Bitcoin miners are the backbone of the cryptocurrency ecosystem due to their dual role of validating transactions and securing the blockchain. Their operational decisions, especially those related to their Bitcoin reserves, can substantially influence the market dynamics.

The strategic choices miners make about retaining or liquidating their Bitcoin earnings can significantly influence the supply-demand equilibrium in the market.

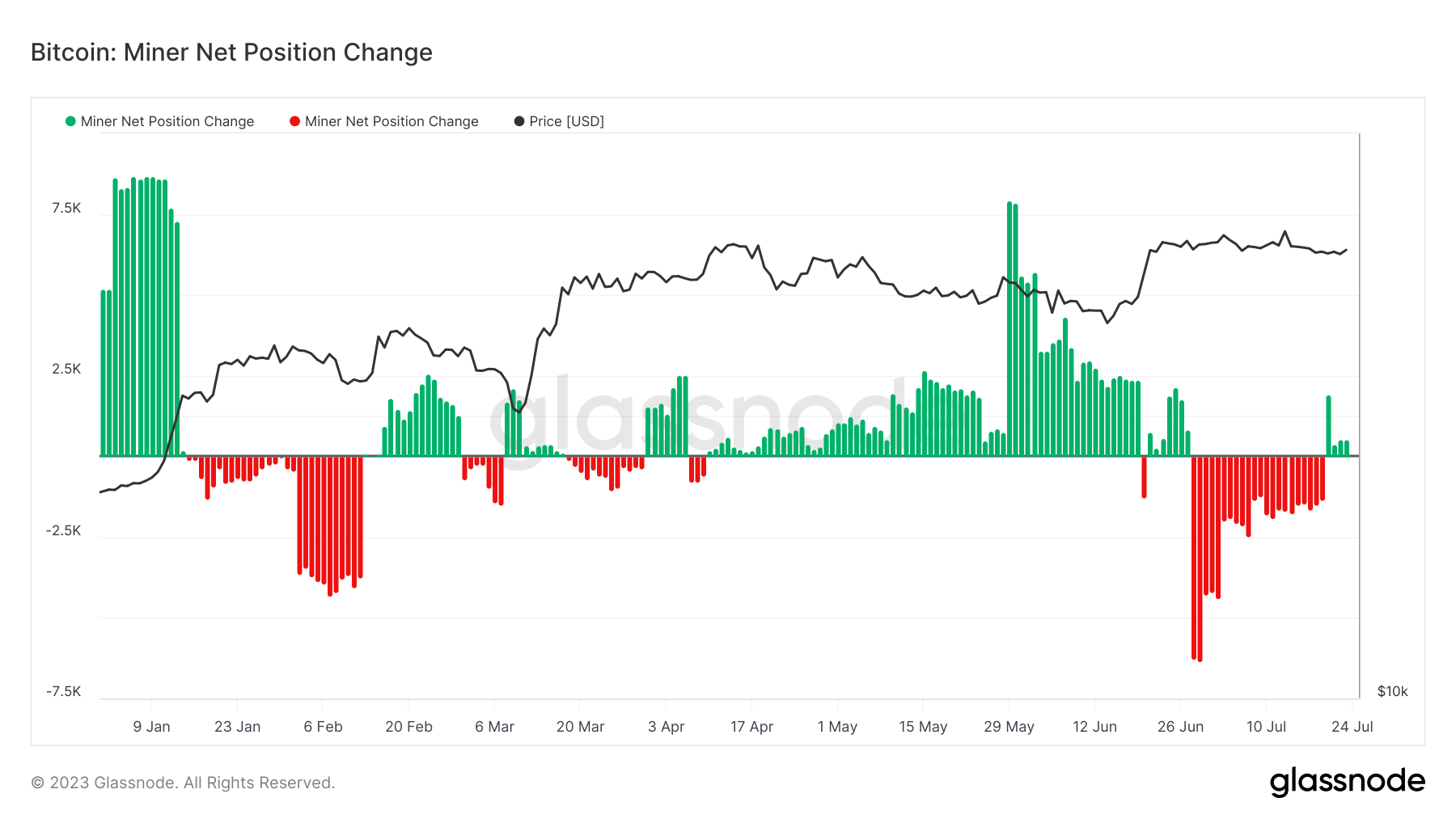

Historically, changes in miner positions have been closely tied to Bitcoin’s price movements. Negative changes, where miners sell more Bitcoin than they earn, often correlate with short-term price slumps and prolonged downtrends or bear markets. This is likely because such selling increases the supply of Bitcoin on the market, putting downward pressure on the price.

On the other hand, positive changes, where miners accumulate more Bitcoin than they sell, can support price increases. This is because accumulation reduces the supply of Bitcoin on the market, helping to sustain or increase the price.

