Bitcoin (BTC) miners sold a significant amount of their mined Bitcoin in June to fund their operations, according to Glassnode data analyzed by CryptoSlate.

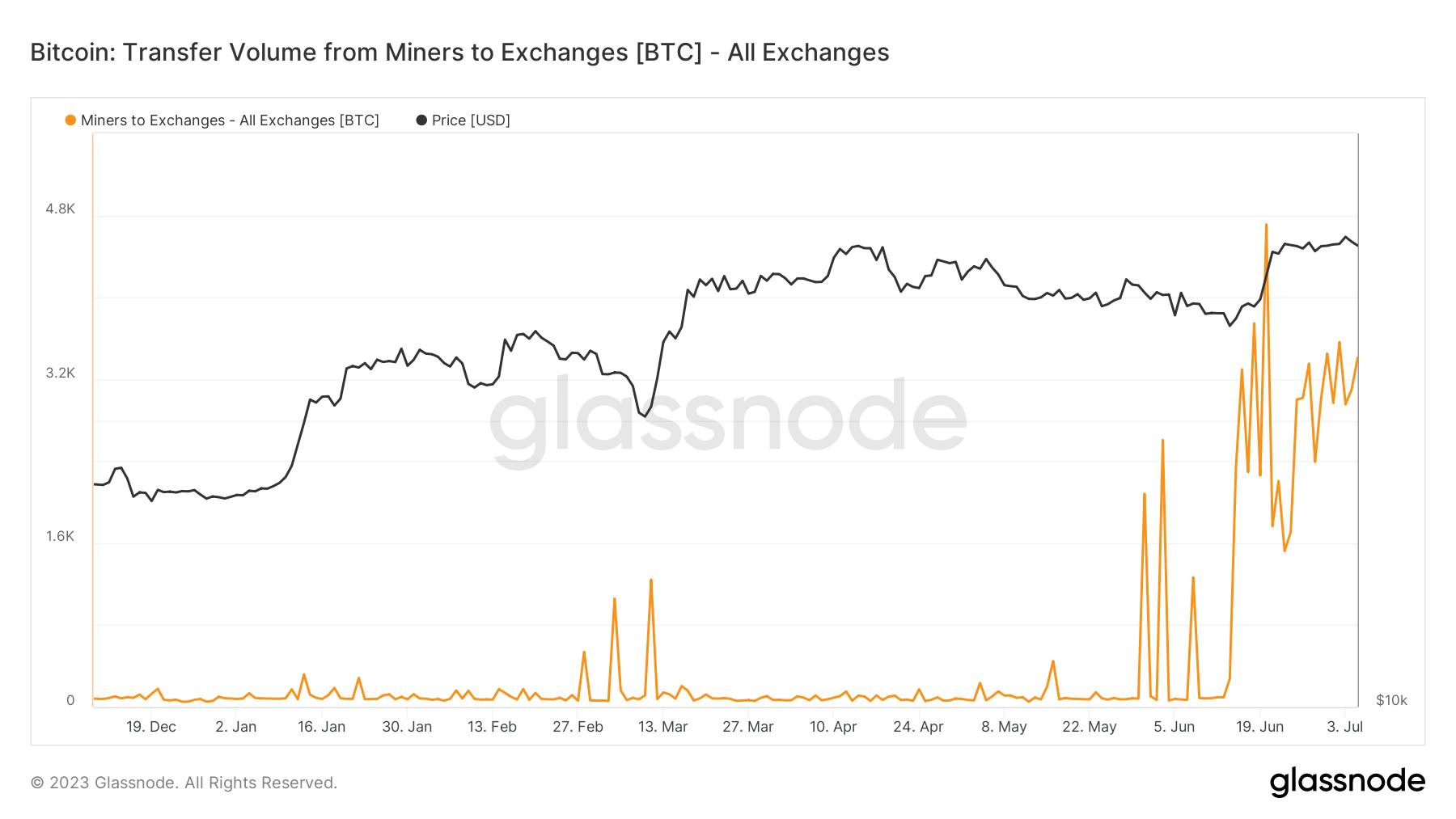

According to the chart below, miners’ exchange flow peaked at 4,710 BTC on June 20—the highest rate of the past five years. Other days of the month also saw significant spikes, averaging over 2000 BTC to exchanges.

