The recent drop in Bitcoin’s price to $29,200 has sparked significant liquidations, with the market witnessing nearly $50 million in realized losses, most coming from short-term holders.

The behavior of long-term holders (LTH) and short-term holders (STH) is crucial to understanding market dynamics. LTHs are those who have held their Bitcoin for more than 155 days, while STHs have held their Bitcoin for less than this period. The actions of these two groups can provide valuable insights into market sentiment and potential future movements.

LTHs are considered investors with a high conviction in Bitcoin’s long-term value and are less likely to sell their coins in response to short-term market fluctuations. On the other hand, STHs are generally more responsive to short-term price movements and market news. They are more likely to buy during market upswings and sell during downturns, contributing to market volatility. An increase in the proportion of Bitcoin held by short-term holders can often signal increased speculative activity and can sometimes precede increased price volatility.

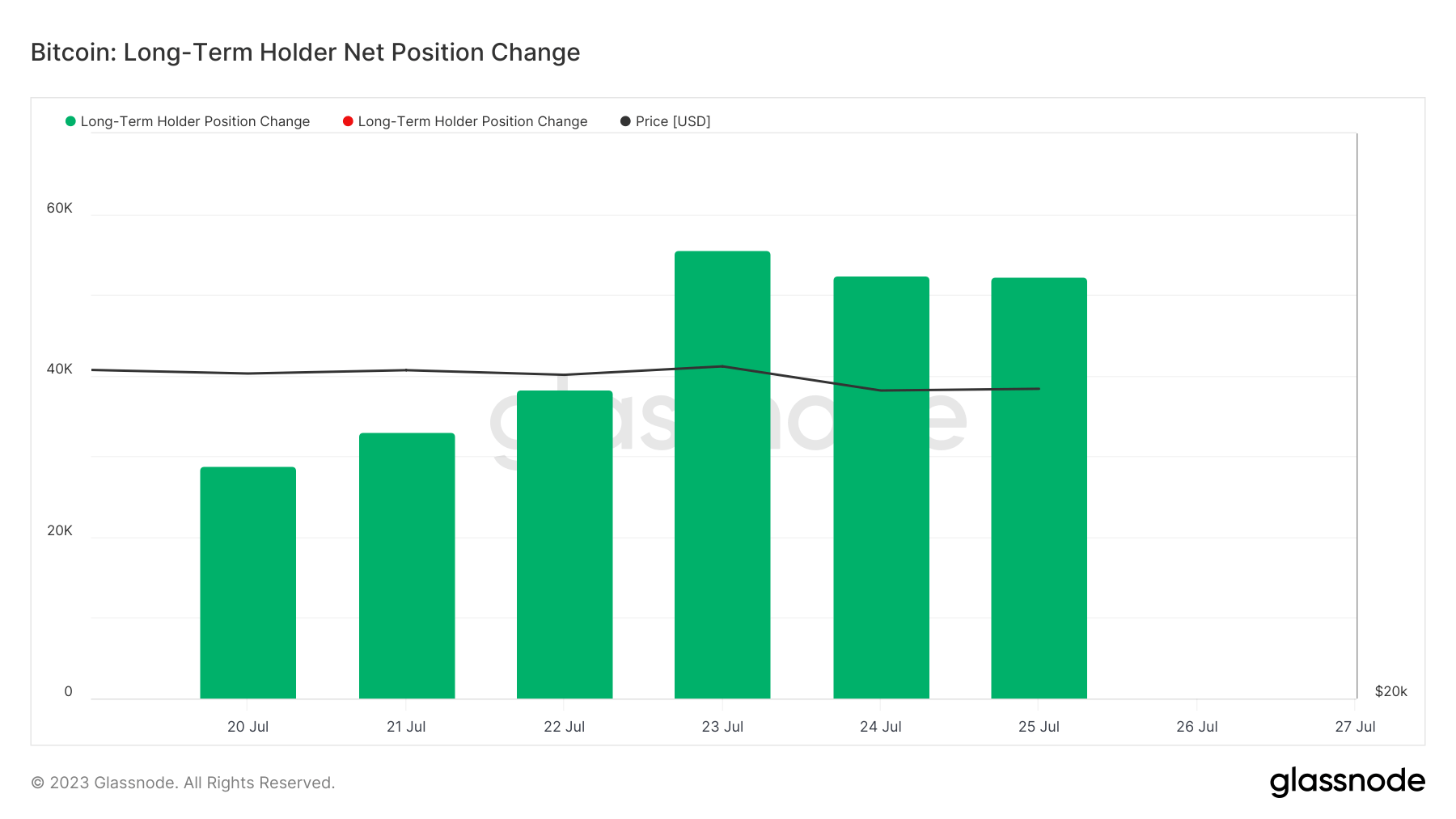

Despite the recent price volatility and increased realized losses, data from on-chain analytics firm Glassnode indicates that LTHs appear to hold strong. There has been little change in the supply of Bitcoin held by this group, suggesting resilience in the face of the current price slump.

