Quick Take

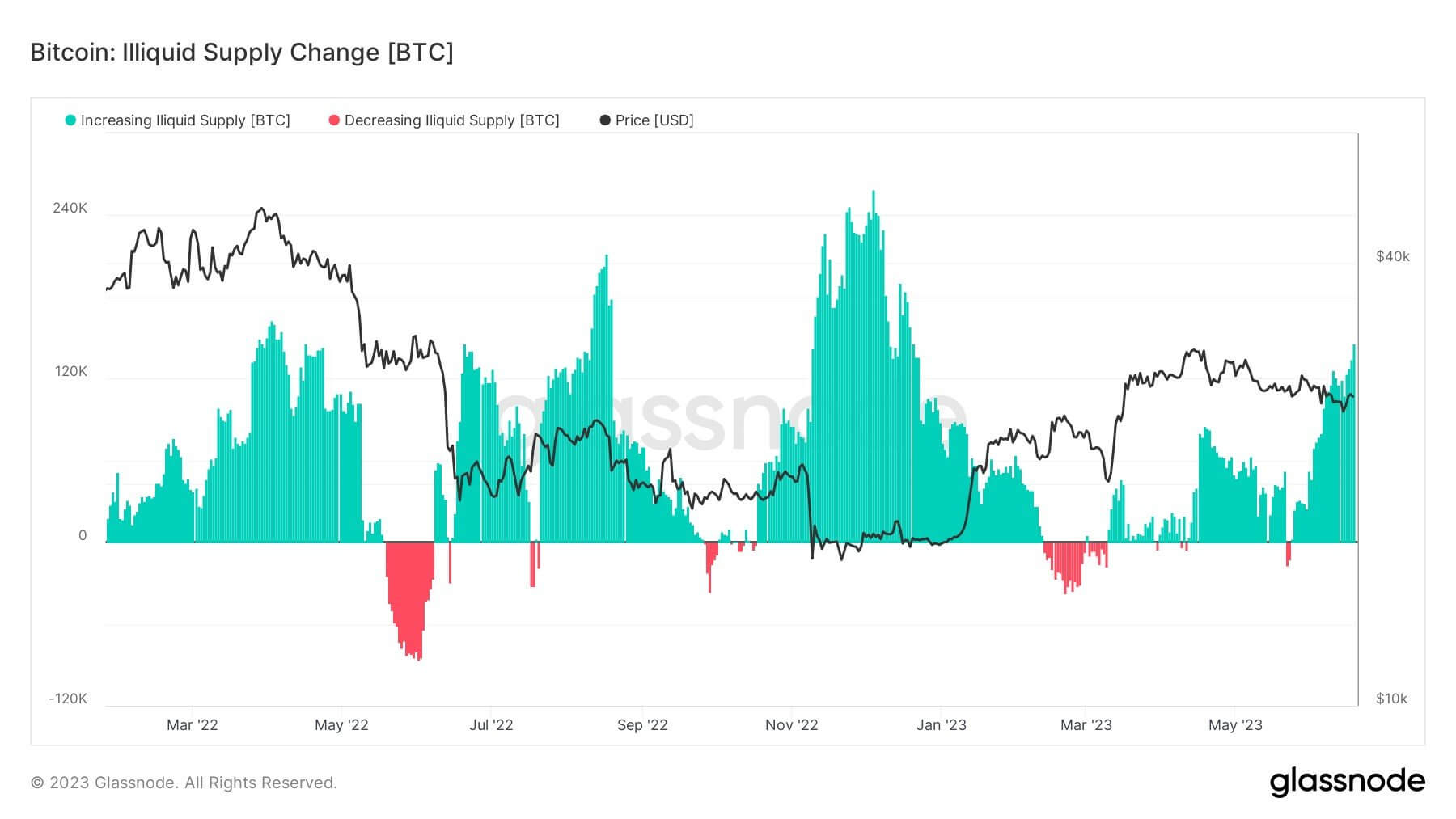

- ‘Illiquid supply’ refers to the amount of Bitcoin held by entities and is not readily available for trading or selling.

