Quick Take

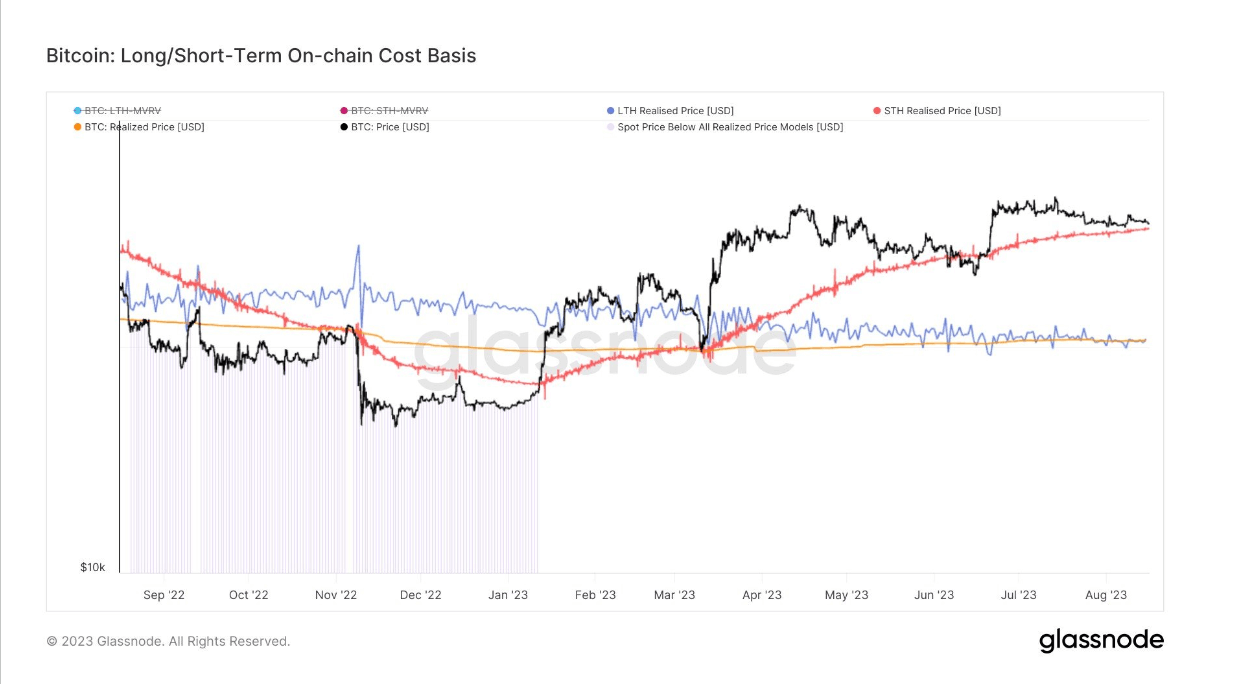

Bitcoin’s price dynamics are exhibiting a pattern of consistent reliance on the short-term holder cost basis as a support level, currently standing at $29.1k. For the third time this year, Bitcoin has gravitated towards this price level, indicating its significance in the market’s perception of Bitcoin’s value.

The Short-Term Holder Realized Price, representing the average on-chain acquisition cost of coins moved within the last 155 days and not held in exchange reserves, helps us understand this phenomenon. These coins are considered the most likely to be transacted on any given day, thereby influencing Bitcoin’s price movement.

Notably, this price level provided support during two critical periods earlier this year – the banking crisis in March and a notable dip in mid-June. This recurring pattern underscores the importance of the short-term holder cost basis as a determinant of Bitcoin’s price resilience.

The post Bitcoin price resilience hinged on short-term holder cost basis, on-chain analysis shows appeared first on CryptoSlate.