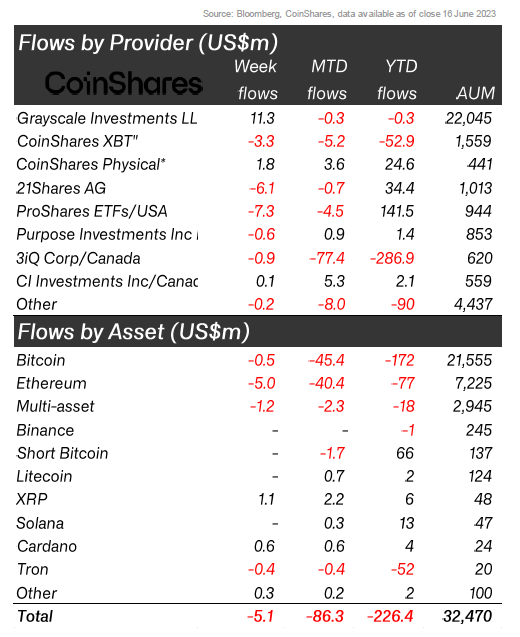

The week ending June 19, 2023, saw minor outflows totaling $5.1 million from digital asset investment products, as reported in CoinShares’ Digital Asset Fund Flows Weekly.

Despite these outflows, altcoins experienced inflows totaling $2.4 million following the prior week’s price crash, suggesting a shift in investor sentiment.

While Ethereum (ETH) experienced the most significant outflows for the week, totaling $5 million, altcoins like XRP, Cardano, and Polygon garnered inflows of $1 million, $0.6 million, and $0.2 million, respectively. These inflows indicate that investors are adding to their ETP positions in these cryptocurrencies, despite the overall negative trend in digital asset investment products.

Comparing the data to the previous week, where Ethereum ETPs saw their largest single week of outflows since the Merge, the overall trend appears to persist with continued outflows. However, a shift in investor sentiment toward all major altcoin ETPs, except Tron, is emerging.

This trend raises questions about the future of digital asset ETPs, particularly in light of recent filings by Fidelity and BlackRock to start Bitcoin ETFs. With interest rate hikes leaving investors cautious, as noted by CoinShares, it remains uncertain how these new offerings will impact the digital asset investment landscape should they be accepted.

Further, there is still uncertainty around several assets, including ADA and Polygon, which saw inflows this week due to the SEC declaring in court filings that it considers those tokens to be securities in the Coinbase and Binance lawsuits.

While the long-term implications of this trend are still uncertain, it highlights the evolving interest in digital assets through traditional financial vehicles like ETPs.

The post Altcoin ETPs see inflows amid ETH, BTC outflows as alts recover appeared first on CryptoSlate.