Despite the volatility Bitcoin experienced in 2023, the extended sideways movement between February and July has proved to be fertile ground for accumulation. Onchain analysis showed that short-term holders (STHs) and long-term holders (LTHs) had steadily accumulated throughout the past quarter, indicating a strong belief in the asset’s long-term value.

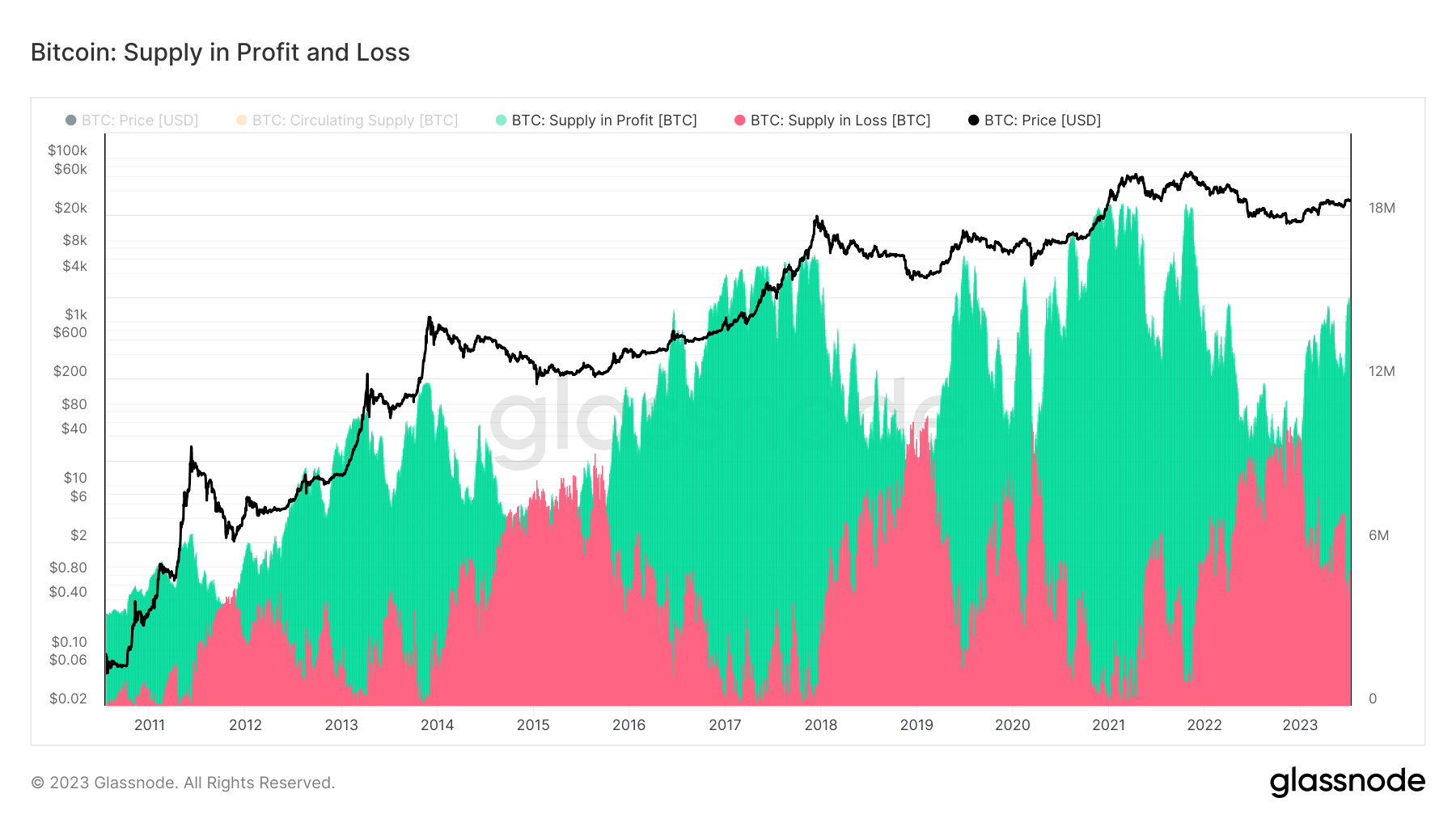

Measuring Bitcoin’s supply in profit and loss is an essential part of analyzing the market. These metrics provide valuable insights into market sentiment and investor behavior — a higher supply in profit indicates that investors are holding onto their assets, expecting further price appreciation. Conversely, a higher supply in loss could signal potential sell-offs.

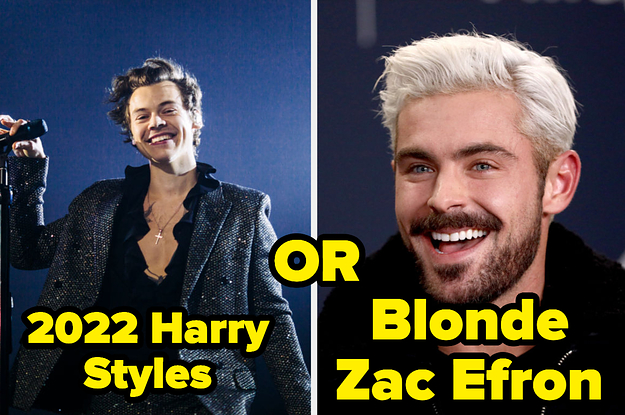

Between September and December 2022, during a period of significant price volatility, the supplies in profit and loss converged multiple times, reflecting the market’s uncertainty.