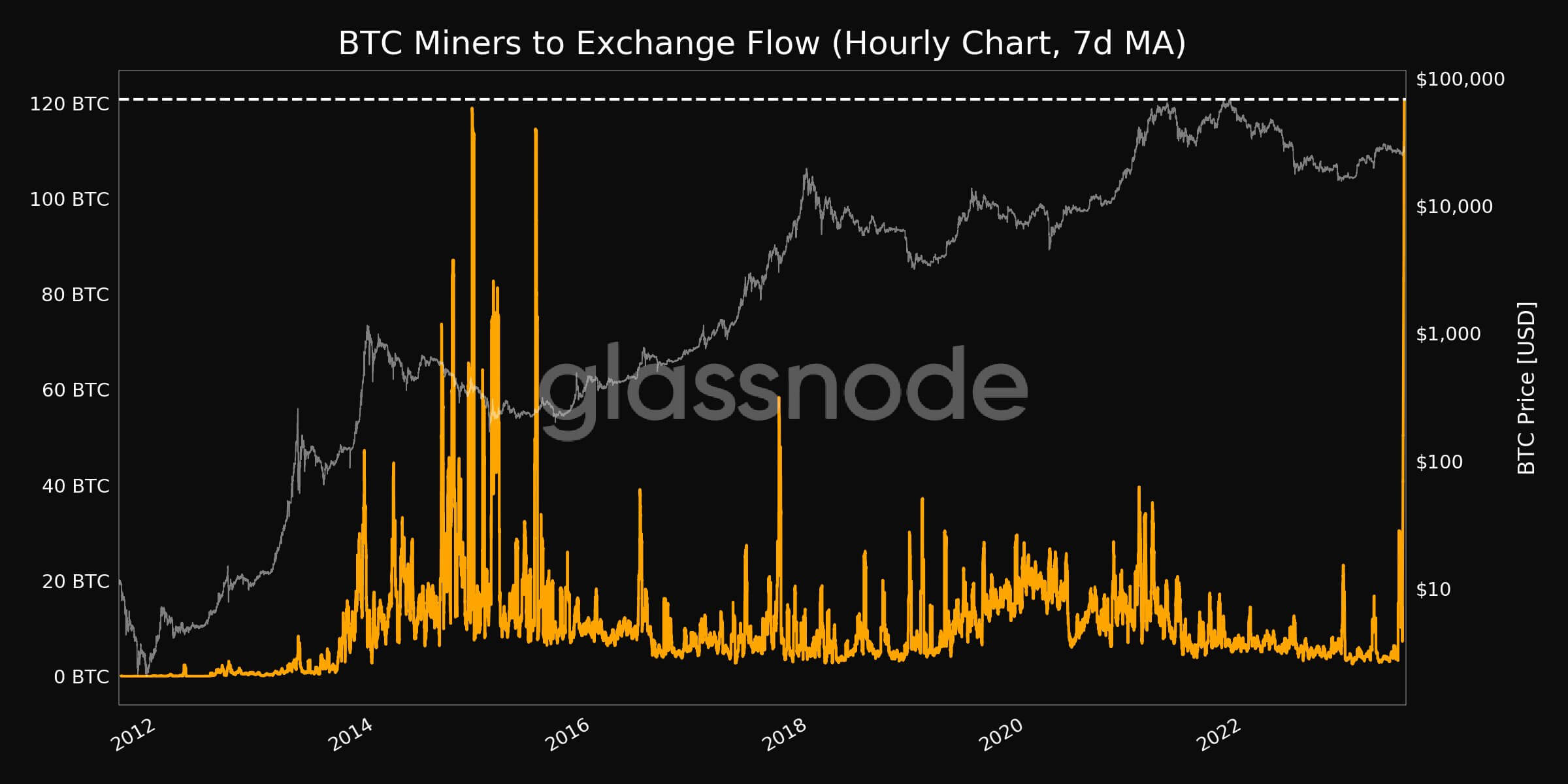

Glassnode stated that the seven days moving average hourly flow from miners to exchange reached as high as 120.77 BTC, one of the highest levels since 2015.

