The Bitcoin price witnessed a 2.8% dip today, hitting a fresh local low at $28,353. Earlier, BTC was trading above $29,100 before the bears took control and pushed the price down by over $700. At press time, BTC saw a slight recovery. Nevertheless, the BTC price is now at an important inflection point.

According to legendary trader Peter Brand’s chart analysis, $29,000 is the crucial price level for Bitcoin. He shared the following chart and tweeted:

Bitcoin seriously challenging multi-contact point trendline from 2023 bottom. Move through Aug low would be bear signal or bear trap. As a swing trader I would respect the violation of the trendline. So, my positions would be either short or flat. Only if a bear trap is actually “sprung” would I consider it a bullish development. I strongly prefer horizontal chart construction.

Why Is Bitcoin Down Today?

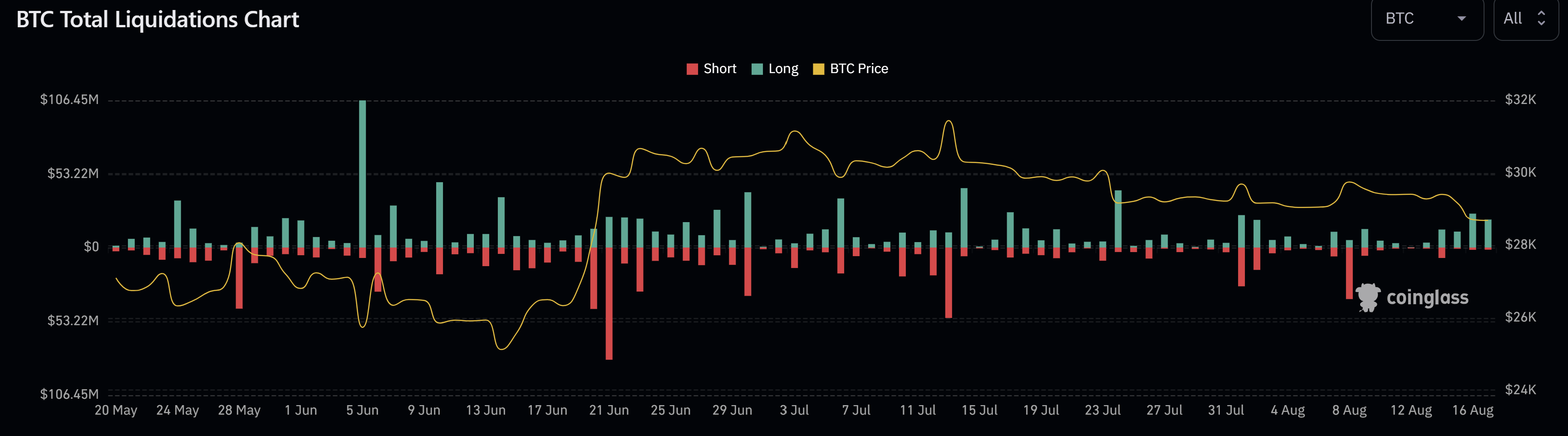

The Bitcoin Futures market has played a key role. Over the past 2 days, long positions worth $24,76 and $20,17 million respectively have been liquidated according to Coinglass data. Open interest had built up quickly before the bitcoin price collapsed. A squeeze was only a matter of time.

Renowned analyst Byzantine General commented: “This is brutal. Longs keep getting liquidated over and over. Open interest finally moved, but only so little. Funding hasn’t budged at all.”

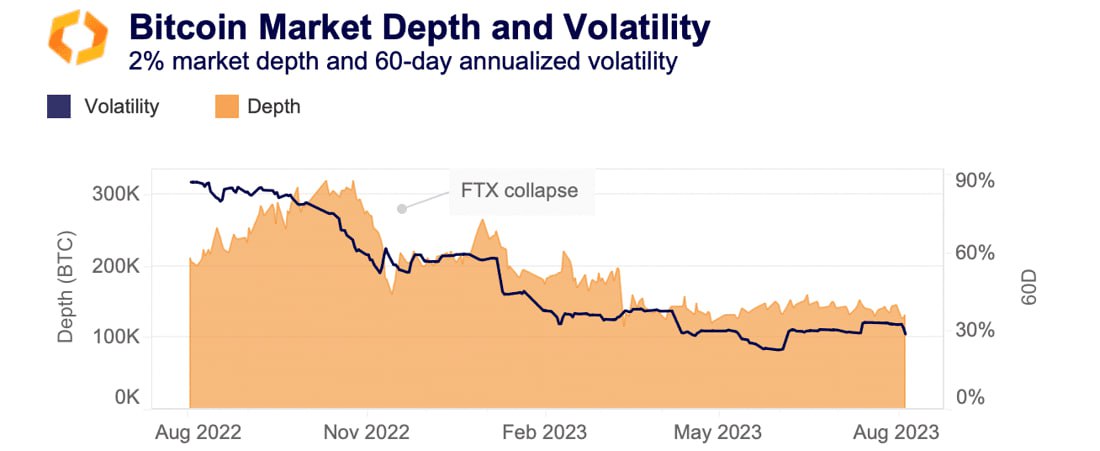

One thing to consider is that the Bitcoin and crypto market is more illiquid than it has been in a long time. Thus, BTC is vulnerable to bigger price fluctuations much more quickly than in a more liquid market. Operation Choke Point 2.0 has been extremely damaging to the market, with market makers disappearing and US dollar rails being cut off. According to Kaiko data, BTC trading volume across all exchanges has fallen to 2-year lows.

Renowned on-chain analyst Willy Woo commented on Peter Brandt’s analysis: “Crunch time for BTC. Macro headwinds from US dollar strength. Meanwhile there’s increasing demand on futures market (pro traders) and on-chain fundamentals picking up. Either way, up or down, we are now setting up for a strong move. Volatility squeeze incoming.”

With that, Woo cites another factor in Bitcoin’s price plunge today, the DXY. Glassnode founders Jan Happel and Yann Allemann added in an analysis that “this year’s significant moves have come from the dynamics in the DXY and US10Y, which are an effect of the macro environment.” As a result, BTC is feeling heavy all of a sudden. However, Happel and Allemann are optimistic:

We believe this turmoil is short-term. The DXY and rates will begin to top out in the coming week (2 weeks tops) and the Bitcoin Risk Signal (65) should drop.

The DXY is currently in a clear uptrend on lower time frames, trading at 103.4. However, as Happel and Allemann emphasize, the DXY still needs to confirm this uptrend. 104.65 could be crucial for this. If the DXY gets rejected, the BTC price could start a new upward momentum.

In general, macro factors and the fears of a recession also weigh on the Bitcoin market. In the first week of August, Fitch downgraded the US long-term credit rating and traditional financial markets tanked. Then, JP Morgan said they no longer expect a recession and markets tanked more. This marked the local top for the S&P 500. Since then, the S&P has lost $850 billion.

Last but not least, the wait for a Bitcoin ETF is likely to be a deciding factor for the market at the moment. The Bitcoin spot ETF hype has died down for the moment. The decline in ETF hype is evident by looking at the US trading hour premium, which ramped up after the initial Blackrock ETF announcement alongside CME futures open interest.

If these premiums return, it could signal new momentum. Until then, investors may wait impassively for the first Bitcoin spot ETF to be approved in the United States, leaving the market further in no-man’s land.

At press time, BTC stood at $28,619.