Quick Take

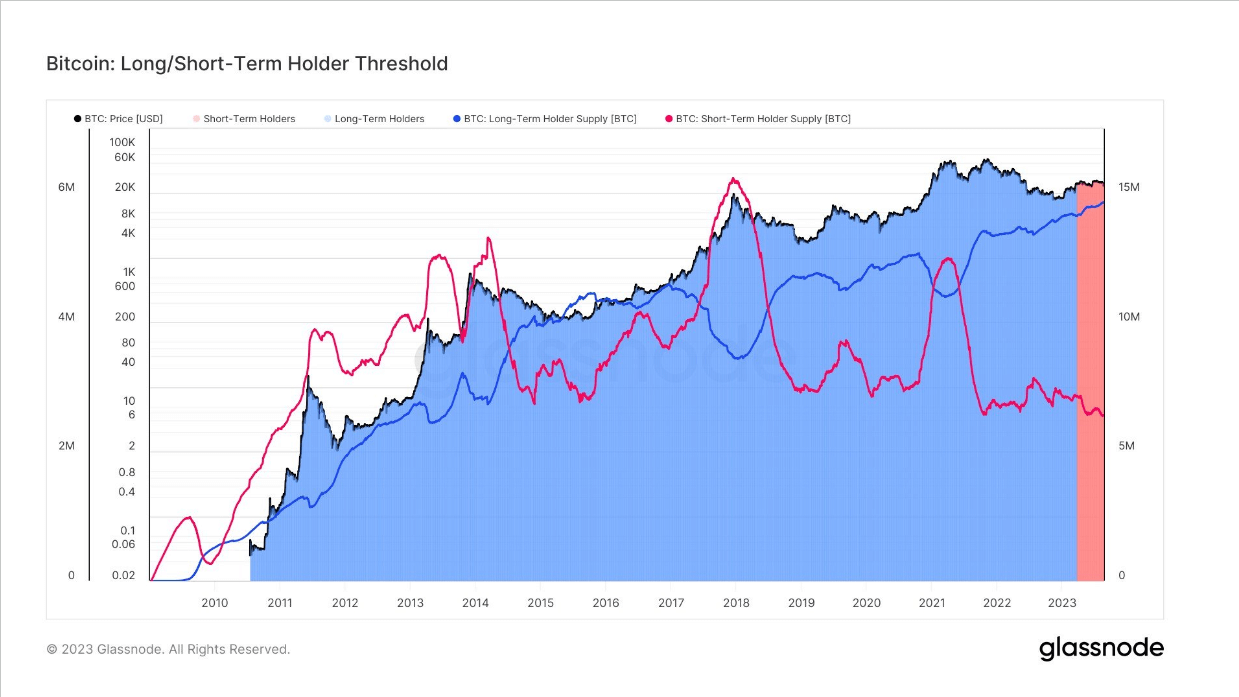

Recent data analysis reveals an all-time high in Bitcoin’s long-term holder supply, defined as Bitcoin held for more than 155 days, reaching 14.654 million. Conversely, the short-term holder supply, considering Bitcoin holdings of less than 155 days, has plummeted to an all-time low of 2.561 million if we exclude the year 2011. This presents an unprecedented divergence in Bitcoin’s supply dynamics.

The widening gap could be indicative of a stronger conviction in Bitcoin’s long-term potential among investors, leading to increased holding periods. On the flip side, it may also suggest a diminishing interest among short-term speculators, possibly due to market volatility or shifting investment trends. Regardless, this divergence presents an intriguing dynamic in the Bitcoin market that warrants close observation for its potential broader market implications.

The data analysis underscores the evolving landscape of Bitcoin ownership and its potential impact on liquidity, volatility, and market sentiment, providing valuable insight for investors and institutions navigating the cryptocurrency market.

The post Bitcoin’s long-term holder supply hits record high as short-term interest dips appeared first on CryptoSlate.