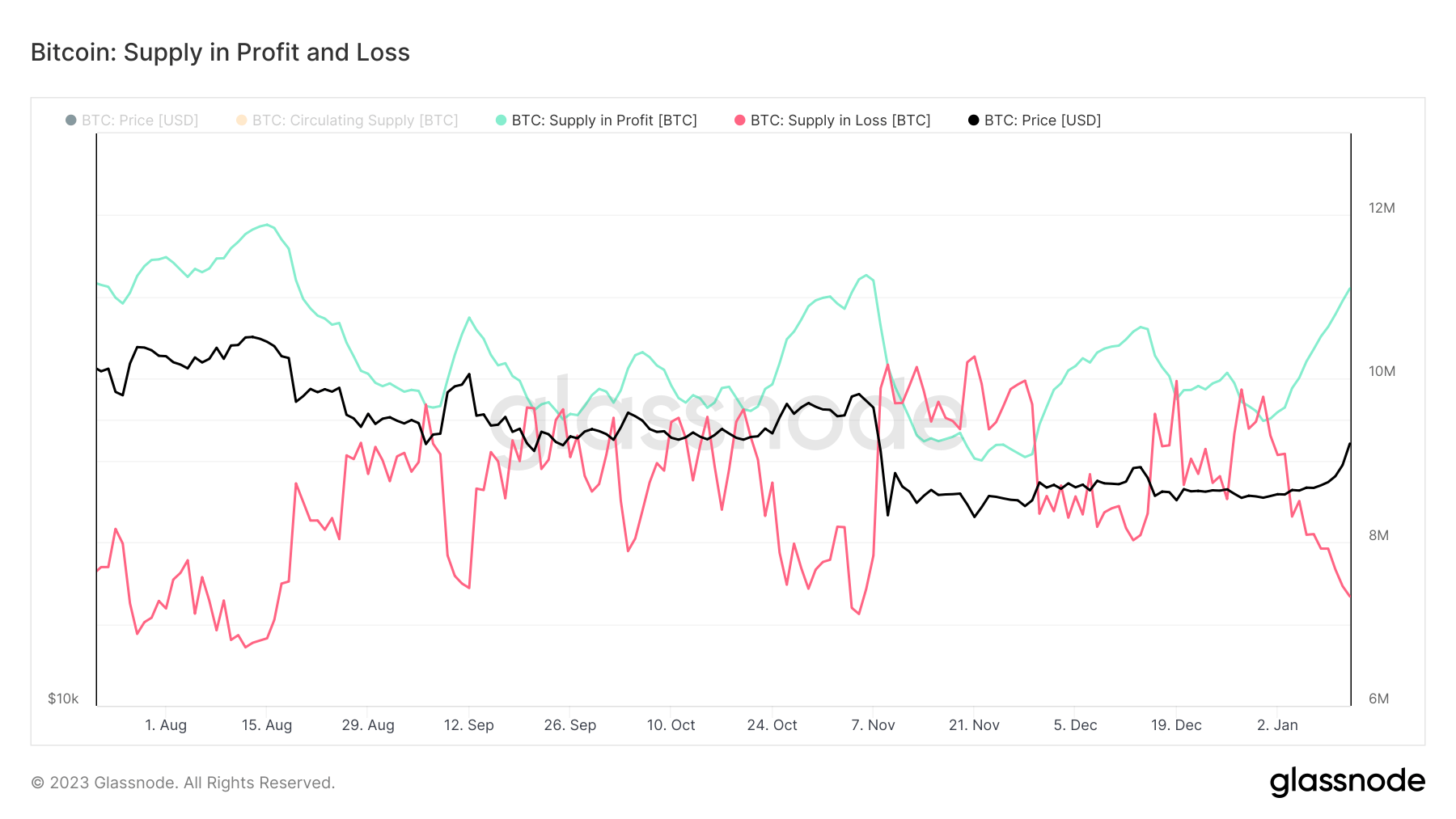

However, the landscape has shifted since the beginning of 2023. The supplies in profit and loss have diverged, with the portion of the supply in profit increasing by over 53%. According to data from Glassnode, 14.61 million BTC is currently in profit, while 4.34 million BTC is in loss.

As of July 11, 75% of the supply is in profit, leaving only 25% in loss. This significant equilibrium is reminiscent of the scenarios witnessed during the mid-points of the 2016 and 2019 market cycles. Glassnode data further revealed that 50% of Bitcoin’s trading days had seen a higher Profit-to-Loss balance and 50% a lower one.

The current accumulation phase and the resulting 75% of Bitcoin’s circulating supply being in profit is a promising sign for the cryptocurrency. If historical patterns continue, this could be the mid-point in Bitcoin’s current market cycle, suggesting that a bottom has been reached and the market is currently gearing up for a rally.

However, it’s crucial to consider that while historical patterns provide useful context, they may not always predict future movements. Today’s Bitcoin market is influenced more than ever by a host of macro factors, such as regulatory developments and broader economic conditions.

The post Heavy accumulation puts 75% of Bitcoin’s circulating supply in profit appeared first on CryptoSlate.