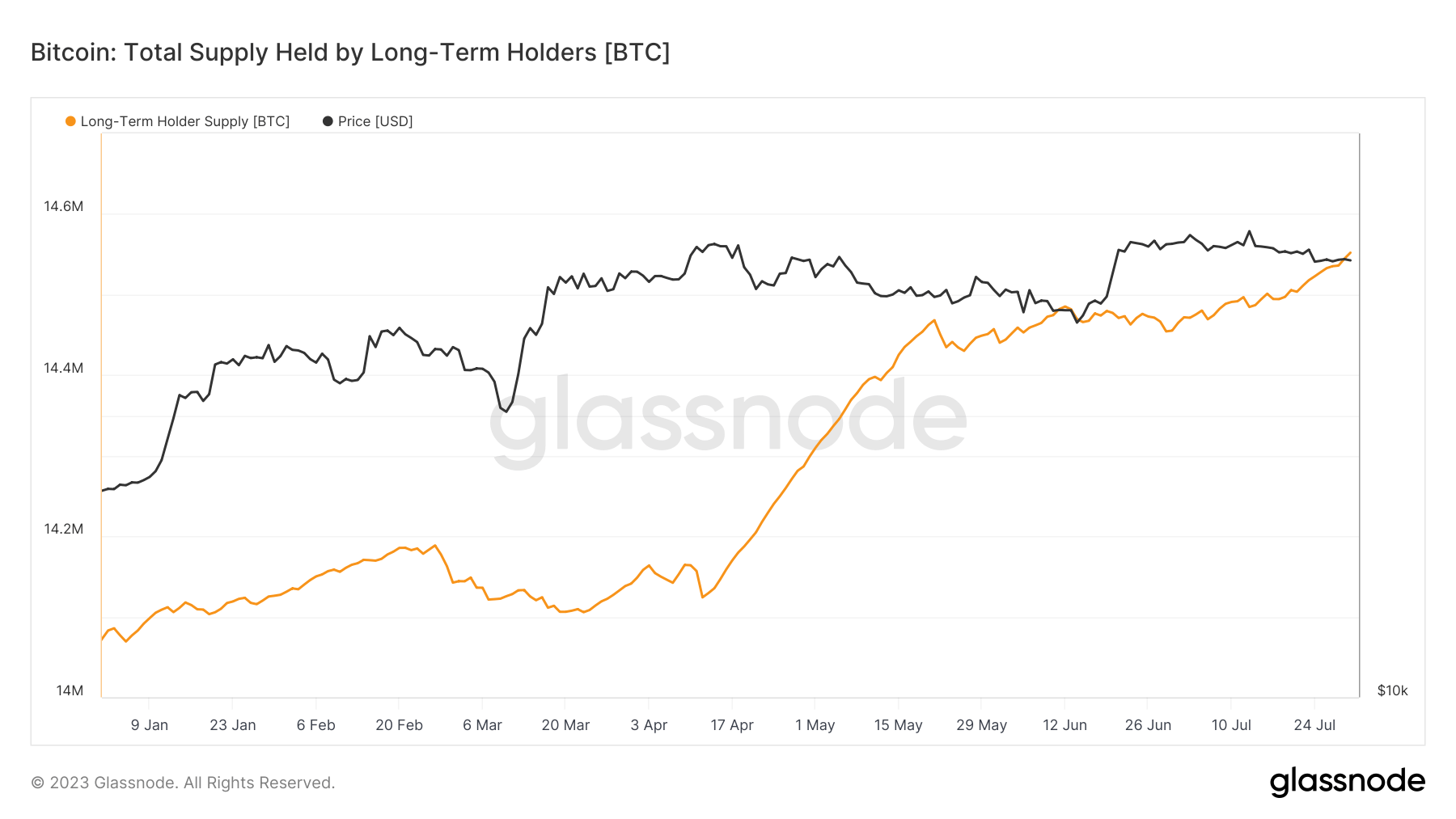

On July 30, the amount of Bitcoin held by long-term holders reached an all-time high. According to data from blockchain analytics firm Glassnode, long-term holders now possess 14.55 million BTC, marking a new record in Bitcoin’s history.

Long-term holders (LTHs) are defined as addresses that have held onto their Bitcoin for over 155 days playing a crucial role in the Bitcoin market due to their tendency to hold onto their assets through market volatility and thereby reducing the available supply and potentially exerting upward pressure on prices.

