Quick Take

As the upcoming FOMC meeting looms tomorrow, July 26, anticipation builds up around the Federal Reserve’s projected interest rate hike of another 25 basis points.

Market estimates attribute a near-certainty to this adjustment, assigning it a 99% probability. This increment would bring the federal funds rate to a range between 5.25 and 5.50 percent, aligning it with the peak rate witnessed in 2008.

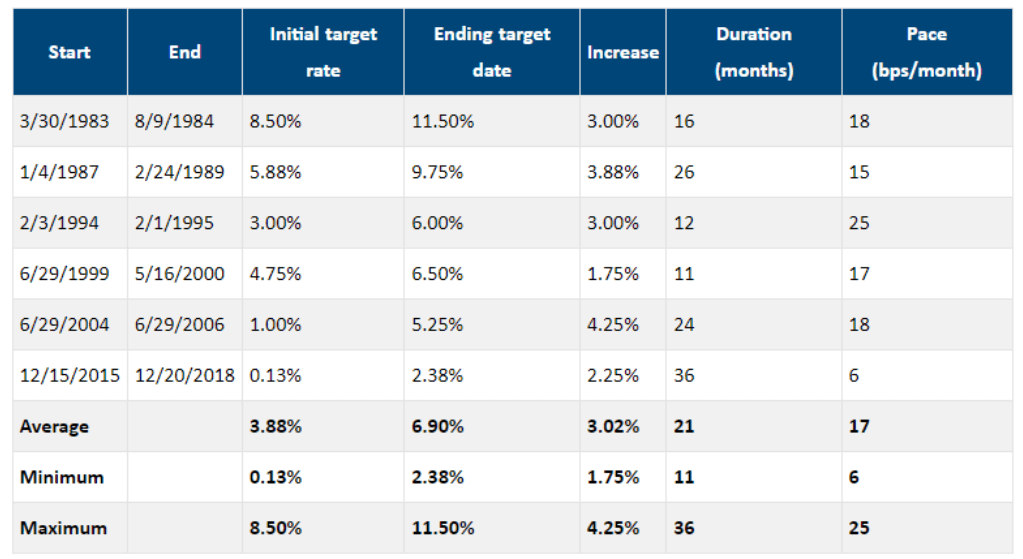

Don Johnson’s analysis suggests an unprecedented trajectory of the Federal Reserve’s actions in the current cycle. In his assessment, the rate hikes during this period have surpassed those implemented in earlier cycles, specifically those in 2018, 2006, 2000, 1995, 1989, 1987, 1984, 1982, and 1960.

The table below provides a comparative perspective on previous rate hiking schedules, showcasing the intensity and speed of the current rate hikes.

One of the most pressing concerns is whether the economy, laden with considerable debt, can withstand these swift and substantial adjustments.

The post FOMC preview: Brace for impact appeared first on CryptoSlate.