The SEC’s lawsuits against Binance and Coinbase have had a notable impact on the crypto market, affecting the behavior of all market participants, particularly short-term holders.

Short-term holders (STHs) are addresses that have held onto their coins for less than 155 days. While often appearing impulsive, this cohort’s actions provide an essential insight into broader market trends.

The effects of any market trends on short-term holders tend to be immediate, causing swift and abrupt reactions. These quick reactions often precede more significant shifts in market sentiment, revealing potential price trends. The behavior of short-term hodlers can act as an early warning system for larger market movements.

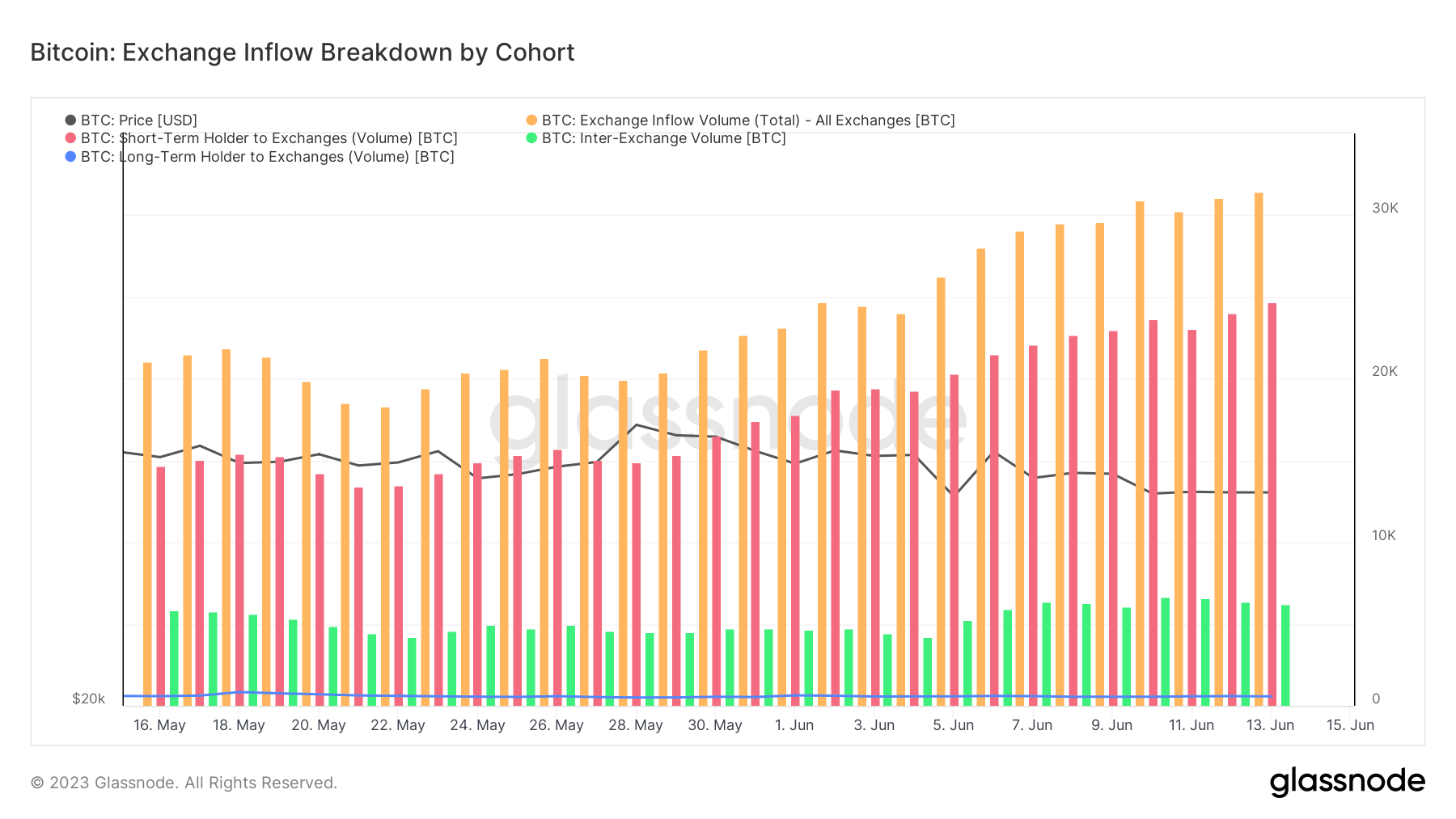

Following the SEC’s lawsuits against Binance and Coinbse, there has been a significant uptick in the short-term holder Bitcoin supply sent to exchanges. Between June 5 and June 7, 76% of all Bitcoin deposits across exchanges could be attributed to STHs.