Throughout 2023, miners have spent most of the year increasing their Bitcoin positions, indicating bullish sentiment. However, the market has seen several periods with negative position changes, all correlated with increased price volatility or downtrends.

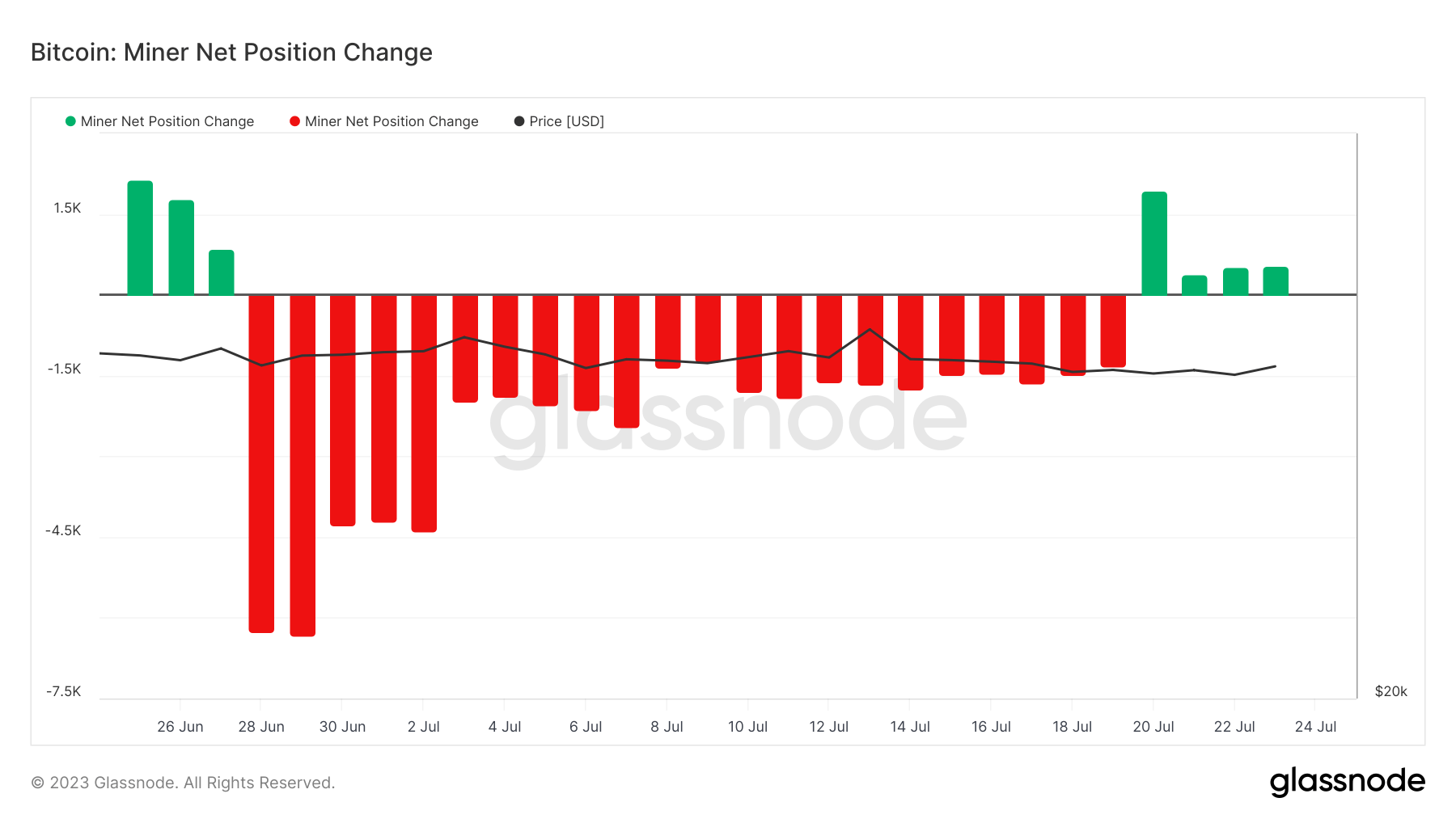

In July, miners spent almost the entire month increasing their holdings.

This trend changed on July 20, when data from Glassnode showed a positive shift in miner positions. Between July 20 and July 24, miners added over 451 BTC to their holdings. This accumulation of Bitcoin by miners could be a bullish sign for the market, as it reduces the supply of Bitcoin on the market, potentially supporting or even increasing the price.

