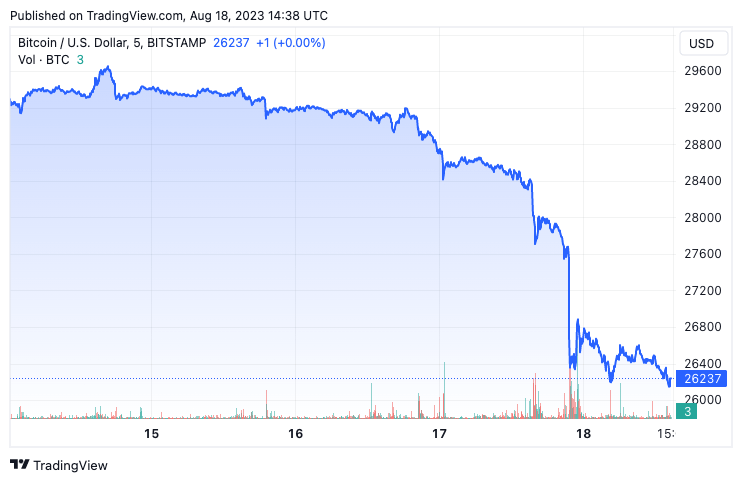

Bitcoin’s price plummeted to $26,298 on Aug. 17, marking a significant 9% decline within a 24-hour span.

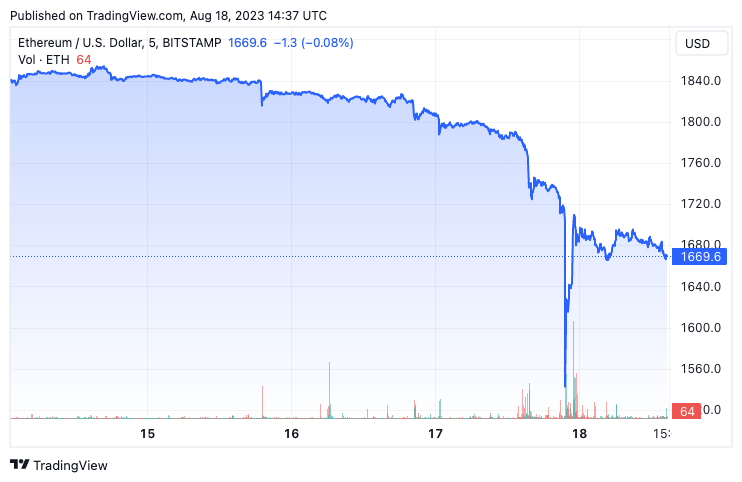

Ethereum wasn’t spared either, as its price tumbled to $1,620, reflecting a 10% drop during the same period.

This abrupt downturn didn’t just rattle traders but also triggered extensive liquidation events for both Bitcoin (BTC) and Ethereum (ETH).

The derivatives market witnessed liquidations surpassing $1 billion. But it’s essential to differentiate between futures liquidations and realized loss. Futures liquidations refer to the process where the exchange automatically closes a trader’s position once their account balance falls below the maintenance margin. In contrast, realized loss pertains to the actual loss an investor incurs when they sell an asset for less than its purchase price.

