On-chain data shows the total number of Litecoin whales has grown recently as the coin’s halving is now just a month away from now.

Litecoin Addresses With At Least 10,000 LTC Have Increased In Number Recently

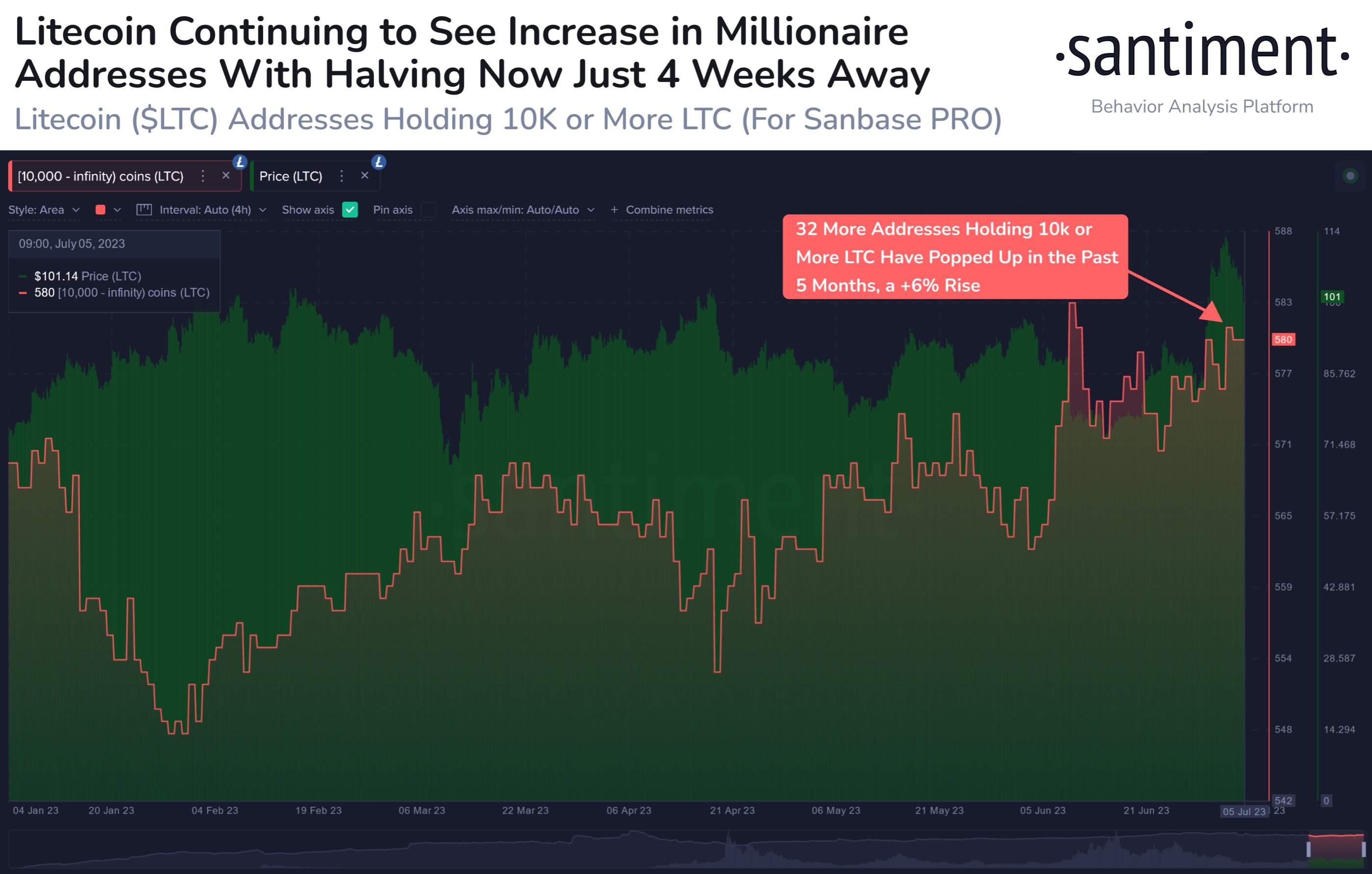

According to data from the on-chain analytics firm Santiment, the LTC “millionaire” addresses have observed a jump recently. The relevant indicator here is the “Supply Distribution,” which tells us how many addresses belong to which wallet groups on the Litecoin network.

The addresses are divided into these wallet groups based on the total number of coins that they are holding at the moment. The 100-1,000 coins cohort, for instance, includes all addresses or investors on the blockchain that are carrying a balance of at least 100 and at most 1,000 LTC.

In the context of the current discussion, the millionaire LTC holders are of interest. At the current price, this threshold is approximately equal to 10,000 LTC, so the 10,000+ coins group is of focus (note that the upper bound of the range here is just infinity).

Here is a chart that shows how the total number of addresses belonging to these large Litecoin investors has changed during the last few months:

As displayed in the above graph, the Litecoin addresses holding at least 10,000 LTC have observed a notable growth in their count during the past few months or so.

Generally, the holders of the millionaire LTC wallets are the whales. These humongous investors can be quite influential in the market, as they hold such significant amounts in their addresses.

The total number of whale addresses rising in the market would suggest that more large investors are coming into the network and buying notable amounts of the cryptocurrency.

Thus, as the indicator’s value has observed an increase of 6% during the last few months, it means that whales have become more interested in the asset. The reason behind this cohort being bullish is likely to be the fact that the Litecoin halving is only a month away now.

The “halving” here refers to a periodic event taking place about every four years that permanently cut down the block rewards of the asset into exactly half. Since the block rewards that miners receive represent the only way to produce more of the asset, the supply’s growth becomes more constrained following halvings.

Due to this reason, halvings have often come with a bullish narrative for the cryptocurrency. LTC has been rallying recently, making many believe that this price increase might continue on to the event.

In the past couple of days, however, the cryptocurrency has taken a step back as its price has declined. But nonetheless, from the chart, it’s visible that the whale addresses haven’t budged after this drop, suggesting that these investors are still bullish on the asset.

LTC Price

At the time of writing, Litecoin is trading around $104, up 24% in the last week.