American billionaire hedge fund manager Paul Tudor Jones said he’s sticking with Bitcoin (BTC) but wonders whether regulatory hostilities, falling inflation, and AI developments will hamper future price growth.

CNBC’s Andrew Sorkin pointed out that Tudor Jones bought Bitcoin during the health crisis when it was priced at around $8,000, continuing to ride it through the market peaks and troughs since. Injecting, the hedge fund manager said, “I’ve never sat on a horse that long,” adding that he will continue holding a “small allocation” because of its fixed supply.

“It’s the only thing that humans can’t adjust the supply in, so I’m sticking with it. I’m going to always stick with it as just a small diversification of my portfolio.”

However, when asked if he is buying more under current market conditions, Tudor Jones expressed uncertainty due to expectations it may become “boring in the future.”

He referenced the ongoing U.S. regulatory hostilities toward the digital asset sector. Also raising the point that inflation “may be done,” meaning Bitcoin’s inflation hedge narrative may no longer carry as much weight as six months ago.

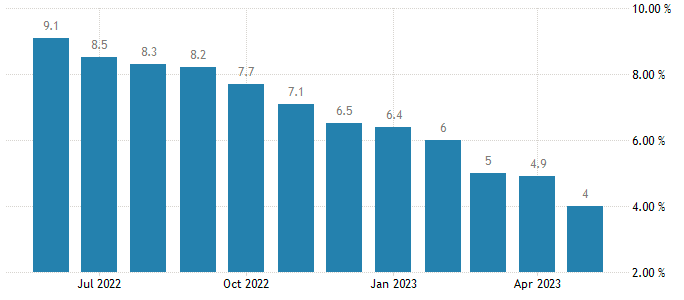

The annual U.S. Consumer Price Index (CPI) has been trending down each month since June 2022, leading to a current rate of 4% in May.

Adding the rise of AI and its possible “productivity boost” into the mix, Tudor Jones said things are entirely different now compared to the start of the year. For those reasons, he is cautious about buying more.

The price of Bitcoin reached a year-to-date high of $31,500 on June 23. The move aligned with institutional players demonstrating interest in the coin, including BlackRock’s spot ETF filing, which triggered a spate of other legacy firms to follow suit.

The post Paul Tudor Jones cautious about buying more Bitcoin as macro narrative turns appeared first on CryptoSlate.