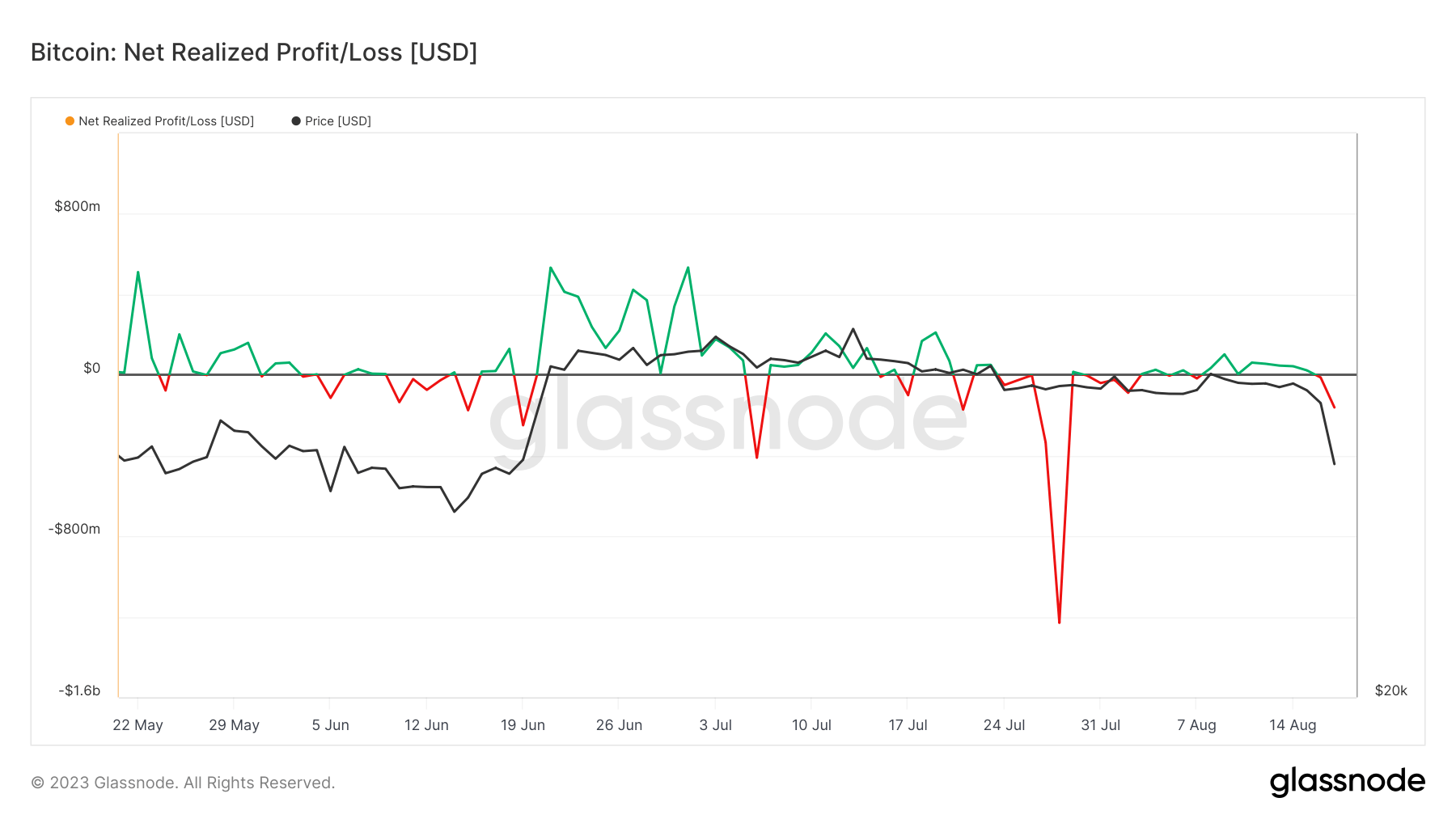

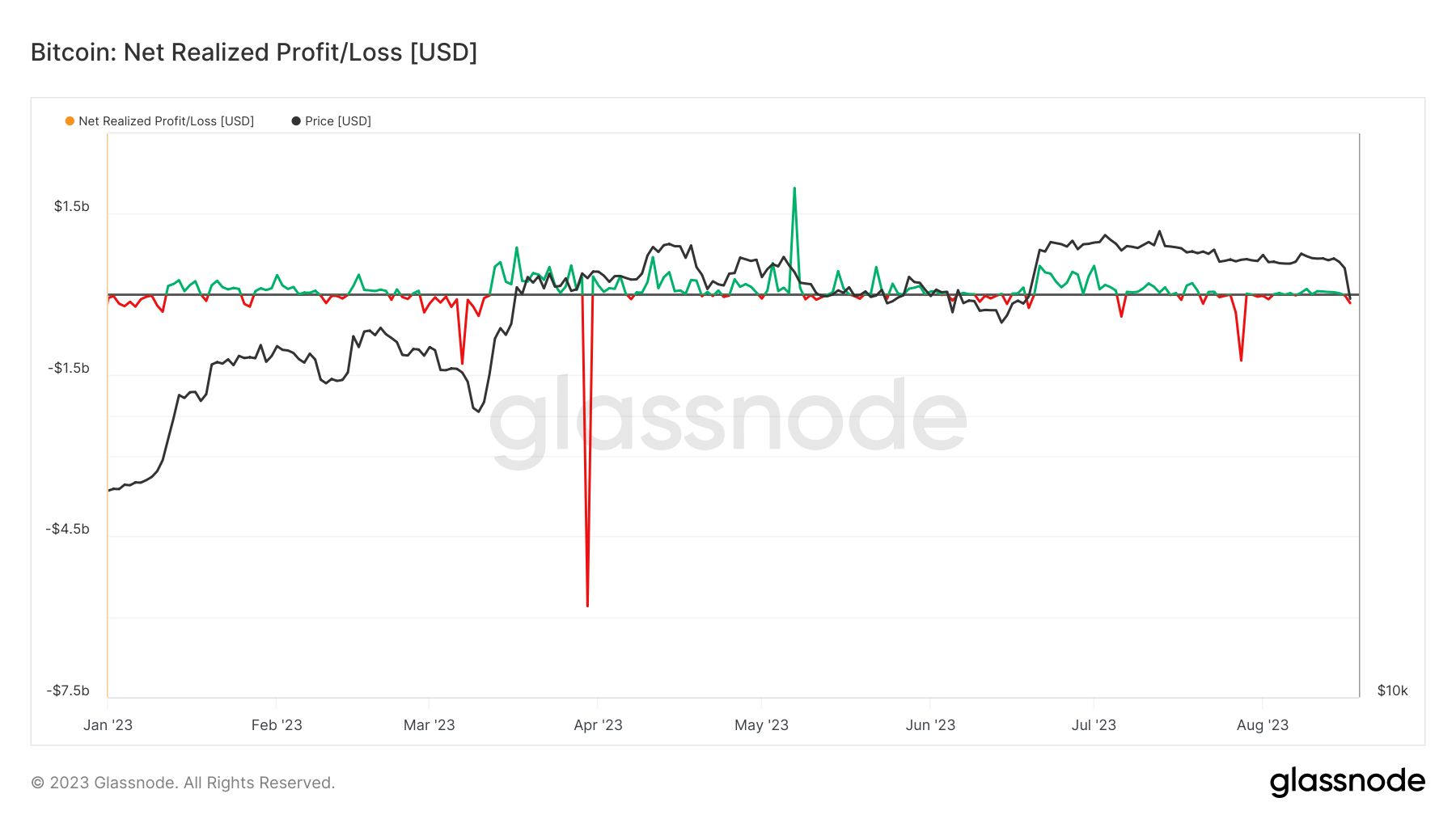

On-chain data revealed that the net realized profit/loss, a metric that gauges the profit or loss of all transacted coins, saw $160 million in realized losses on Aug. 17.

While this figure might seem alarming, it’s worth noting that it pales in comparison to the staggering $1.2 billion in losses recorded on July 28. However, what sets the Aug. 17 event apart is the aftermath — unlike previous substantial realized loss incidents this year, the Aug. 17 event was succeeded by an unusually sharp drop in Bitcoin’s price.