Of the 234,400 BTC deposited to exchanges, 179,800 BTC came from STHs.

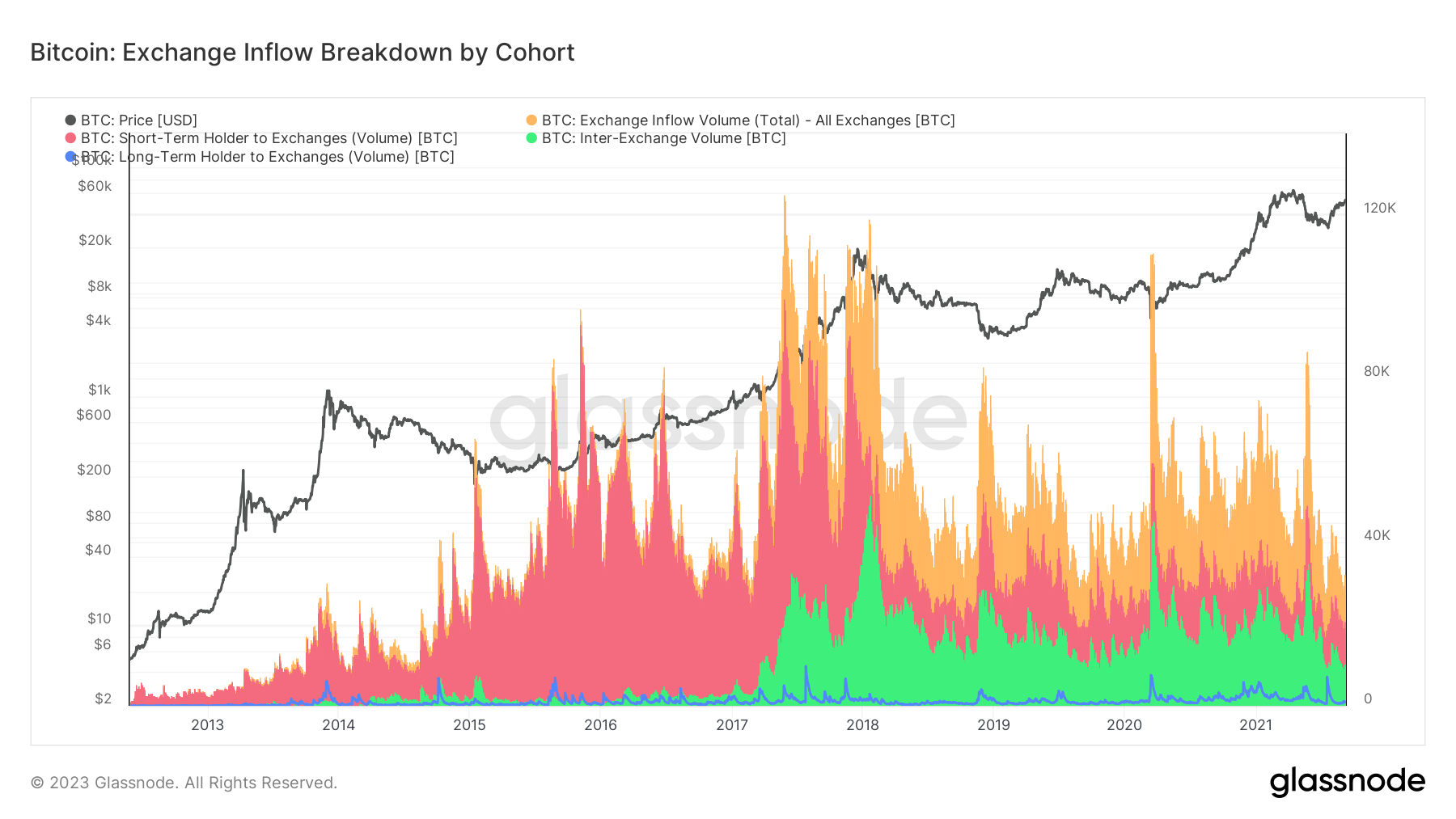

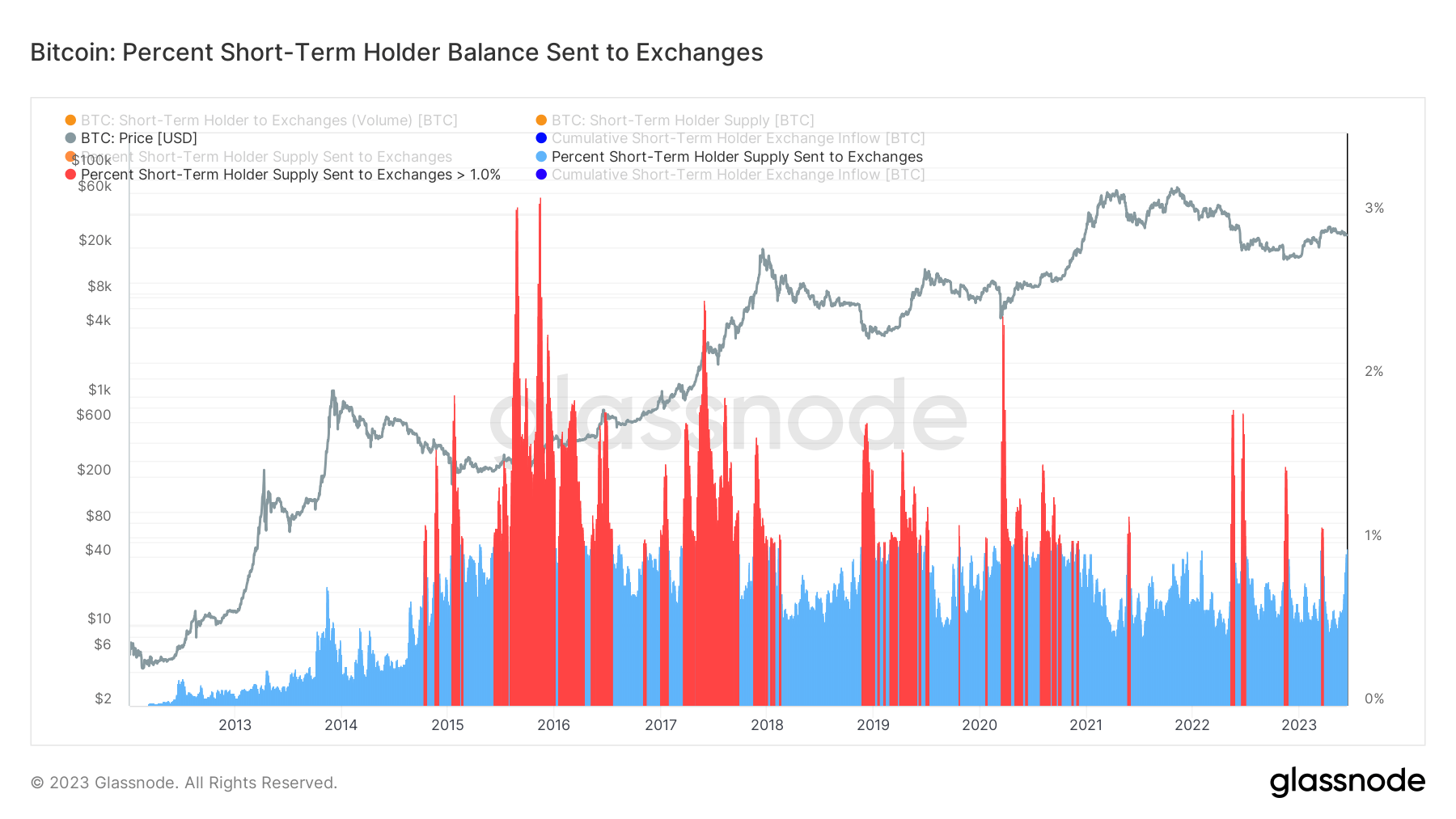

This sudden spike in short-term holder deposits dominance isn’t a frequent event. In the early days of the crypto market, most exchange deposits came from short-term holders, as indicated in the chart below. However, as the market matured, short-term holders began accounting for a smaller portion of exchange deposits. As more long-term investors have entered the space, short-term holder actions have been diluted, making such spikes a notable occurrence.

