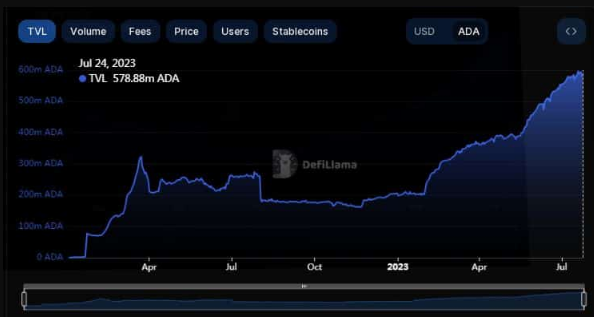

Cardano has leaped considerably in the realm of DeFi activities, particularly in terms of Total Value Locked (TVL), despite the somewhat lackluster performance of ADA itself.

TVL refers to the total value of assets locked within various decentralized finance protocols and applications on the Cardano blockchain. An increasing TVL can have several positive implications for the Cardano ecosystem.

The significance of TVL lies in its reflection of the overall engagement and adoption of DeFi projects built on Cardano. A higher TVL indicates greater trust and confidence in these decentralized financial services.

It demonstrates that users are willing to lock their assets within the ecosystem, utilizing various DeFi protocols for lending, borrowing, staking, and other financial activities.

Cardano TVL Surges Amid Price Decline

ADA has experienced a recent decline in its price, with the latest data from Coingecko showing it currently stands at $0.305. Over the past 24 hours, the price has faced a modest 0.4% decline, and over the last seven days, it has decreased by a mere 0.3%. Despite these losses, there is a notable silver lining in the form of Cardano’s TVL on the network.

The surge in Cardano’s TVL by 28% in the last three months indicates a growing interest in the DeFi activities offered by the network. It reflects growing confidence among users willing to lock their assets in decentralized applications, such as lending platforms, decentralized exchanges, and liquidity pools.

This increased participation can foster the development of a vibrant and robust DeFi ecosystem on Cardano, offering users a wide range of financial services.

Moreover, the year-to-date (YTD) triple growth of Cardano’s TVL raises optimism for the project’s potential recovery and a potential return to its previous all-time high levels achieved in 2022.

As the DeFi ecosystem on Cardano expands, it can attract more developers, projects, and investors, further enhancing the network’s utility and value proposition.

Cardano DeFi Lockup Surpasses Ethereum, But Market Cap Lags Behind

Meanwhile, a recent report sheds light on a noteworthy plunge in the total tokens locked within Ethereum, Cardano’s main rival. On the other hand, Cardano has emerged as a strong contender, outperforming Ethereum regarding individual token lockup within its DeFi ecosystem.

While Cardano excels in terms of token lockup, it still needs to catch up in other critical areas compared to Ethereum. One of the most significant disparities lies in the market capitalization of the two cryptocurrencies. Ethereum’s market capitalization remains considerably higher than Cardano’s, highlighting Ethereum’s long-standing dominance in the blockchain space.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Blog Tiền Ảo