In the first week of September, an outflow of $59 million worth of digital assets managed by Digital Asset Funds was recorded, the latest Coinshares data has shown. The latest outflow means the value of digital asset investment products under management has dropped by a total of $294 million or 0.9% in the past four weeks. The Coinshares data shows bitcoin (BTC) as the digital asset which had the highest net outflow ($69 million) in the first week of September.

Bitcoin Short Inflows the Largest Since March

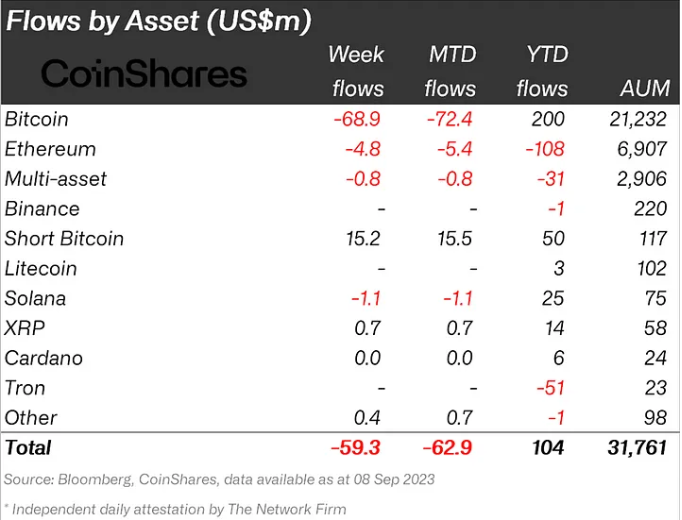

During the first week of September, digital asset investment products saw a net outflow of $59 million in assets under management (AUM), the latest data from the alternative asset manager Coinshare analysis has shown. According to the asset manager’s blog, the latest net outflow figure brings the value of total outflows in the past four weeks to $294 million, or 0.9% of total AUM.

As explained in the blog, inflows were also seen in short investment products and this may be an indication that the sentiment for digital assets remains poor. Concerns over the regulation of this asset class and the strengthening dollar are cited as some of the reasons why investors are less keen on investing in digital assets.

In terms of flows by asset, the Coinshares data shows bitcoin (BTC) as the digital asset that had the highest net outflow ($69 million) in the first week of September. On the other hand, short bitcoin net inflows during the same period topped $15 million, the largest since March 2023.

Meanwhile, Ethereum’s net outflow of $4.8 million during the same period saw its year-to-date outflows rise to US$108m representing 1.6% of the total AUM of $6.9 billion. Out of all the digital assets tracked by Coinshares, only XRP and other unidentified digital assets are shown to have recorded positive inflows of $0.7 million and $0.4 million respectively.

What are your thoughts on this story? Let us know what you think in the comments section below.