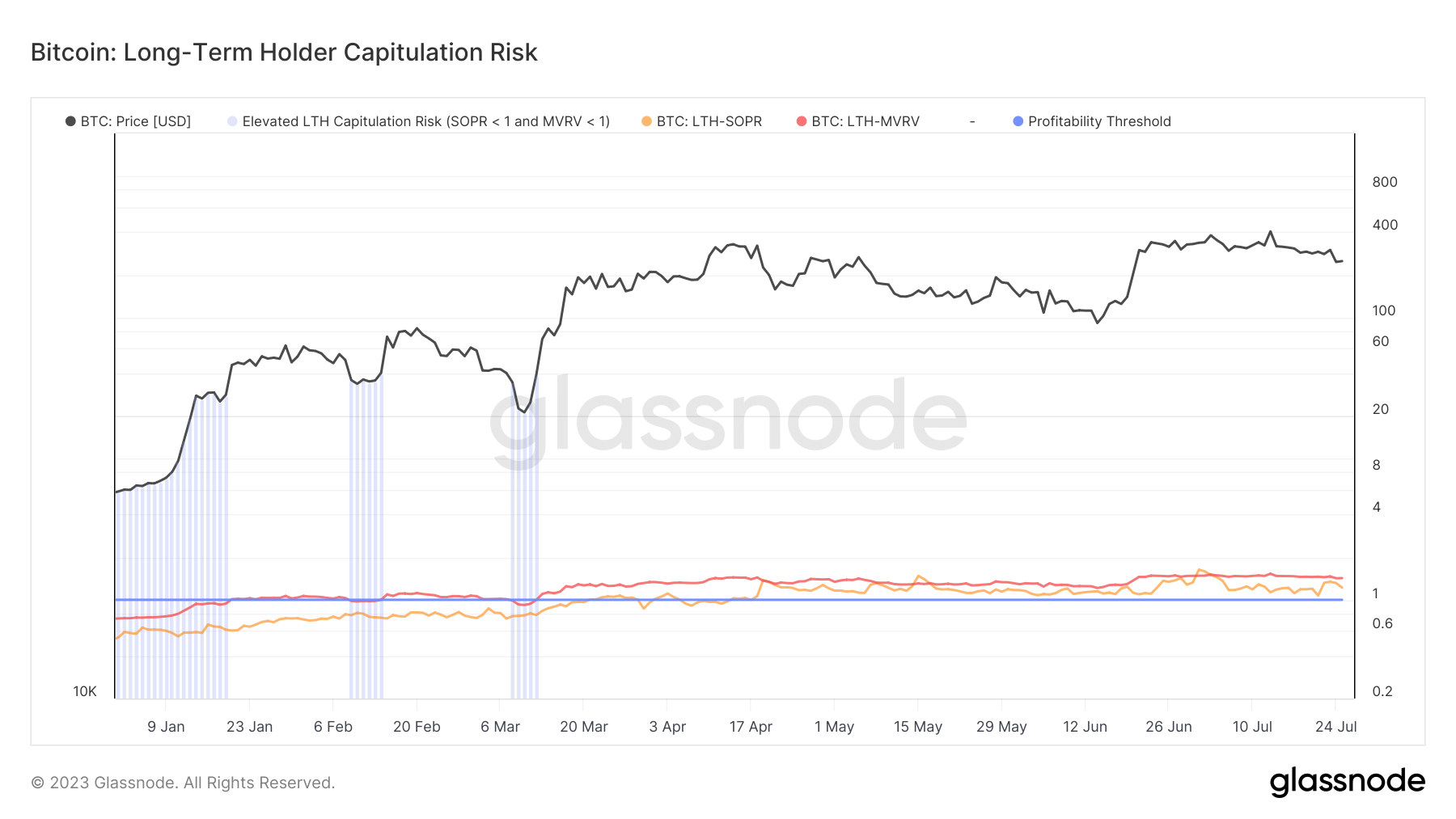

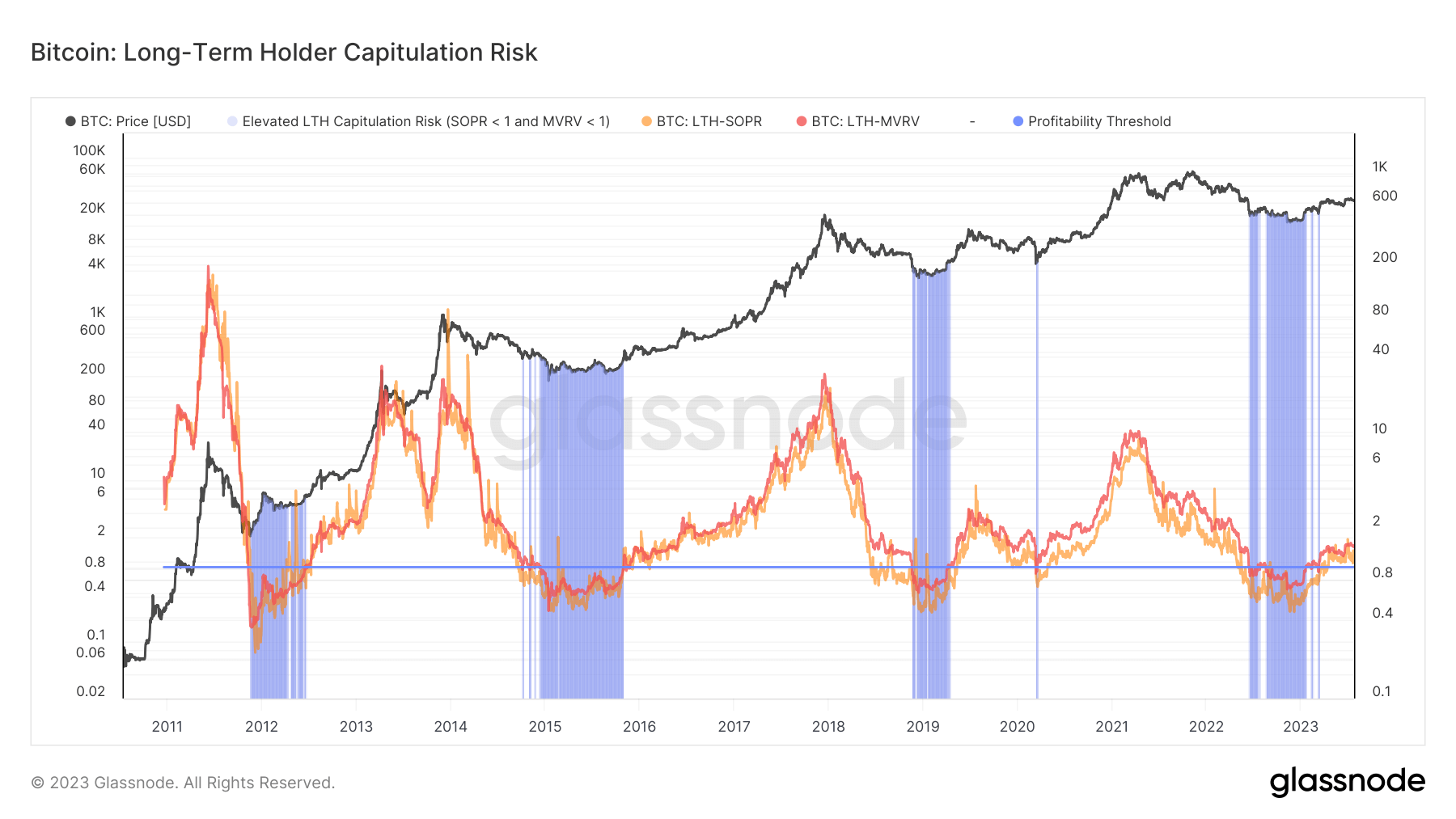

The LTH Capitulation Risk, a metric that identifies periods of elevated stress on long-term Bitcoin investors, indicates little danger of these holders selling off their BTC holdings.

This metric amalgamates two indicators: the LTH-MVRV, representing the unrealized profit or loss of long-term holders, and the LTH-SOPR, indicating the realized profit or loss of the same group. Historically, periods of elevated capitulation risk have correlated with Bitcoin’s price dips, but currently, this risk appears to be low.