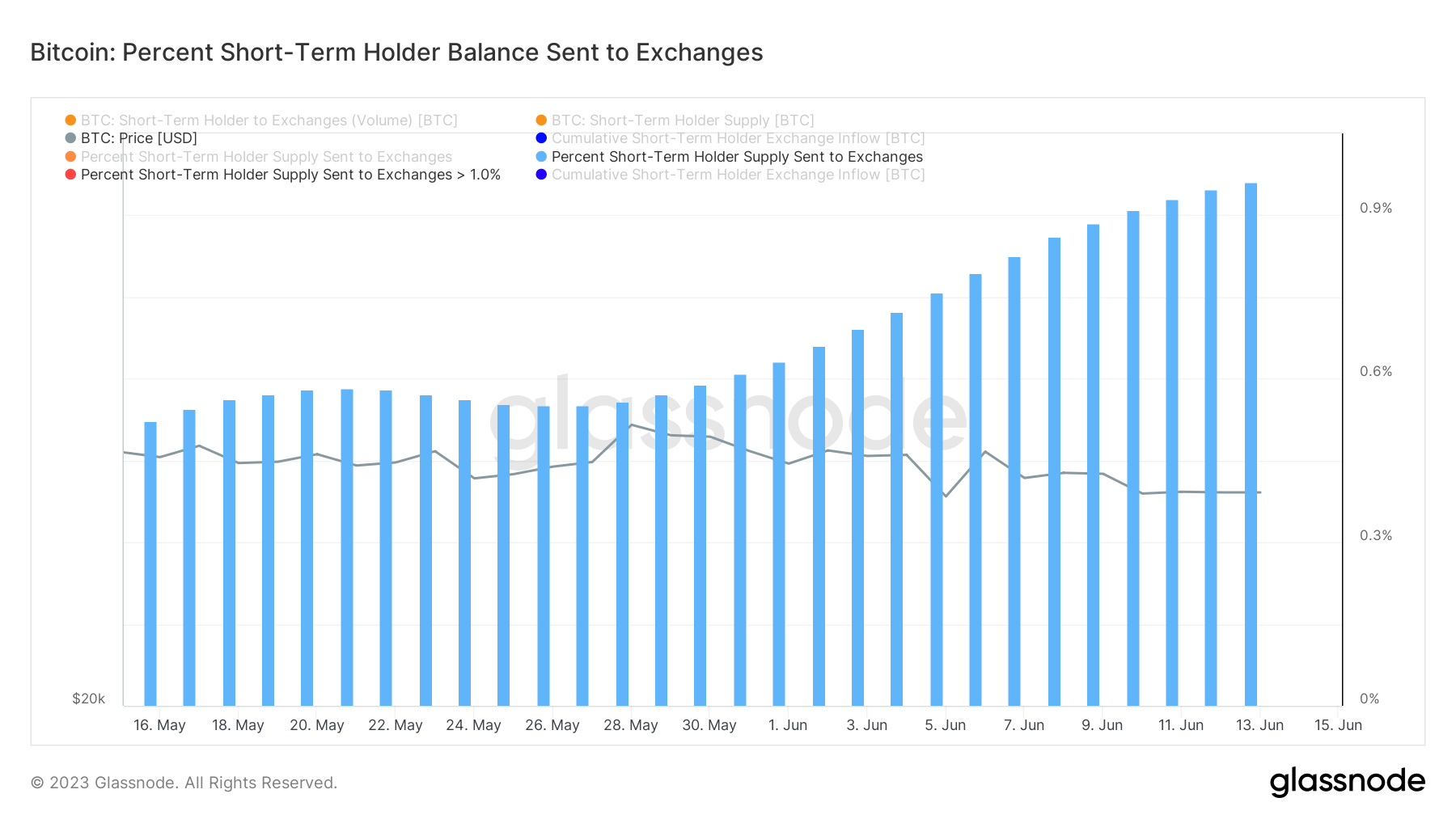

CryptoSlate analysis found that short-term holders sent 0.94% of their total Bitcoin supply to exchanges on June 12. This marks a sharp increase that began at the end of May and peaked at 0.96% on June 13.

Historically, instances where short-term holders sent 1% or more of their supply to exchanges in a single day have correlated with high-volatility events, such as market capitulation and rallies.

The post Short-term holders react swiftly to SEC lawsuits, sending Bitcoin deposits soaring on exchanges appeared first on CryptoSlate.