Quick Take

Bitcoin has slipped below its $29,000 support level, currently lingering around $28,500, as multiple macroeconomic factors coalesce to pressure the digital asset.

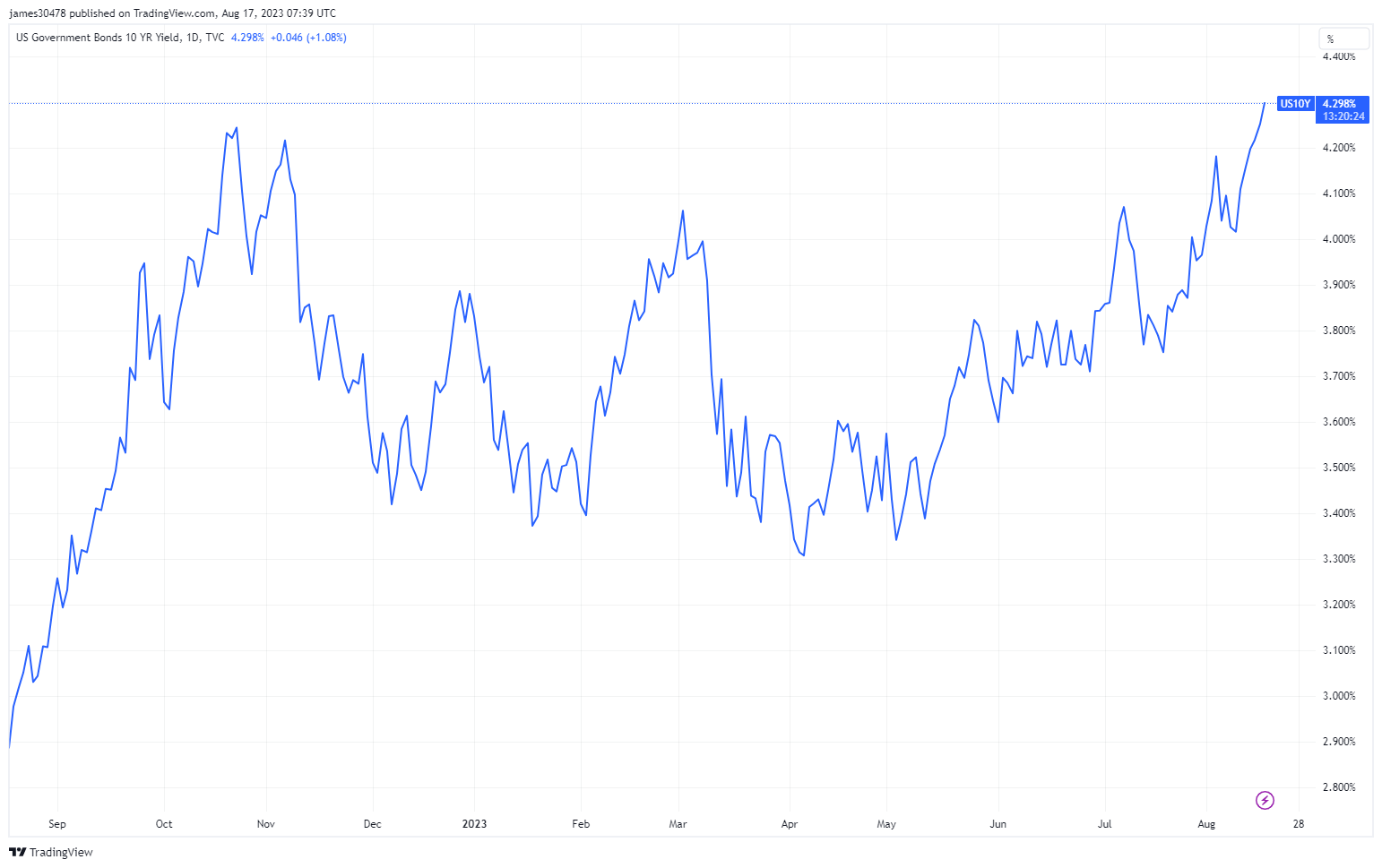

As a primary influencing element, U.S. treasury yields have demonstrated a continuous ascent, with the 10-year yield marking its highest close since June 2008 at 4.27%. This rise in yields, indicative of potential inflation risks and higher rates, creates a challenging environment for Bitcoin.

Simultaneously, the U.S. dollar index has surged above 103, applying additional strain on global currencies. As the dollar strengthens, the appeal of alternate assets like Bitcoin can diminish, contributing to the downward trend.

This situation has been further augmented by the recent release of the FOMC minutes, where most officials acknowledged the persistent inflation risks, hinting at the possibility of higher rates in the future.

While U.S. equities also tread a downward path, the combined effect of these factors has resulted in Bitcoin losing critical support levels, demonstrating the cryptocurrency’s susceptibility to traditional market dynamics.

The post US 10Y hits highest close since June 2008 as Bitcoin loses $29,000 support appeared first on CryptoSlate.