In a recent development, Republican lawmakers on the U.S. congressional committee responsible for overseeing the Securities and Exchange Commission (SEC) have intensified their scrutiny of the agency’s crypto approval process.

Led by Chair Patrick McHenry, 23 House Financial Services Committee lawmakers have sent a letter to SEC Chair Gary Gensler, demanding an explanation regarding Prometheum’s approval as a crypto broker-dealer.

Lawmakers Allege Strategic Move Via Prometheum’s Crypto Approval

Their inquiry focuses on Prometheum’s status as a special purpose broker-dealer (SPBD) for “crypto securities.”

Introduced by the SEC in December 2020, the SPBD framework was designed to enable custody and transactions involving digital asset securities. Notably, the Financial Industry Regulatory Authority (FINRA) approval is a prerequisite for SPBDs to operate, and until May 17, 2023, no SPBD had received such approval.

The approval of Prometheum Ember Capital, a subsidiary of Prometheum, as the first and sole SPBD under the new regime has raised concerns among Republican lawmakers.

They also question the timing of the approval, which coincided with a joint hearing held by the House Financial Services Committee and the House Agriculture Committee on crypto assets market regulation.

Moreover, the lawmakers suspect the approval was strategically aimed at “undermining” the need for legislative action by showcasing an already functional regulatory framework for digital asset securities custody.

While Prometheum claims to offer a comprehensive solution for regulated crypto asset offerings, it has yet to serve a single customer, according to the House Financial Services Committee.

Additionally, the firm has not disclosed the digital asset securities supported on its platform, raising questions about its eligibility criteria. Notably, the SEC has not provided definitive guidance on what constitutes a digital asset as a security, making it difficult to ascertain the scope of Prometheum’s operations.

Prometheum’s Chinese Connection Raises National Security Concerns

In the letter issued to Gary Gensler, Republican lawmakers also expressed concerns regarding Prometheum’s limited operational capabilities, precisely its inability to perform clearing or settlement services necessary for operating as an alternative trading system.

Given these limitations, the lawmakers question why FINRA approved a firm with no operational history or customer track record over other applicants.

Moreover, deeper concerns arise regarding national security and data privacy. As reported by Bitcoinist, In 2018, Prometheum partnered with Shanghai Wanxiang Blockchain Inc., a Chinese entity involved in blockchain software development.

Although the agreement was subsequently terminated, questions persist about the potential involvement of a Chinese entity in Prometheum’s early-stage technology development. Notably, a representative of the Chinese entity, Feng Ziao, holds a directorial position at Prometheum.

As Republican lawmakers demand answers from Chair Gary Gensler, the spotlight shines on the SEC’s approval process and the underlying factors that led to Prometheum’s unique status as an SPBD.

The outcome of this inquiry could have far-reaching implications for the regulation of digital assets and the broader crypto industry.

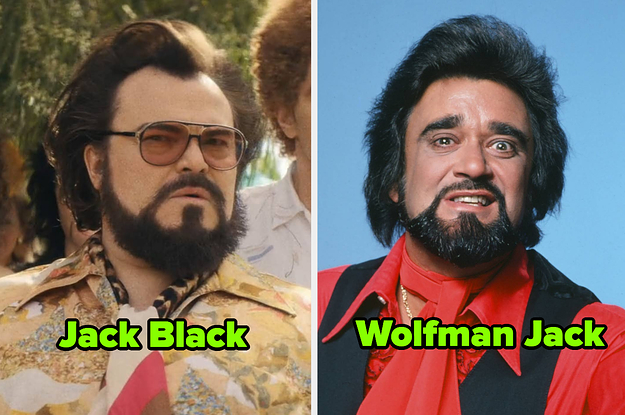

Featured image from iStock, chart from TradingView.com