On-chain data shows the Bitcoin trading volume has been increasing recently, which could help further the asset’s rally.

Bitcoin Trading Volume Has Registered A Large Boost Recently

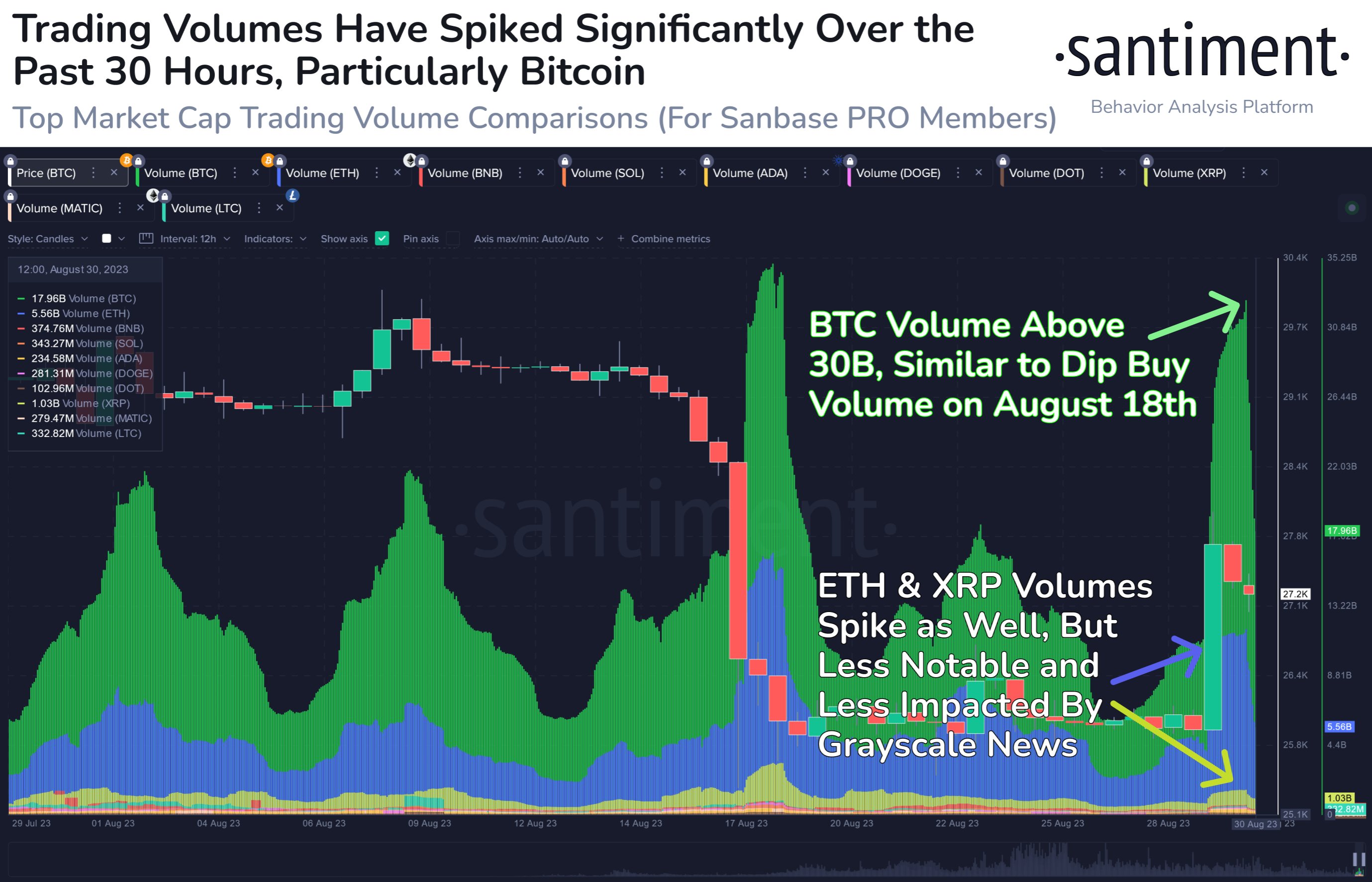

According to data from the on-chain analytics firm Santiment, BTC continues to see high volumes. The “trading volume” here refers to measuring the daily total amount of a specific asset being moved around on the blockchain.

When the value of this metric is high, it means that many tokens of the cryptocurrency in question are currently observing some movement. Such a trend implies that traders are active in the market right now.

On the other hand, low values of the indicator suggest the network is going through a period of low activity, a possible sign that the general interest in the coin among investors has dropped.

Now, here is a chart that shows the trend in the trading volume for some of the most significant assets in the sector over the past month:

The above graph shows that the top assets have seen some uplift in this metric with the latest rallies in their respective prices, but Bitcoin’s extraordinary growth is a clear standout.

Ethereum and XRP have also seen significant spikes in their trading volumes, but the sharpness of their growths has remained unchanged, like what BTC has observed.

At the height of this latest volume spike, about $30 billion in the asset had moved across the chain in the preceding 24-hour span, the most the indicator had touched since August 18th.

Bitcoin had observed a sharp crash from the $29,000 level to under the $26,000 mark. The volume had ushered in following this crash, as the traders had reacted in various ways, with some panic selling while others took the opportunity to buy.

Considering that the peak of the spike had coincided with the bottom for the asset, it’s possible that a lot of the volume had been flowing for dip accumulation.

Historically, spikes in the volume after volatile events like a crash or a rally have generally been common, as these are the moments when the investors’ attention is suddenly brought towards the asset. When the volume doesn’t go up even in such events, it can get a bit concerning.

Any sharp move in the price is generally only sustainable when there is a large amount of fuel behind it in the form of traders, so the volume not only spiking but also continuing to rise with the latest Bitcoin rally could be a positive sign for the surge’s sustainability.

BTC Price

Bitcoin had earlier broken above the $27,000 level, but today, the asset appears to have slumped below the mark, as it’s currently trading around $26,900.