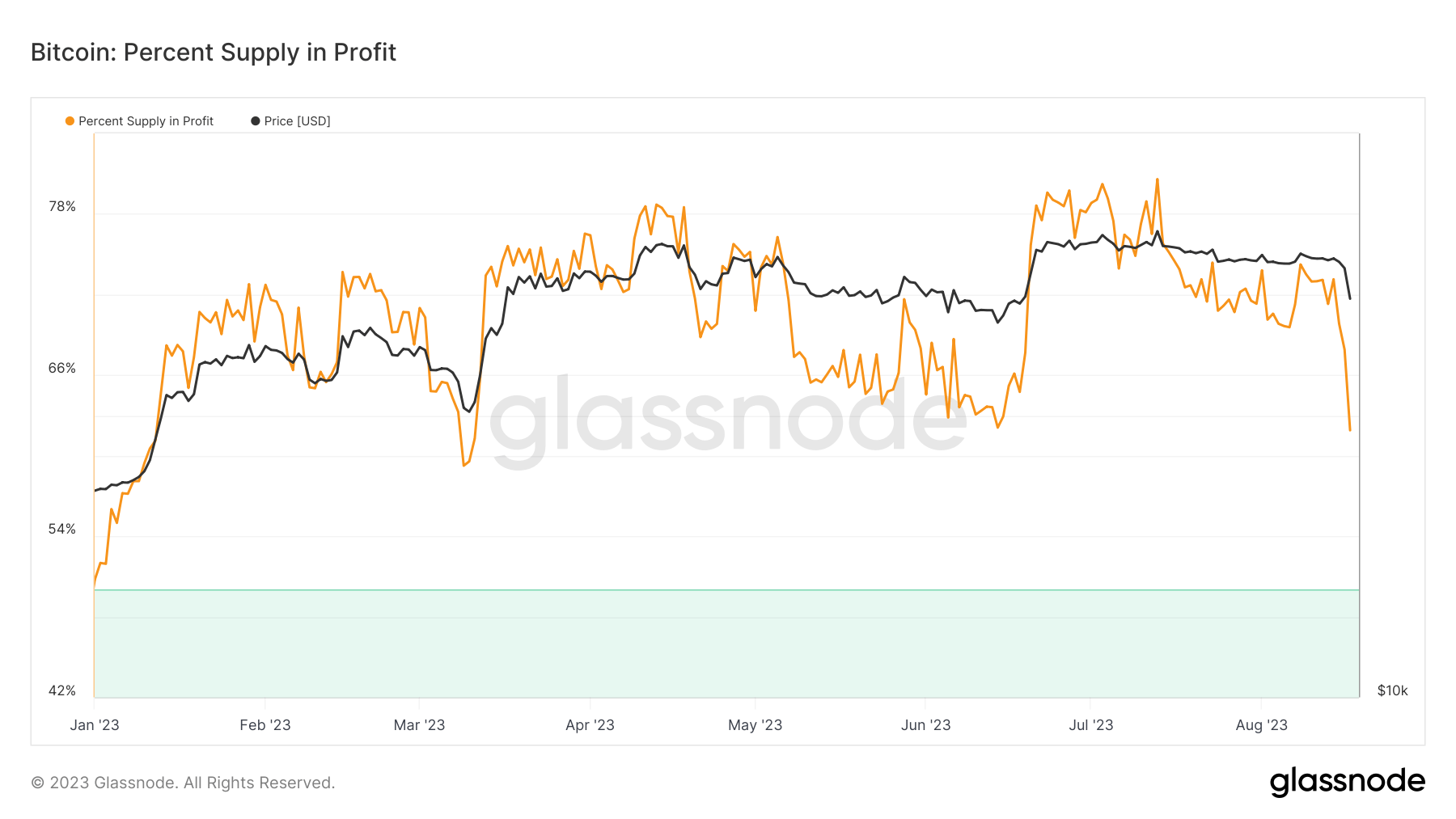

On Aug. 18, Bitcoin’s price showed resilience and bounced back slightly to $26,600 at press time. However, the percentage of supply in profit, which indicates the proportion of circulating Bitcoins that were bought below its spot price, took a significant hit and currently stands at just above 61%.

The post Bitcoin’s drop to $26.6K sees over $160M in realized losses appeared first on CryptoSlate.