Over the weekend, meme coin mania returned with new fervor as it reached the Coinbase-backed Ethereum layer-2 network Base.

On July 30, BALD, an obscure meme coin with no website, on the L2 solution gained wide attention after its value exploded by more than 10,000% on the decentralized exchange Leetswap to a peak of around $0.085, and its market capitalization soared above $85 million, according to Dexscreener data. The asset’s trading volume during the period was more than $100 million.

Some community members linked the meme coin to Coinbase insiders. One tweet noted that BALD’s deployer is a whale connected to a large supply of Coinbase liquid Ethereum token, cbETH.

Rug pull fears emerge

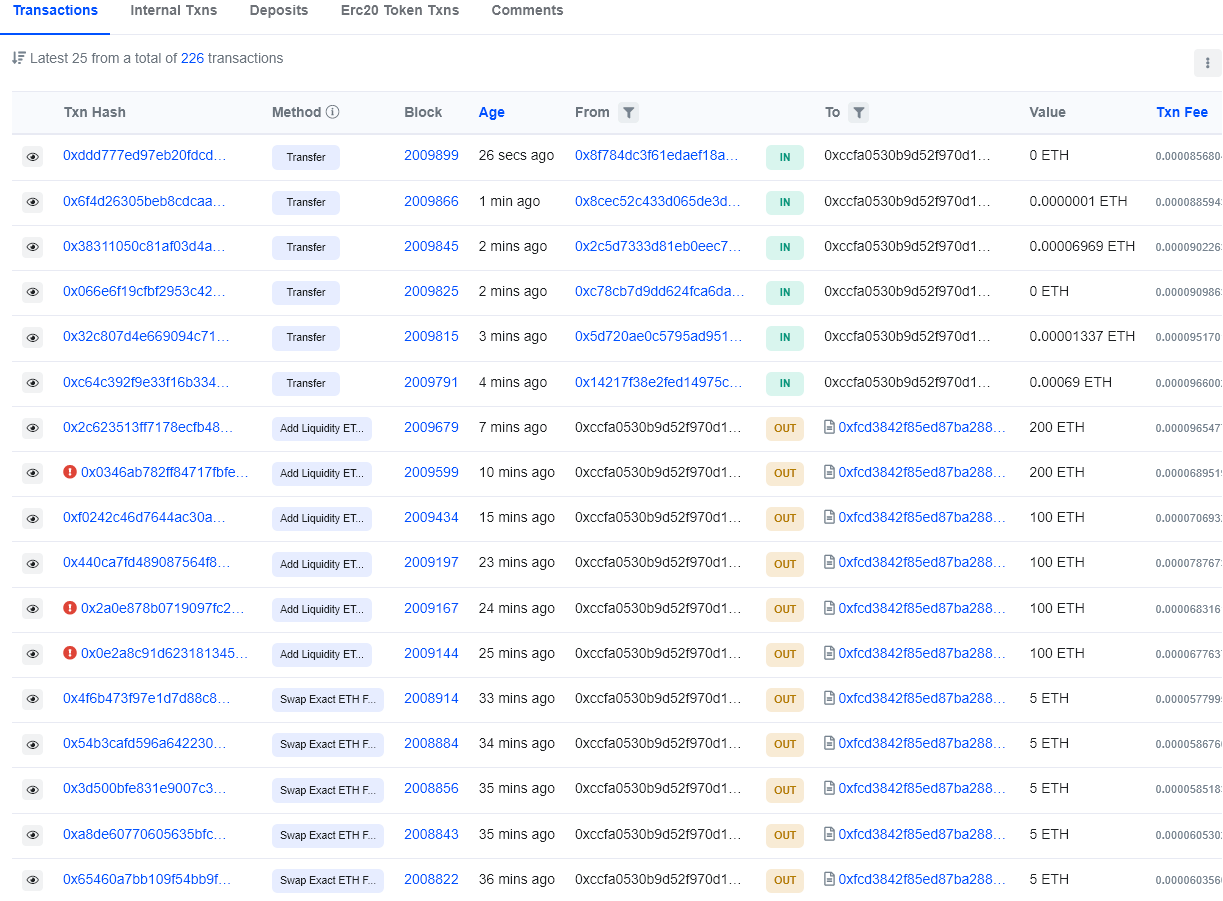

On-chain data shows that its value sharply declined by more than 80% after its deployer removed millions of dollars worth of liquidity, prompting speculations of a rug pull.

The deployer stated on the project’s official Twitter account that he had not sold any tokens since the launch. He clarified that the transactions were to add two-sided liquidity to the token.

However, crypto sleuth The Data Nerd said the deployer withdrew 7,000 ETH and 142 million BALD tokens worth $13 million. The deployer’s address currently holds 12,000 ETH worth $23 million.

Degens profit

At its peak, one Twitter user turned a $500 investment in the meme coin into a $1.5 million profit. On July 29, Cheatcoiner tweeted that he bought 2% of the asset under the $50,000 market cap.

According to Lookonchain, four addresses that spent around $1,000 to buy 5% of the asset’s total supply of 50 million BALD tokens made $1 million in a day after its value soared. The addresses were purchased 4 minutes after the digital asset started trading, and Lookonchain suggested that the buyers were probably insiders.

Another address that made a significant profit was “0xC57E”, which earned over 400 ETH, more than $800,000, in one day. According to Lookonchain, the address bought BALD with 65 ETH on the Base network on July 30 and sold it for 482 ETH.

Meanwhile, it was unclear how these addresses cashed out their profits as Base Network lacked a mainnet bridge connecting it back to Ethereum.

Typically, meme coin trading has been primarily focused on BNB Chain through Pancakeswap. Trading within the niche sector of betting on obscure tokens without any fundamentals has declined dramatically during the bear market.

Meme coin trading gives an insight into the state of market liquidity across different blockchains, with the weekend’s Base activity indicating a growing presence on the Coinbase-backed network.

The post Rug pull fears emerge after obscure meme coin surges 10,000% on Coinbase-backed Base network appeared first on CryptoSlate.