On-chain data shows that Bitcoin short-term holders have contributed to 78% of the total exchange inflows in the market recently.

Bitcoin Exchange Inflows Are Dominated By The Short-Term Holders

According to the latest weekly report from the on-chain analytics firm Glassnode, the short-term holders have been actively making inflows since February of this year.

The “short-term holders” (STHs) here refer to the investors who have been holding onto their coins since less than 155 days ago. The STHs make up one of the two major cohorts in the Bitcoin market, with the other group being the “long-term holders” (LTHs).

Statistically, the longer an investor holds onto their coins, the less likely they become to sell at any point. Since the LTHs have been carrying their coins for longer than the STHs, they are naturally the cohort more probable to hold through any distress or profit-taking opportunities that appear in the market.

One way to compare the selling pressure being put on by these investors is to compare their “exchange inflow,” which is an indicator that measures the total amount of BTC that these holders are transferring to centralized exchanges.

Generally, holders use these platforms for selling, so their deposits can provide hints about the degree of selling that they are participating in at the moment.

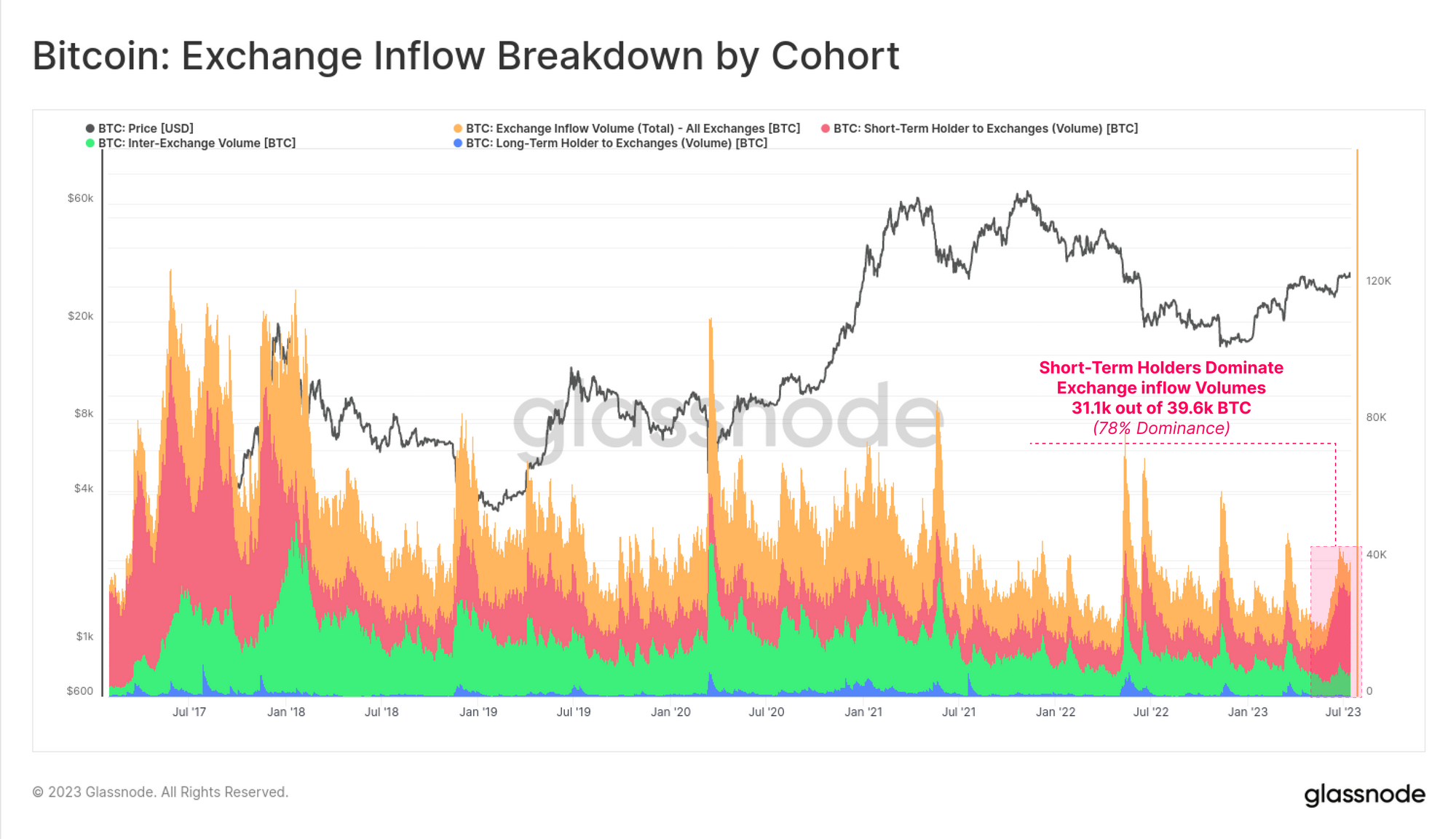

Now, here is a chart that shows the breakdown of the different Bitcoin exchange inflow volumes in the market:

As displayed in the above graph, the total exchange inflow volume in the market is currently equal to about 39,600 BTC. Out of these, 31,100 BTC came from the STHs alone, meaning that these investors accounted for around 78% of the total.