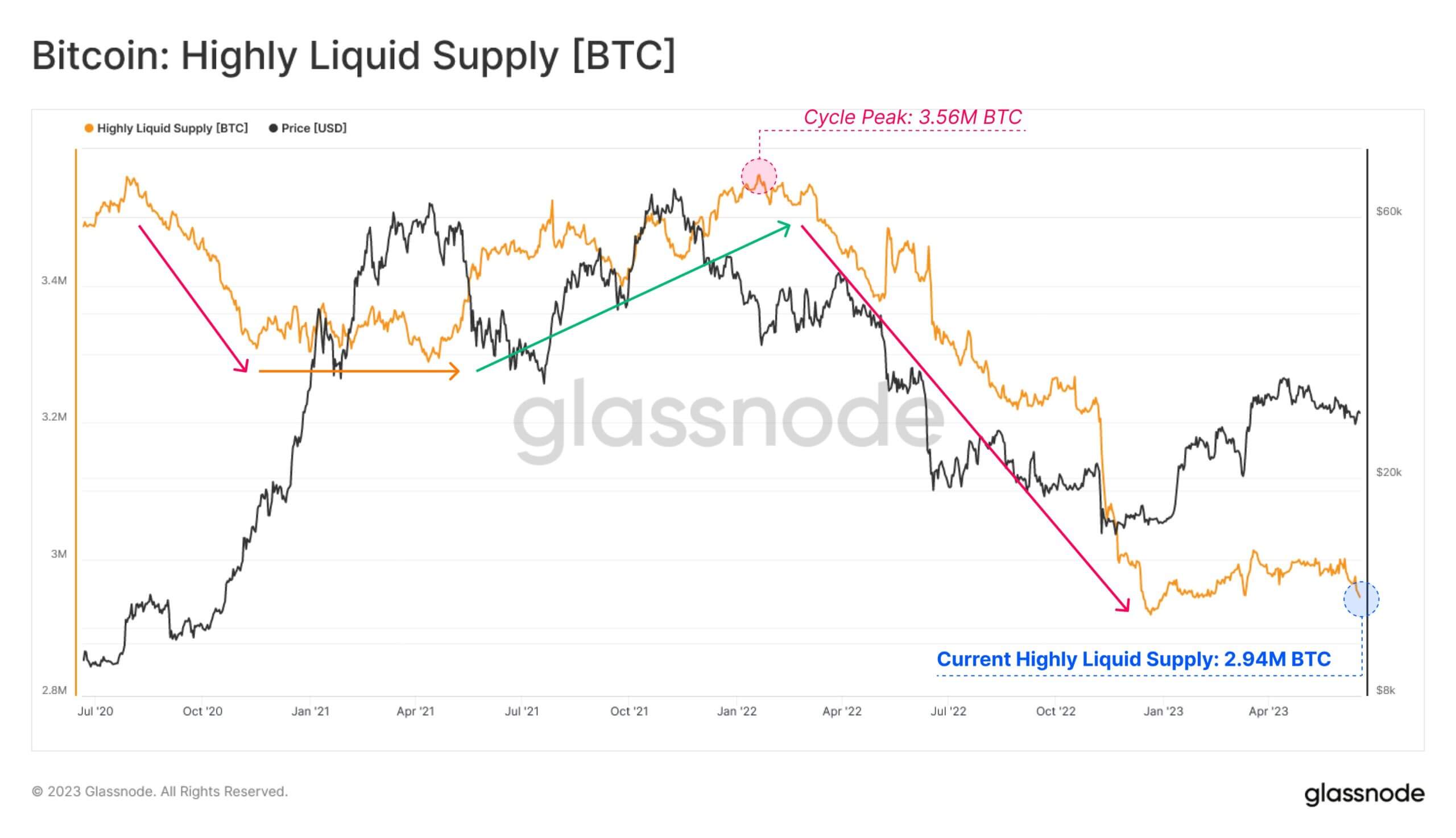

- Glassnode analysis identified the highly liquid supply in a noticeable downward trend. “Currently residing near a cycle low of 2.94M BTC, a -620K BTC decrease since Jan 2022”.

- Glassnode further said, “This suggests a significant contraction in the actively tradeable supply, resulting in both a decline in liquidity, as well as a constrained supply side.”

- To take the opposite side of this, more and more Bitcoin is becoming illiquid.

- 150k coins became illiquid in the past 30 days, similar to those seen after Luna’s collapse, marking a new year-to-date high.

- From a trend perspective, Bitcoin is becoming much less speculative and liquid.

The post Roughly 150K Bitcoin became illiquid in past 30 days appeared first on CryptoSlate.