Despite its recent resurgence to regain the 200-week moving average (WMA), Bitcoin’s price has remained within a tight trading range for the past week.

BlackRock’s announcement of integrating Bitcoin into their ETF portfolios and Bitwise’s refiling for a Bitcoin spot ETF are significant news that could potentially move Bitcoin’s price. Furthermore, whispers of a “seismic” move by Fidelity in crypto are adding to the anticipation.

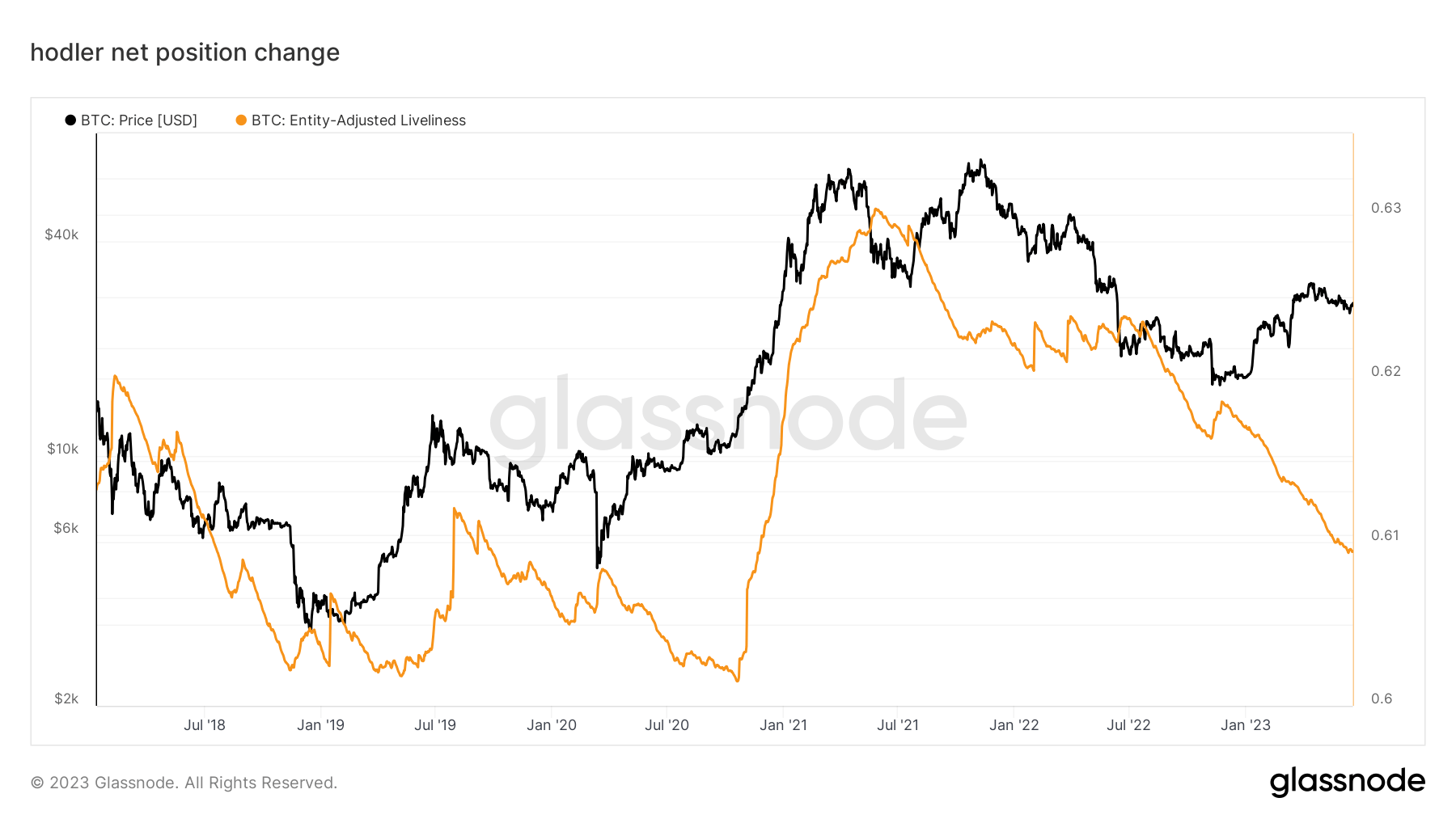

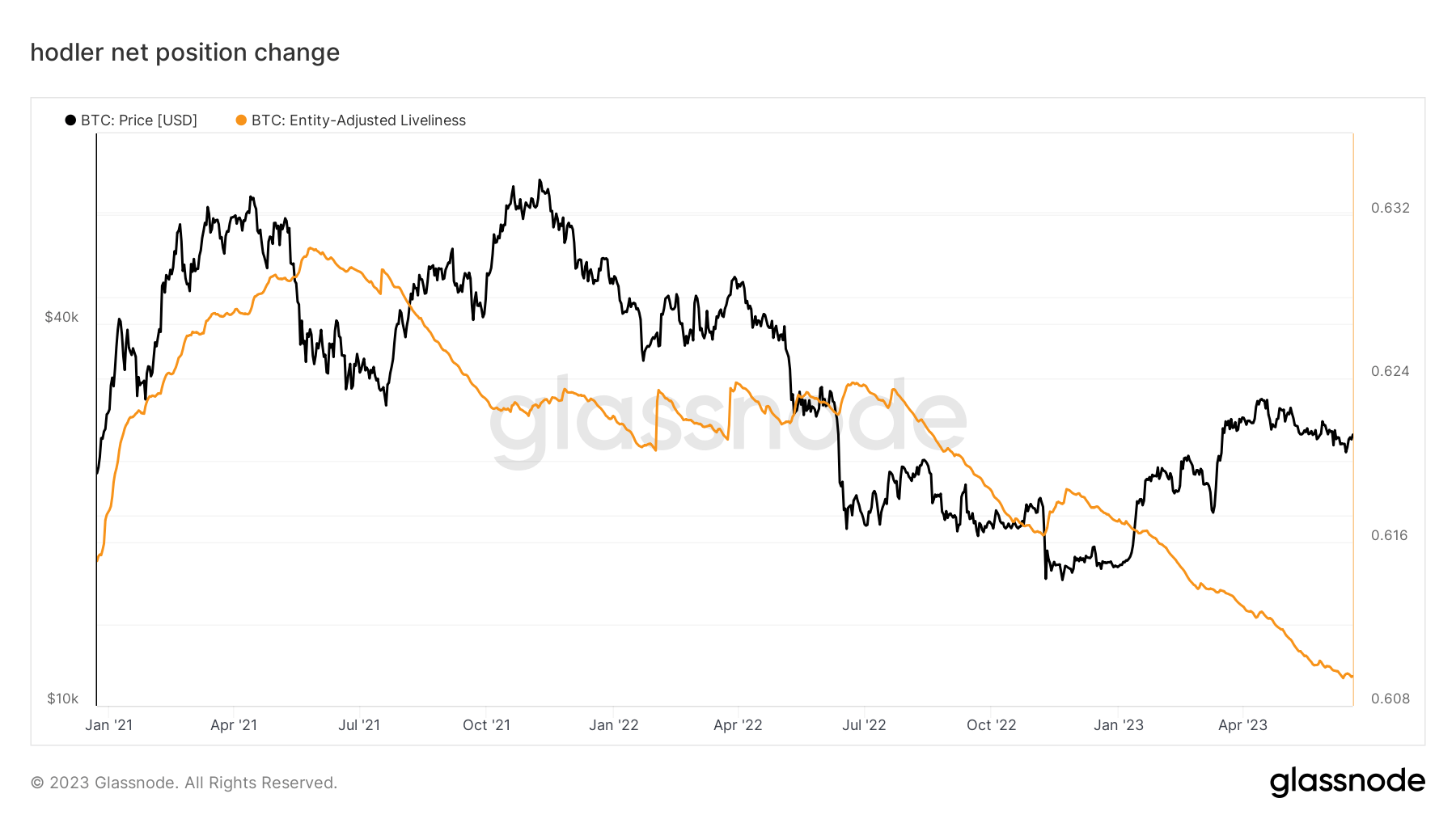

However, analysis of various on-chain metrics, including Bitcoin’s liveliness, suggests a lack of volatility in the market.

Liveliness is a time-weighted measure of Bitcoin UTXOs (unspent transaction outputs), indicating the proportion of Bitcoin that’s been dormant for a certain period. As such, it serves as a valuable barometer of market activity and provides insight into the behavior of Bitcoin hodlers.

The liveliness metric uses “coin days,” meaning the number of days since each coin was last moved. A higher liveliness score and uptrends suggest that hodlers are active and moving their coins around. Conversely, a lower liveliness score and downtrends indicate a lack of activity among hodlers and coin dormancy.

Bitcoin’s liveliness has been on a downward trajectory since peaking in May 2021, correlating with the onset of the ongoing bear market.

A decreasing trend in liveliness often signifies that hodlers are moving their Bitcoins to cold storage, taking them out of circulation. This behavior leads to an increase in the illiquid supply of Bitcoin, which contributes to the current stability we are witnessing in the market.

This historical downtrend suggests that more hodlers are moving their coins to cold storage, potentially positioning for a long-term investment strategy.

The post Bitcoin liveliness indicates hodler behavior during extended price stability appeared first on CryptoSlate.