June 5, it dropped from $27,300 to $25,300, a 7.3% decrease. This sharp dip incited concern among investors, as the legal uncertainty raised the possibility of a further decline in Bitcoin’s value.

However, Bitcoin’s drop halted at $25,300. By June 7, the cryptocurrency had regained its losses, posting a recovery of 7.9%. Bitcoin’s ability to maintain its value above $25,300 can be attributed to the crucial resistance level that falls within the trading range the cryptocurrency has sustained for the past 30 days.

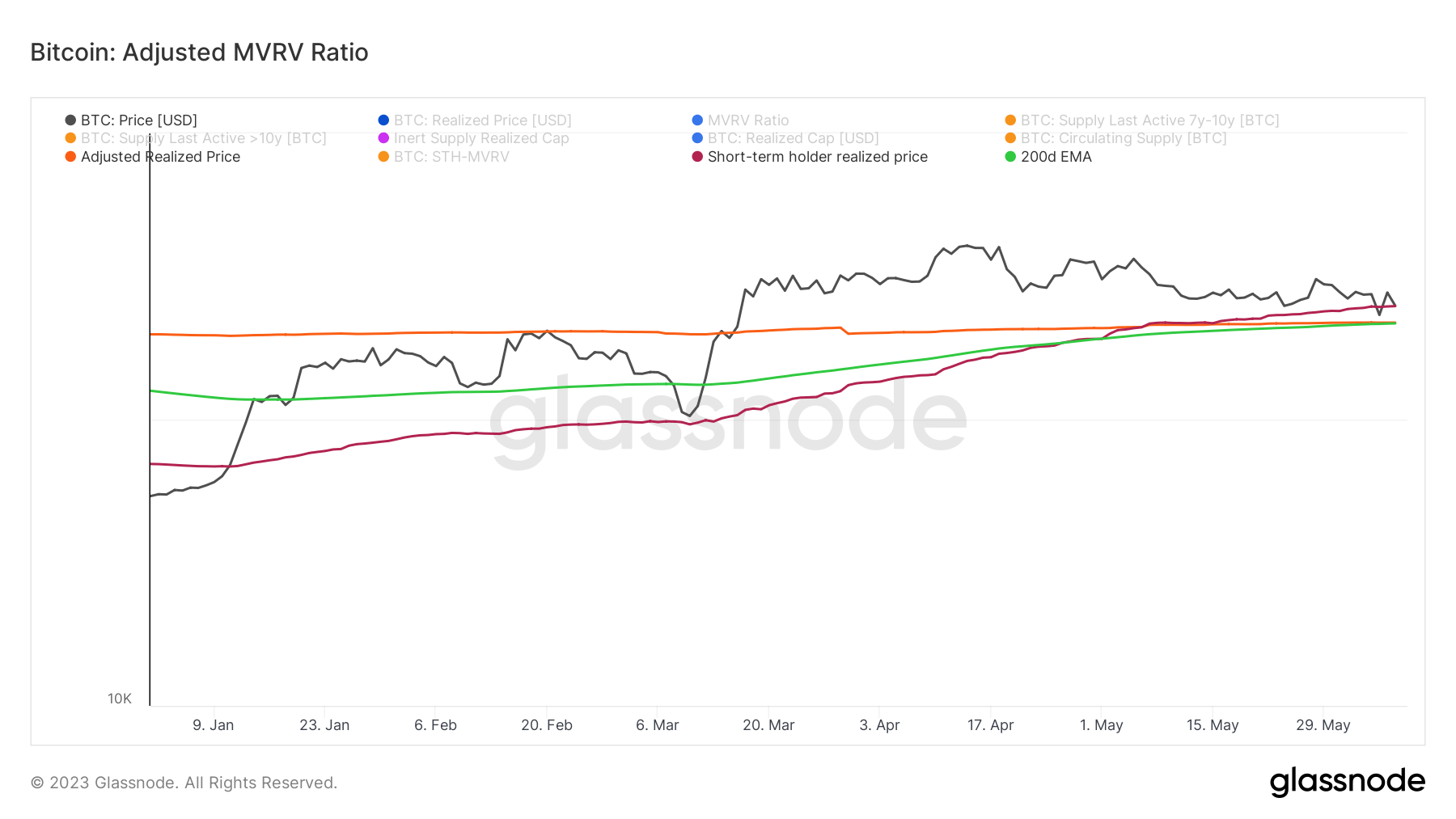

This trading range comprises three significant price points: the upper, middle, and lower. The upper level corresponds to the short-term holder cost basis, the middle to the 200-day exponential moving average (EMA), and the lower to the adjusted realized price. Each of these metrics is integral to assessing market sentiment for Bitcoin.

The short-term holder cost basis reflects the average price at which short-term holders have purchased Bitcoin. This metric provides valuable information about the potential sell threshold for these investors, which can inform overall market sentiment.

The 200-day EMA is a widely used tool in market analysis. It calculates the average closing price of a security over the last 200 days, but unlike a simple moving average, the EMA assigns more weight to recent prices. This characteristic makes the EMA more responsive to recent price changes, which can help detect potential trend reversals earlier. As such, it provides insight into long-term market sentiment, allowing for a comprehensive view of price trends.

The adjusted realized price refers to the average price at which all coins in the market were last moved, with adjustments for lost and unmoved coins. It provides a reference point for evaluating whether most investors are in profit or loss.

On June 4, Bitcoin’s adjusted realized price stood at $25,300. The short-term holder realized price was $26,300, while the 200d EMA was $25,300.

Analyzing Bitcoin’s realized price is essential when establishing support and resistance levels. Examining realized price metrics and adjusting them based on entities such as long-term and short-term holders provides a more precise understanding of Bitcoin’s potential trading range.

Such understanding becomes crucial for identifying price bottoms and the start of market cycles. Therefore, despite the market volatility sparked by the SEC lawsuits, Bitcoin maintained its value above $25,300, indicating the market’s robustness.

The post Why is Bitcoin is holding strong in spite of the SEC’s regulatory crackdown? appeared first on CryptoSlate.