Quick Take

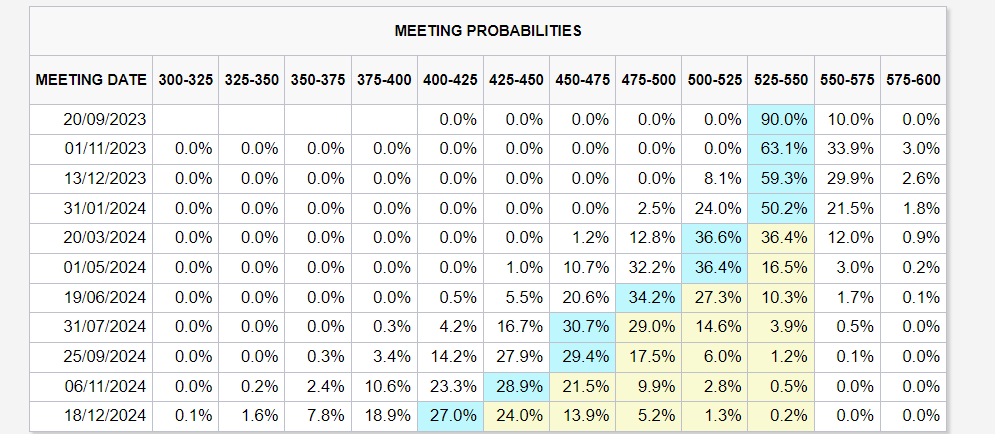

The market anticipates continuity in the Federal Reserve’s pause for the remainder of the year, as suggested by current trends. The resurgence of Consumer Price Index (CPI) and Producer Price Index (PPI) inflation rates has activated a reevaluation of these expectations. Prevailing market sentiments are pricing in 125 basis points worth of rate cuts in 2024, setting the bar between 400-425 bps by the end of 2024.

This is a clear indication of a market correction in anticipation of potential rate cuts, with the Fed’s stance for 2024 being a key determinant. Should the Fed not follow through with rate cuts in 2024, it could trigger a repricing of equities markets. Such a repricing could generate a fresh ripple effect, creating possible headwinds for Bitcoin and other similar assets.

It’s crucial to keep an eye on the Fed’s actions which have the propensity to influence a broad spectrum of markets, further underscoring the interconnectivity between conventional finance and the ever-evolving world of cryptocurrencies.

The post Federal Reserve’s 2024 plans could create headwinds for Bitcoin appeared first on CryptoSlate.