On-chain data shows the Bitcoin network saw new addresses crop up at the second-highest rate in history during the past weekend.

Bitcoin New Addresses Metric Shot Up During This Past Weekend

According to data from the market intelligence platform IntoTheBlock, BTC has just observed its highest number of new addresses since 2017. The relevant metric here is the “new addresses,” which simply keeps track of the total number of new addresses appearing on the Bitcoin network every day.

Generally, new users coming into the network aren’t the only ones generating new addresses as existing holders of the asset may also create new addresses for better privacy of their transactions and other purposes like dividing funds into multiple wallets.

Regardless of this, a good chunk of the new addresses being created on any given day are indeed signs that new investors are coming into the market, so the indicator can provide us with hints about how the adoption of the cryptocurrency is coming along.

When this metric has a high value, it naturally means that a large number of addresses are coming online for the first time on the blockchain, which could suggest that new traffic is being attracted to the blockchain currently.

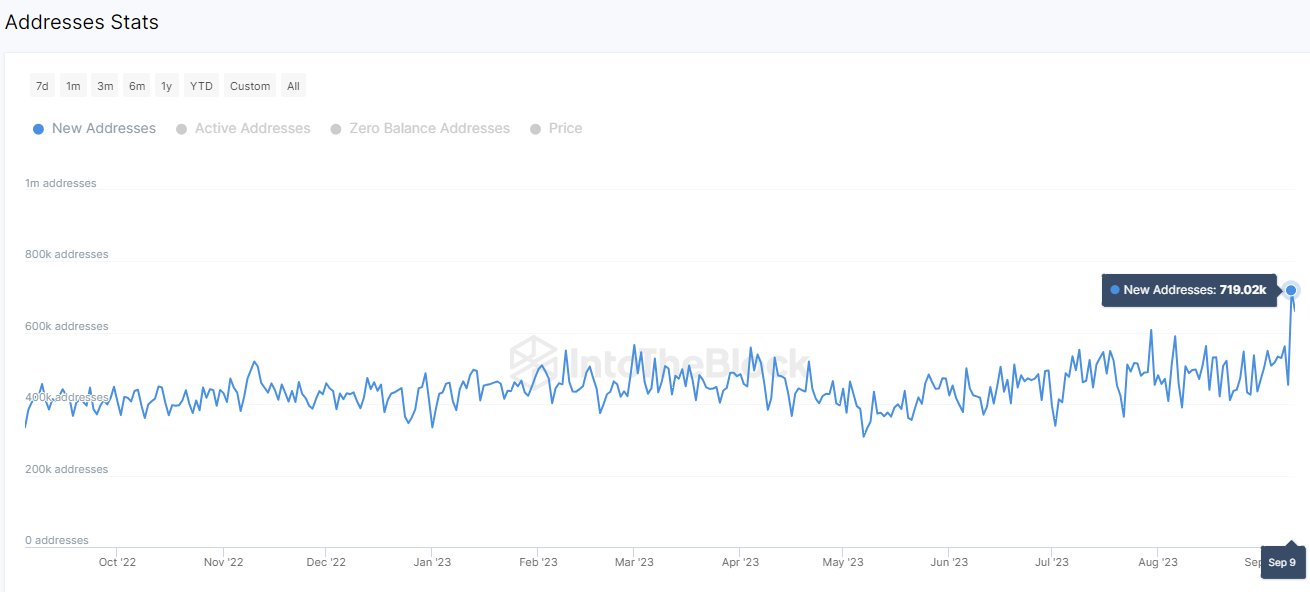

Now, here is a chart that shows the trend in the Bitcoin new addresses over the past year:

As displayed in the above graph, the metric’s value shot up during the weekend that has just passed by, suggesting a significant amount of address creation has occurred.

At the peak of this spike, the daily value of the metric had been about 719,000 addresses, which is the highest that the indicator has been since 2017. The spike in 2017 is an all-time high for the daily new addresses, which means that this latest value is the second-highest spike that the asset has ever seen.

This extraordinary influx of new addresses on the network would imply a large amount of investors have decided to enter into the market. Historically, adoption has been a constructive sign for the cryptocurrency, as a large user base provides for a more solid foundation for sustainable growth in the future.

Any positives arising from adoption, however, typically don’t appear in the short-term periods, as the effect only plays a role for the asset in the longer timespans.

BTC Price

Bitcoin has continued to struggle recently as the asset has been devoid of any sort of real volatility. At present, the asset’s price is floating around the $25,600 mark.

These recent prices may be what has pushed new users toward the network, as they may have found the current lows to be a viable entry point into the market.

However, as mentioned before, this adoption is unlikely to be of any help to the cryptocurrency right now, unless the users coming in are the likes of the whales.