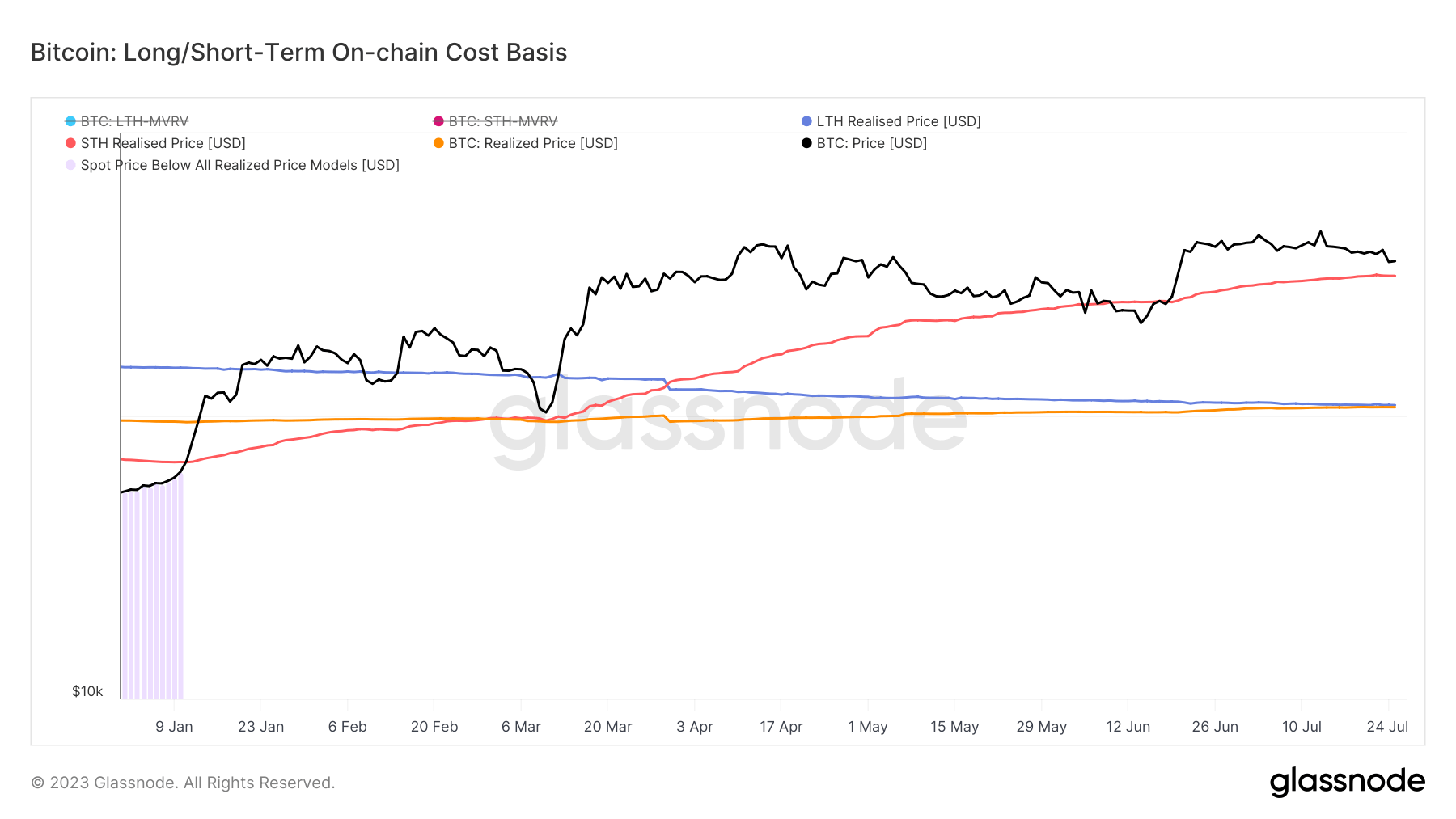

Further, the realized price, which reflects the aggregate price at which each coin was last spent on-chain, currently stands at $20,540, while Bitcoin’s spot price stood at $29,200 at press time. This suggests a significant buffer before Bitcoin’s price drops below the acquisition price of long-term holders.

In contrast, the realized price for short-term holders is $28,200, indicating an elevated risk of STH sell-offs. This is because the spot price is dangerously close to the average acquisition price for this group, and a further dip could trigger more liquidations.

Despite Bitcoin’s recent price dip and the ensuing market turbulence, long-term holders appear to be weathering the storm. Their holding behavior and the current metrics suggest a lower risk of sell-offs from this group. However, the situation for short-term holders is more precarious, and further price dips could lead to increased sell-offs.

The post Long-term holders seem unfazed by Bitcoin’s dip to $29K appeared first on CryptoSlate.