The U.S. economic landscape has been a significant determinant of investor sentiment. The latest U.S. GDP report, which exceeded market expectations, has left investors hypersensitive to moves and decisions coming from the U.S. government. The market was bracing for a weaker economic performance, but the stronger-than-anticipated GDP figures have caused ripples across various asset classes.

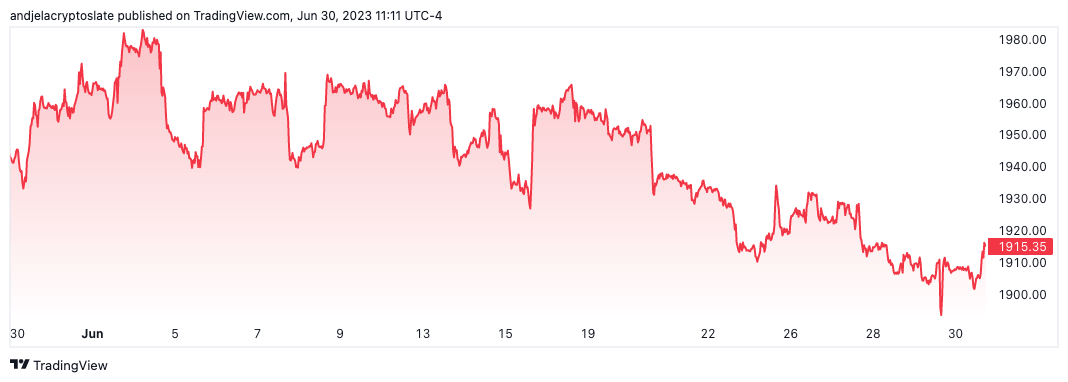

Gold, often considered a safe haven during economic uncertainty, dipped below the $1,900 mark following the GDP report. Over the past 30 days, gold’s price has fluctuated between $1,945 and $1,933.

Changes in gold prices can provide insights into investor sentiment towards alternative investments, which can influence the crypto market, especially during periods of economic uncertainty.

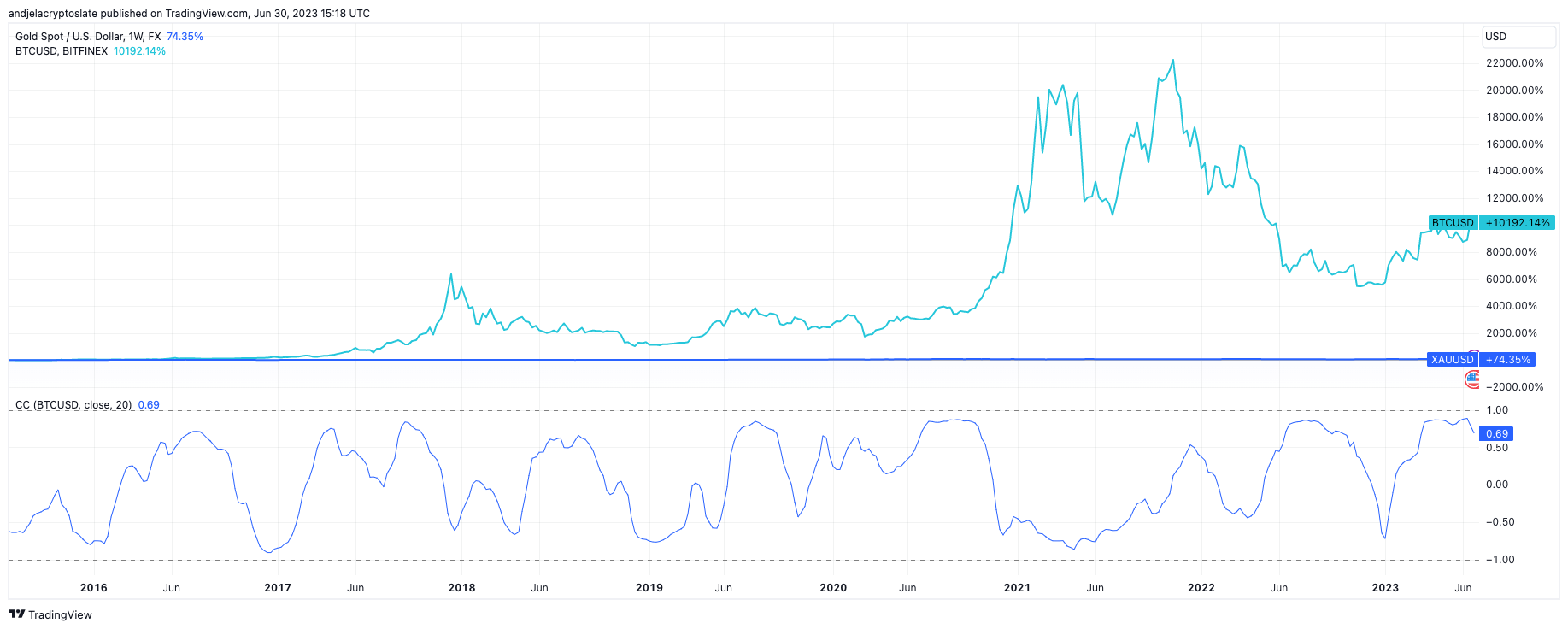

Historically, the price movements of gold and Bitcoin have exhibited a high degree of correlation. This correlation is often attributed to their shared status as alternative investments and stores of value, independent of traditional fiat currencies. Both gold and Bitcoin are seen as safe havens during times of economic uncertainty, providing a hedge against inflation and currency devaluation.

