Quick Take

The June 28 report of the U.S. GDP exceeding expectations has led to notable movements in the economic landscape. In the commodities market, the gold price has dipped below the $1,900 mark, reflecting investor sentiment influenced by robust economic performance.

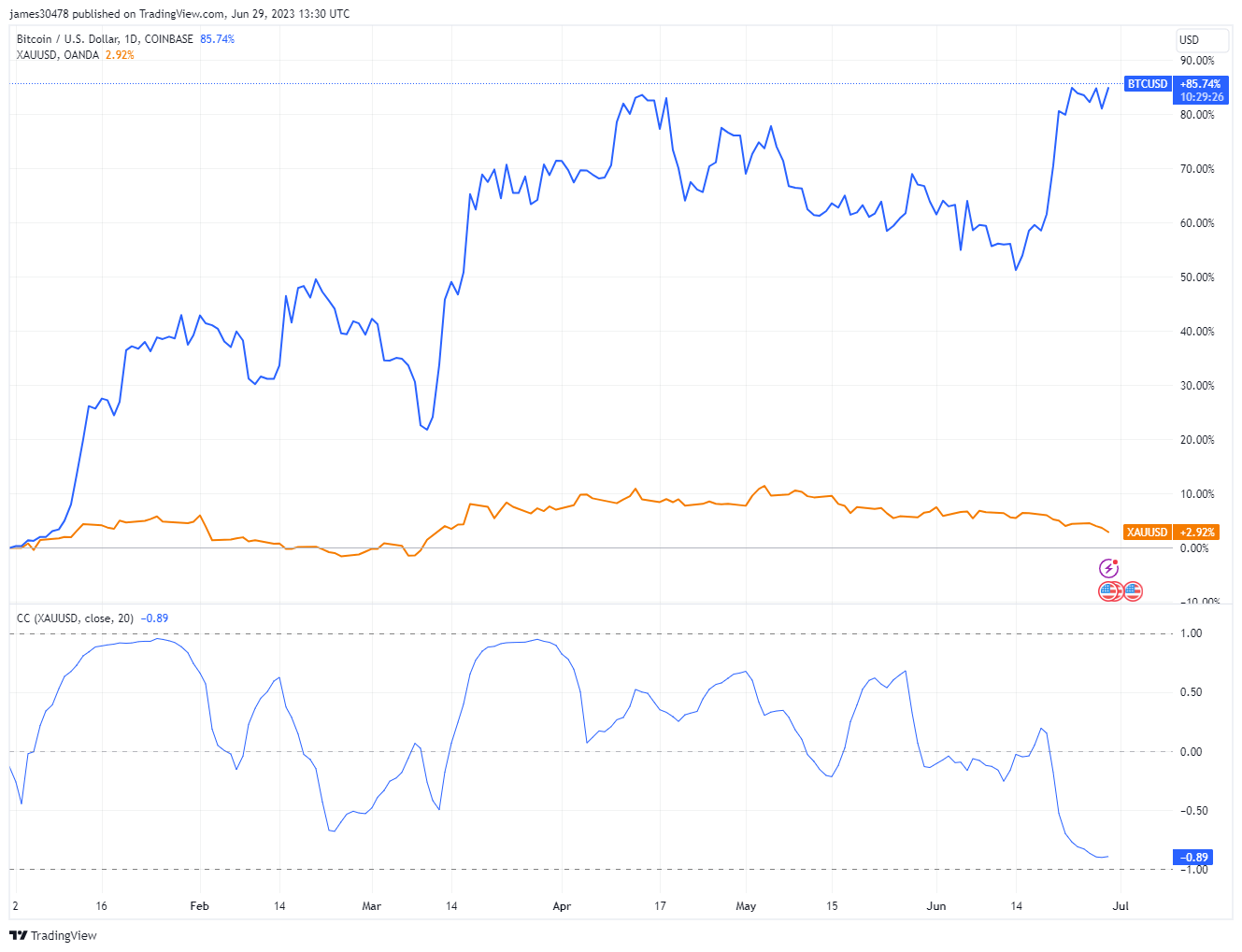

Bitcoin, however, is charting a different course, climbing higher and surpassing the $30,600 level. This divergence between the two often-compared asset classes has resulted in a significant drop in their correlation.

Currently, the Bitcoin-gold correlation stands at -0.89, marking its lowest point for both the year and the trailing one-year timeframe. This indicates that as gold prices decline, Bitcoin prices are trending in the opposite direction, reinforcing their independent market dynamics.

The post Gold slides below $1,900, registers lowest correlation with Bitcoin in 2023 appeared first on CryptoSlate.