Bitcoin is on a winning streak right now after rising above $29,000 for the first time since May 7. The rally was no doubt fueled by the entrance of institutional players like BlackRock into the crypto space. However, the rally may only just be starting as other institutional players look to make their mark in the industry as well.

WisdomTree Files For Bitcoin ETF

With the news of BlackRock and Fidelity both filing for Bitcoin Trust and an ETF, another player has entered the ETF race as well. WisdomTree has filed for a Bitcoin Trust with the United States Securities and Exchange Commission (SEC).

If granted approval, WisdomTree plans to list the trust on the Cboe BZX exchange to allow institutional investors to gain exposure to BTC through the trust. This trust could be similar to the Grayscale Bitcoin Trust (GBTC) which is currently the largest BTC trust in the world. However, with so many new trusts being filed, Grayscale could be seeing some serious competition soon.

While WisdomTree is not as bit as BlackRock, the firm still manages around $94.7 billion in exchange-traded funds and products around the world, making it a prominent player in the space. WisdomTree will offer its shares according to the pricing of the CF Bitcoin US Price made possible by aggregating the flow of BTC on spot exchanges. This would mean that the trust if approved, would basically operate the same way the coveted Bitcoin Spots ETFs would.

Institutions Pushing Price Of BTC

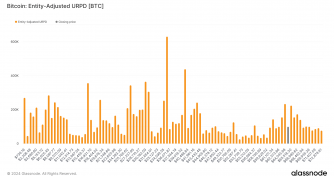

The news of BlackRock filing for a Bitcoin ETF has been one of the major factors behind the current BTC rally and the WisdomTree filing could push the price further as it signals the entrance of more institutional investors to the sector. The sheer amount of volume expected to flow into BTC if these ETFs are approved is the biggest bull case for it.

As Matrixport’s Thielen Markus notes in his Daily Insights report, “The SEC’s probability of approving the Blackrock Bitcoin ETF is high. The ETF might be approved by September/October 2023 and will attract $10bn within 3 months and $20bn within 6 months – materially supporting Bitcoin prices.”

This could mean that BTC’s rally could continue on into September if the ETF is approved. Additionally providing fuel needed for bulls to retain complete control while driving the price toward $40,000. Combined with the fact that approval for Blackrock improves the chances of the likes of Fidelity and WisdonTree, the new volume flowing into BTC could quickly exceed $50 billion.

For now, BTC continues to enjoy all of the attention from the Blackrock news. It is still trading above $28,800 at the time of this writing, with over $28 billion in volume in the last 24 hours alone.