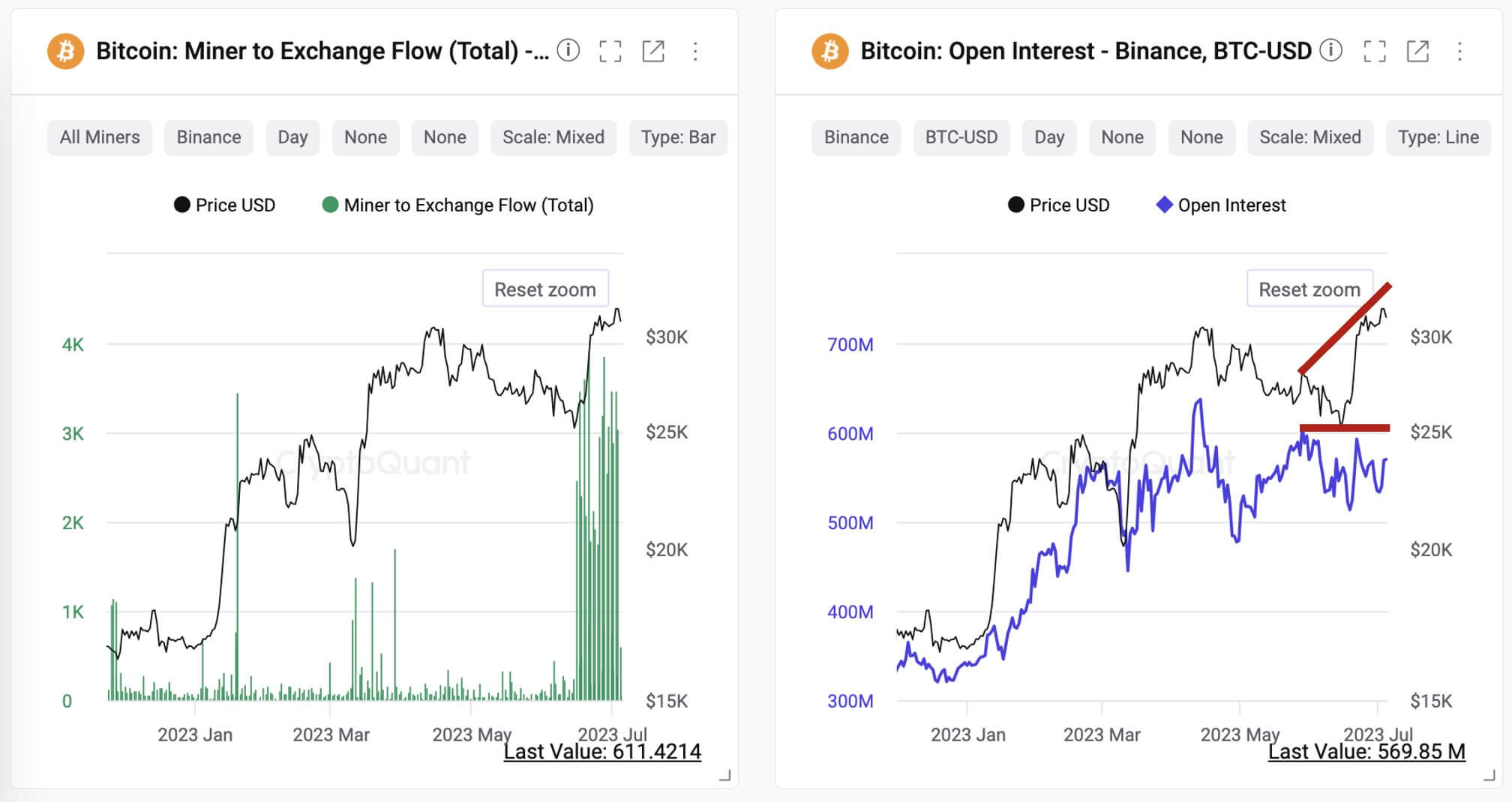

On July 4, CryptoQuant CEO Ki Young Ju said miners sent over 54,000 BTC to Binance in the past three weeks. Ju pointed out that there was “no significant change in BTC-USD open interest, suggesting less likelihood of filling collaterals to punt new long positions.”

Ju added:

“Spot selling seems more likely.”

In their recently released operational updates, Bitcoin miners Marathon Digital, Cleanspark, and Hut 8 confirmed these transactions.

In a July 6 press statement, Marathon Digital said it sold 700 BTC, representing 71.5%, of its mined 979 BTC in June for an undisclosed sum. Its rival, Hut 8, sold 217 BTC—100% of the Bitcoin it produced in May and 70 Bitcoin produced in June—for $7.9 million.

Meanwhile, Cleanspark sold 84% of the 491 BTC it mined in June for $11.2 million, according to a July 3 statement.

These trading activities suggest miners wanted to capitalize on BTC’s recent price surge to secure profits. In June, BTC mostly traded above $25,000, peaking at $31,268 after several traditional financial institutions, including BlackRock and others, filed for Bitcoin ETFs.

The post Bitcoin miners cash in on June price surge, selling thousands of BTC appeared first on CryptoSlate.