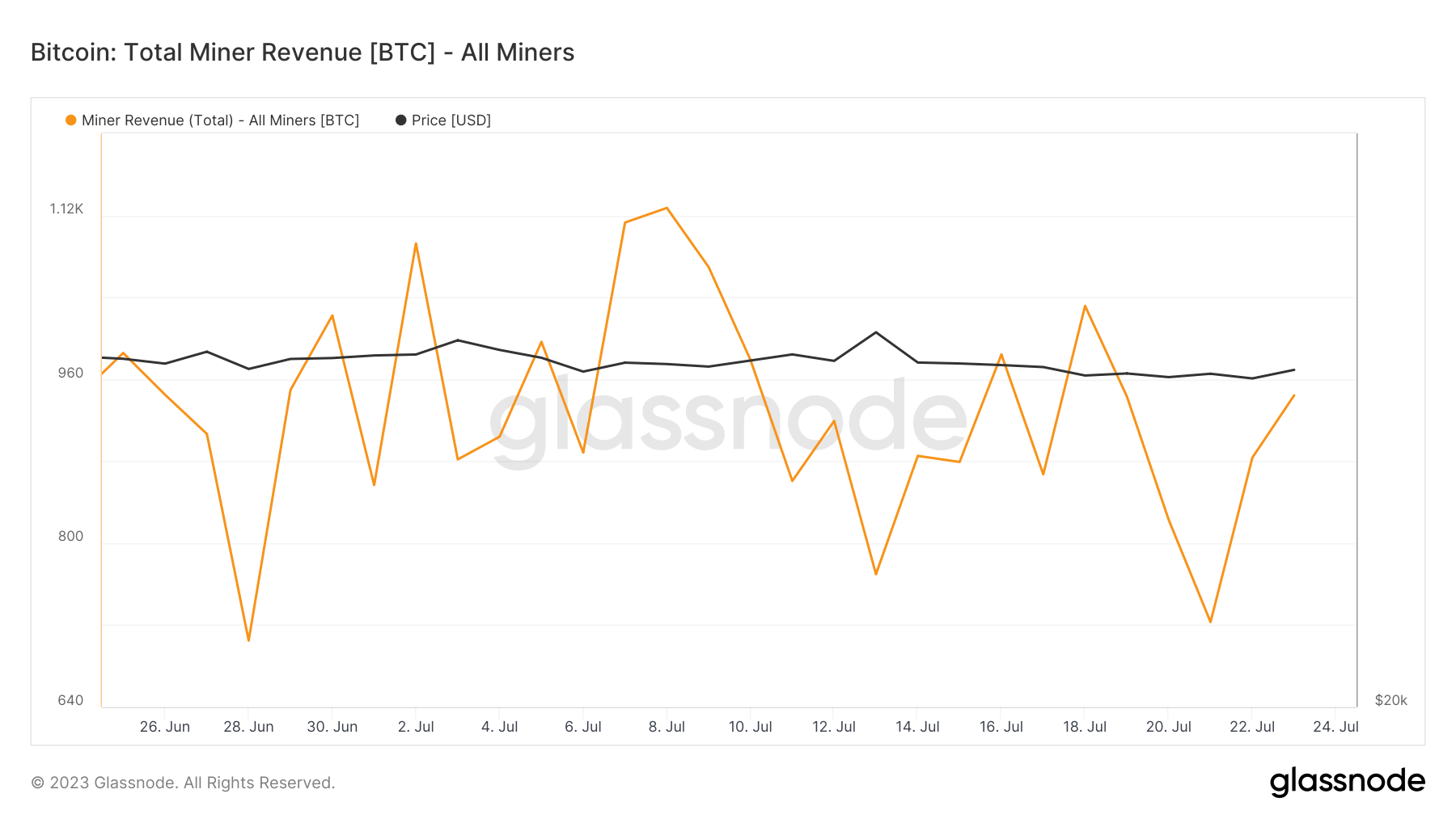

However, it’s not just the behavior of miners that can impact the Bitcoin market but also their revenues. Total miner revenue from fees and block rewards saw a sharp dip on July 21 but has since recovered to levels recorded on July 19 at 944 BTC. Despite the consistent volatility in miner revenue, the revenue recorded on July 24 aligns with the monthly average.

Interestingly, miners have been increasing their holdings despite revenues mainly remaining flat. This could indicate a bullish sentiment among miners, who choose to hold onto their Bitcoin rather than sell it for immediate profit. This behavior could be a response to market expectations or a strategic move to influence market dynamics.

Despite flat revenues, miners’ recent increase in Bitcoin holdings suggests a bullish sentiment among this key market group. It could positively impact Bitcoin prices in the short term.

However, miner behavior alone won’t exert enough pressure on the market to push Bitcoin’s price above its current level.

The post Miners are increasing their Bitcoin balances again appeared first on CryptoSlate.