Quick Take

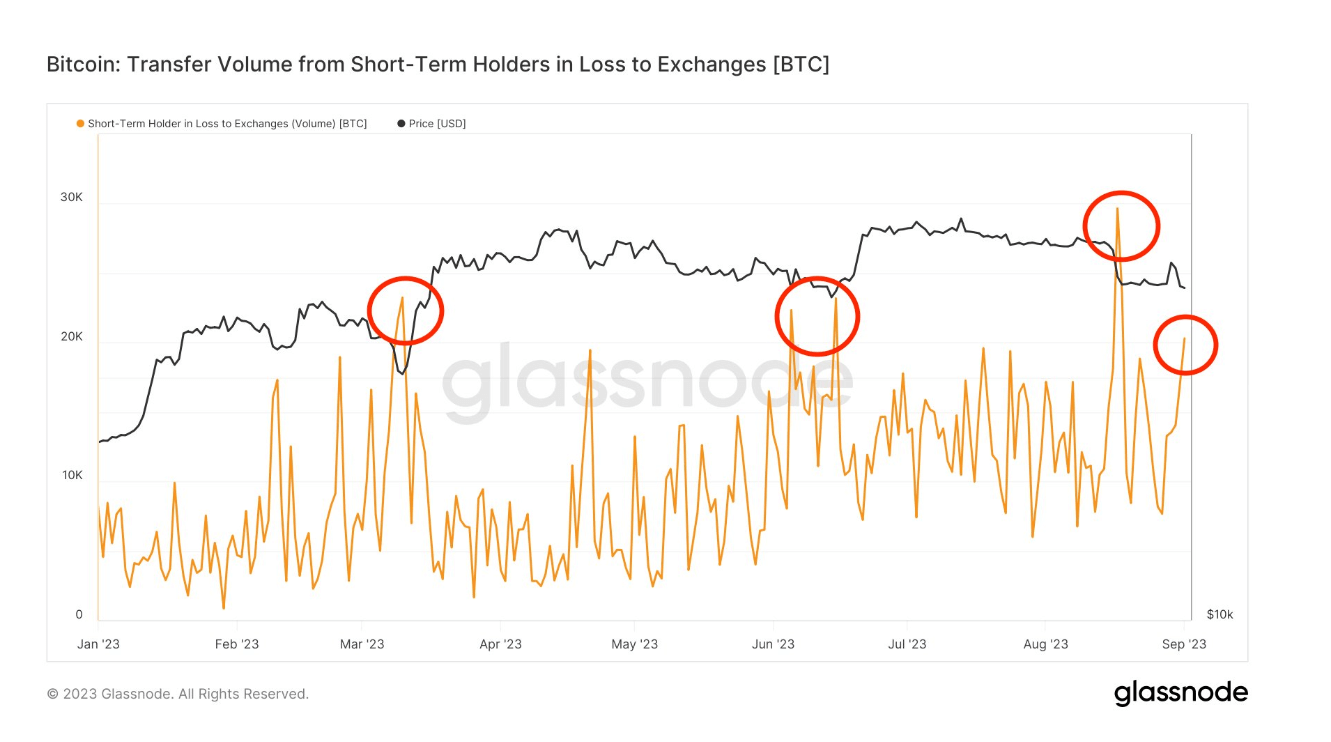

Bitcoin’s landscape has recently seen a significant shift. Short-term holders, defined as entities holding Bitcoin for less than 155 days, have once again succumbed to selling pressure, with approximately 20,000 BTC being sent to exchanges at a loss. This trend marks the fourth largest exodus of short-term holders this year, exemplifying their increasing proclivity to capitulate under market pressures.

This ongoing capitulation is enhancing a stark divergence in the supply dynamics between short-term and long-term holders. As this gap widens, it subtly alludes to a potential reshaping of the market’s structure, with the balance of Bitcoin ownership leaning progressively towards those with a longer investment horizon.

These findings underline the volatility and flux inherent in the cryptocurrency markets as it continues to mature, and the growing divergence between short and long-term holders could carry significant implications for future market dynamics.

The post Short-term bitcoin holders retreat, reshaping market balance towards long-term investors appeared first on CryptoSlate.