When economic conditions are uncertain or volatile, investors often turn to gold as a ‘safe haven’ asset. This is because gold retains its value over time, unlike fiat currencies which can be devalued through inflation. As demand for gold increases during these periods of uncertainty, so does its price.

Conversely, the price of gold can fall when economic conditions improve and investor confidence in traditional markets strengthens. In such scenarios, investors often shift their assets from gold to riskier investments like stocks, leading to decreased demand for gold and subsequently, a drop in its price.

Bitcoin has gained recognition as a hedge against economic uncertainty, similar to gold. During periods of stock market volatility, investors have increasingly turned to Bitcoin as an alternative investment. This is because Bitcoin operates independently of the traditional financial system, making it less susceptible to the same economic pressures that can affect fiat currencies and the stock market.

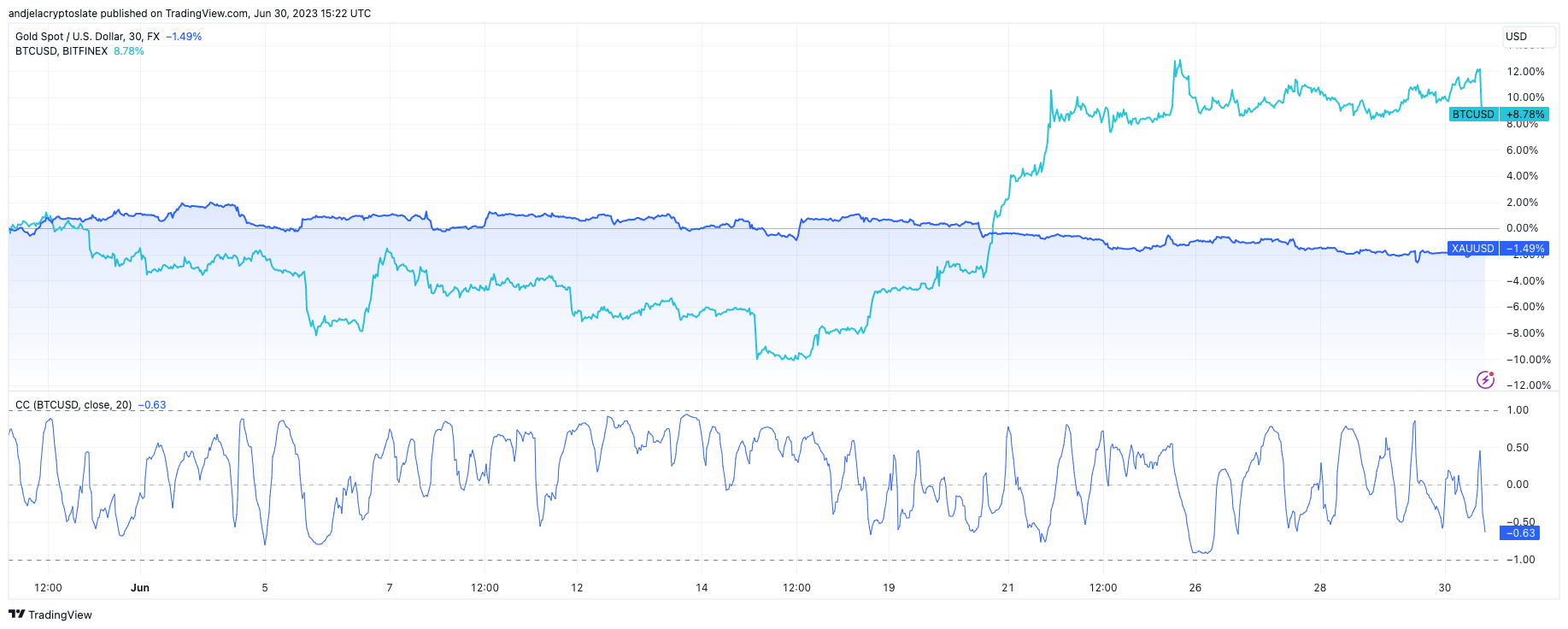

However, this long-standing relationship between gold and Bitcoin appears to be undergoing a significant shift.

The Bitcoin-gold correlation dropped to its yearly low on June 28, trailing the one-year timeframe as well. This divergence suggests a potential decoupling of Bitcoin from gold, indicating a maturing crypto market that’s carving its own path.

This growing independence of the crypto market is a significant development. It could suggest that Bitcoin and other cryptocurrencies are becoming less influenced by traditional market dynamics and more driven by factors unique to the crypto space. This could lead to a more diversified investment landscape where cryptocurrencies play a more distinct role, separate from traditional asset classes.

The post Bitcoin’s breakup with gold may be a sign of crypto’s emerging maturity appeared first on CryptoSlate.