The other volumes in the graph are for the LTHs and the inter-exchange transfers. It would appear that the vast majority of the remaining percentage is being covered by the inter-exchange volume, as the LTHs are contributing a negligible amount to the total inflows right now.

This naturally showcases the resolve of these diamond hands, as these low inflows are despite the fact that the cryptocurrency has observed a rally in its price recently.

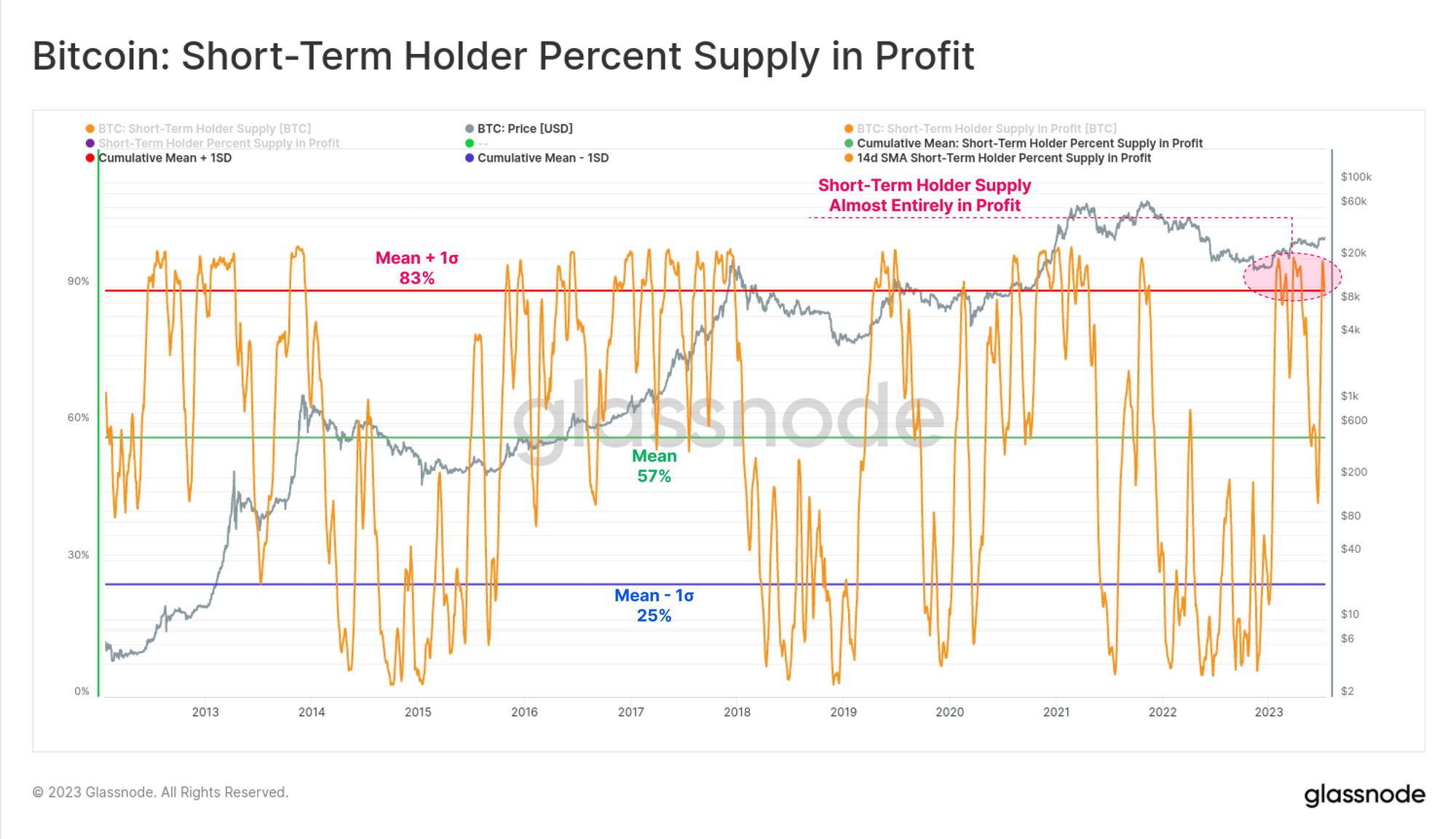

The supply in profit data for the STHs shows that almost all of these investors are in some amount of profit currently, which would explain the elevated selling that this cohort has potentially been participating in recently.

From the chart, it’s visible that the current condition where more than 90% of the Bitcoin STH supply is in profit isn’t particularly unusual, as all rallies in the past have seen these investors go into such profits for some length of period.

BTC Price

At the time of writing, Bitcoin is trading around $29,800, down 2% in the last week.