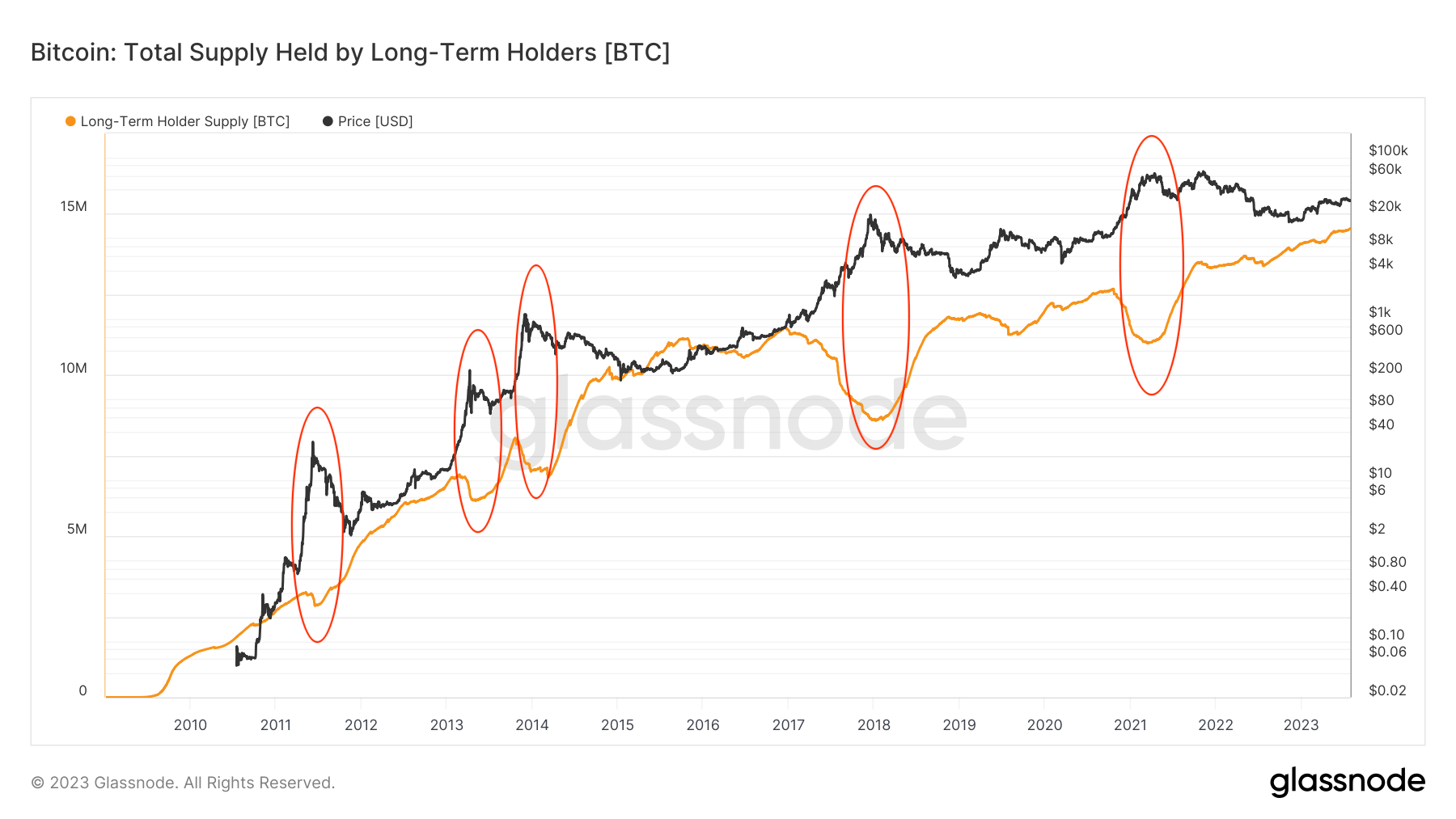

Historically, the supply of Bitcoin held by long-term holders has followed a cyclical pattern, increasing during bear markets and decreasing during bull runs.

