A consumer debt advice start-up aimed at helping Britons weather the cost-of-living crisis has secured external funding ahead of its public launch.

Sky News understands that SuperFi, which is aimed at an estimated 18m adults who are wrestling with monthly household bills, will announce on Friday that it has raised $1m in a pre-seed round.

The raise has been led by Ascension, a venture capital fund, and also includes money from Force Over Mass and a grant from the Greater London Authority.

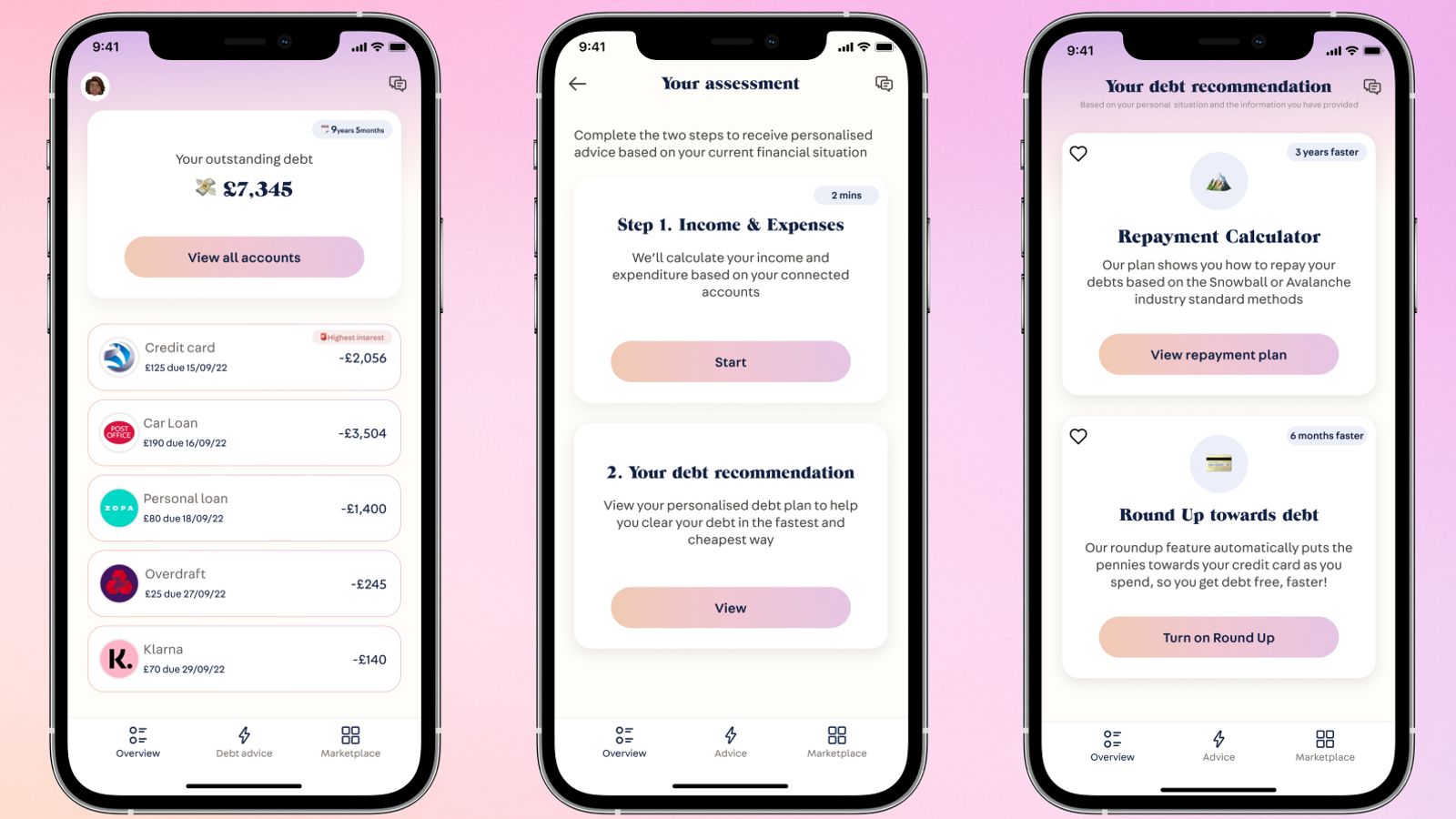

SuperFi estimates that it will be able to save users more than £130m in debt repayments over the next five years, by providing them with an overview of their debts, analysing their financial circumstances, and offering access to suitable debt prevention tools and services.

The platform, which aims to launch later this year, has been founded by a group of technology executives who previously worked for companies including NatWest Group and Groupon.

Be the first to get Breaking News

Install the Sky News app for free

Research from StepChange, the debt charity, suggests there are 18m Britons who are not yet in payment arrears and so are not eligible for formal debt solutions.

The research says that this group collectively owes more than £70bn in unsecured debts.

British Gas profits soar by 889% (but not for the reason you might think)

Shell profits cut by half due to plunging energy prices

Wizz Air lands in trouble over flight disruption compensation

“We believe that debt management should be proactive, not reactive,” Tom Barltrop, co-founder of SuperFi, said.

“Our goal is to help millions of people struggling to pay their bills and credit commitments better manage their debt before it becomes a crisis.”

The new funding is being earmarked to support authorisation via the City regulator’s ‘innovation sandbox’ and to launch partnerships with London boroughs.

Emma Steele, a partner at Ascension, said: “With over £1.6trn in personal debt in the UK alone, the scale of the problem is massive, and SuperFi’s innovative platform is uniquely positioned to address it through a partner-based business model that remains on the consumers’ side as the business scales.”