On-chain data shows the Bitcoin transaction volume has plunged to a 3-year low, a sign that may not be positive for the cryptocurrency.

Bitcoin Transaction Volume Has Continued To Be Low Recently

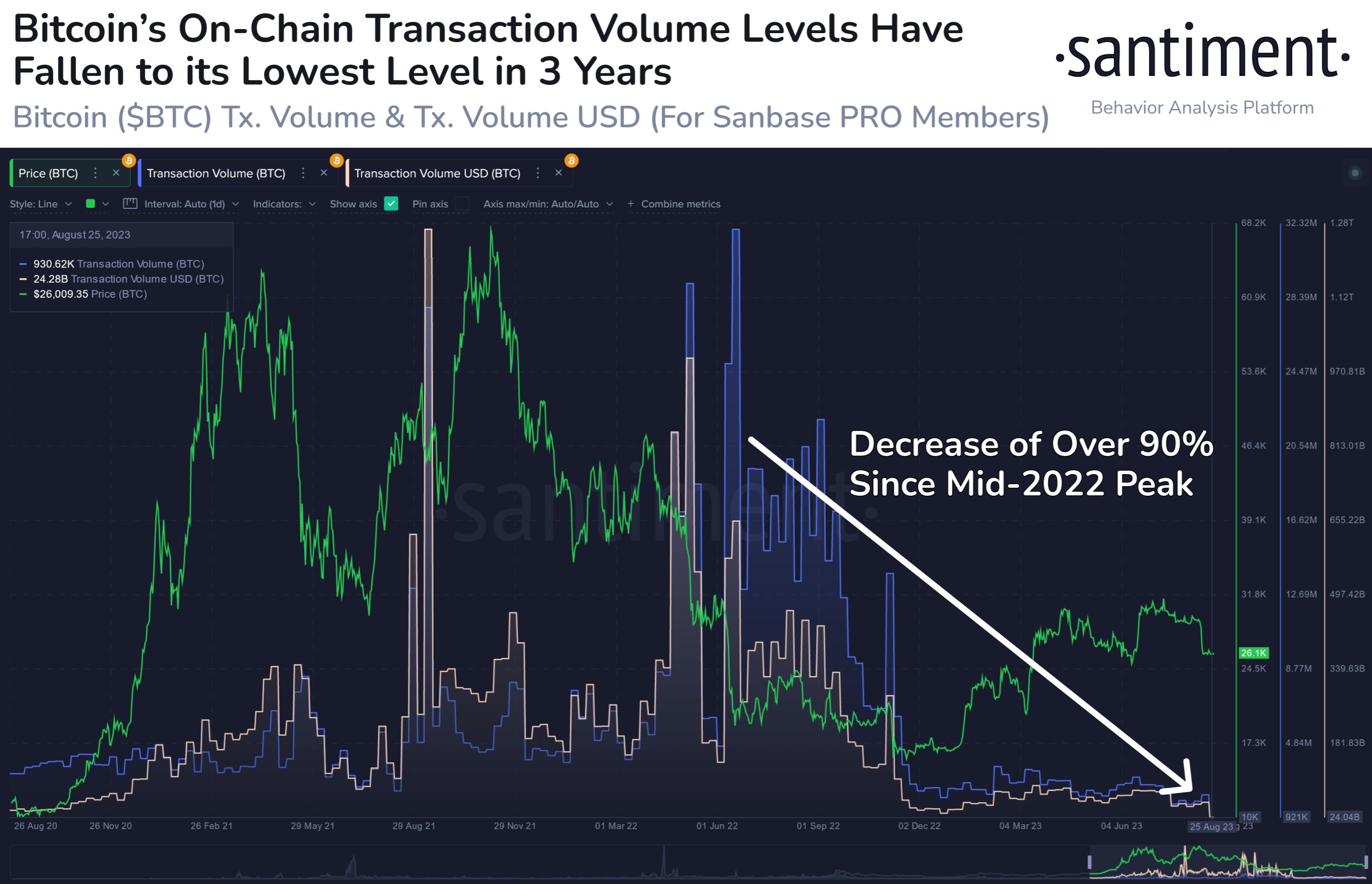

According to data from the on-chain analytics firm Santiment, the BTC transaction volume has seen a decline of 90% since the peak in mid-2022. The “transaction volume” here refers to a measure of the daily total amount of Bitcoin that’s being moved around on the blockchain.

This metric accounts for all types of transactions, whether they be peer-to-peer (P2P) ones, exchange deposits or withdrawals, or the fees that miners receive. As such, the indicator can provide a look into how active the blockchain as a whole is currently.

When the value of this metric is high, it means that a large number of coins are getting involved in transactions on the network right now. Such a trend can suggest that the traders are actively participating in the market currently.

On the other hand, low values imply the chain isn’t observing much activity at the moment, a possible sign that the market participants have little interest in the cryptocurrency.

Now, here is a chart that shows the trend in the Bitcoin trading volume over the past few years:

As displayed in the above graph, the Bitcoin transaction volume had last been at high values during the bear market crashes last year, but since the price lows following the FTX crash, the indicator has remained at low values. This is despite the fact that the cryptocurrency has observed a rally this year.

Generally, investors find volatility to be exciting, so they tend to make more moves than usual during such periods. This is the reason why the indicator had seen large spikes during the aforementioned crashes.

It would appear, however, that the rally has failed to ignite any notable interest in the cryptocurrency, as the network’s usage has continued to be at pretty low levels throughout this period.

Recently, the Bitcoin transaction volume has also seen a further decline, which has taken its value toward the lowest in around three years. In all, the indicator’s value has dropped by more than 90% since the mid-2022 peak, which is a pretty staggering amount.

The analytics firm notes that this decline in the network activity may not necessarily be bearish for the cryptocurrency, but it is naturally still an indication that there is FUD present among the traders right now.

It now remains to be seen whether the Bitcoin transaction volume will continue to stay at low values in the near future, or if a renewal of interest may finally happen. The latter could likely bring back some fresh volatility for the coin’s price.

BTC Price

Bitcoin hasn’t moved too much since the crash as the number 1 ranked cryptocurrency is still trading around the $26,000 mark.