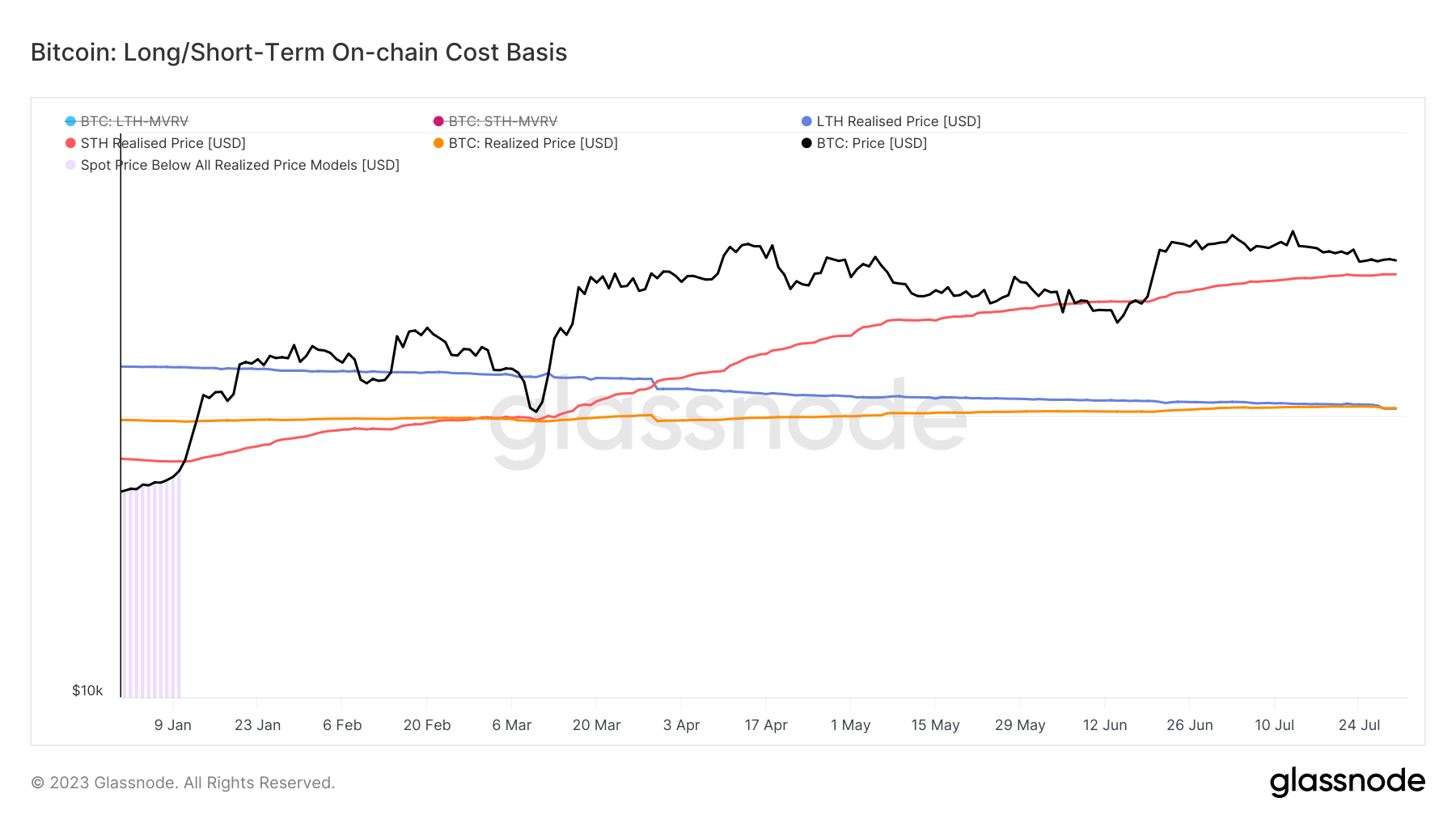

The recent surge in LTH supply occurred when Bitcoin’s price was below $30,000. This accumulation led to a decrease in the long-term holders’ realized price to $20,332, down from $22,539 at the start of the year. A 9.8% reduction in the realized price is noteworthy, showing that long-term holders have been strategically accumulating Bitcoin at lower prices amid the market downturn.

The decrease in the LTH realized price could have a profound impact on the Bitcoin market. It suggests that these holders are undeterred by lower prices and continue to accumulate, potentially providing a strong support level for Bitcoin. This could limit further downside and set the stage for a price rebound.

The recent all-time high in Bitcoin’s long-term holder supply could also have far-reaching implications. An increase in long-term holder supply during a bear market could signal the start of a new accumulation phase, potentially paving the way for the next bull run.

Conversely, a decrease in long-term holder supply during a bull market could indicate profit-taking and potential market tops.

The post Long-term Bitcoin holder supply posts new ATH, undeterred by price appeared first on CryptoSlate.