Chainlink (CHAIN) has recently experienced a surge in its short-term price action, delivering considerable gains to its holders. The excitement surrounding this upward momentum has been palpable, but astute observers have noticed some intriguing indications that suggest this hike might not necessarily signify the peak for LINK.

Such a notion is not mere speculation; instead, it finds its foundation in the actions of LINK holders and the patterns observed in trading activity. These compelling insights offer a glimpse into the future trajectory of Chainlink and its possibilities.

LINK Price Surge Fueled By Increased Accumulation, Network Activity

LINK’s recent price surge has been underpinned by a significant token accumulation and notable activity on the Chainlink network. According to a LINK price report referencing Santiment data, the number of addresses holding between 0 to 1 million LINK has seen an incredible increase, potentially playing a pivotal role in driving the token’s value.

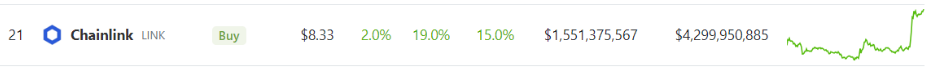

Coingecko data shows LINK registering an impressive $8.33 price, and a remarkable 24-hour rally of 19.0%. In the last week, the crypto has risen 15.0% in value.

However, the surge appears far from an isolated event, as the accumulation rate has shown no signs of slowing down. Such consistent accumulation often suggests a growing conviction among investors and traders that LINK’s value may be on the verge of another substantial increase.

Insights From Network Activity

A telling metric, the adjusted price to Daily Active Addresses (DAA) divergence, provided intriguing insights into the Chainlink network’s current state.

As the token’s price rose, the number of active addresses decreased. When looking at historical trends, this pattern has indicated previous upswings for the Chainlink network. Consequently, this data hints at the possibility of another impending price upswing for the LINK token.

The number of developers actively contributing to the Chainlink network has also experienced a significant increase since the first week of July.

Technical analysts closely scrutinize chart patterns and price movements to identify potential trends and reversals. The recent rally in LINK’s price may have triggered breakout signals and attracted momentum traders, causing the price to surge even further.

These technical indicators and chart patterns can act as self-fulfilling prophecies as traders react to them, potentially leading to a cascading effect on the token’s price.

As the market evolves, tracking these key metrics, understanding market sentiment, and assessing broader market dynamics will be crucial in making informed decisions about LINK’s prospects.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Cavatorta