Quick Take

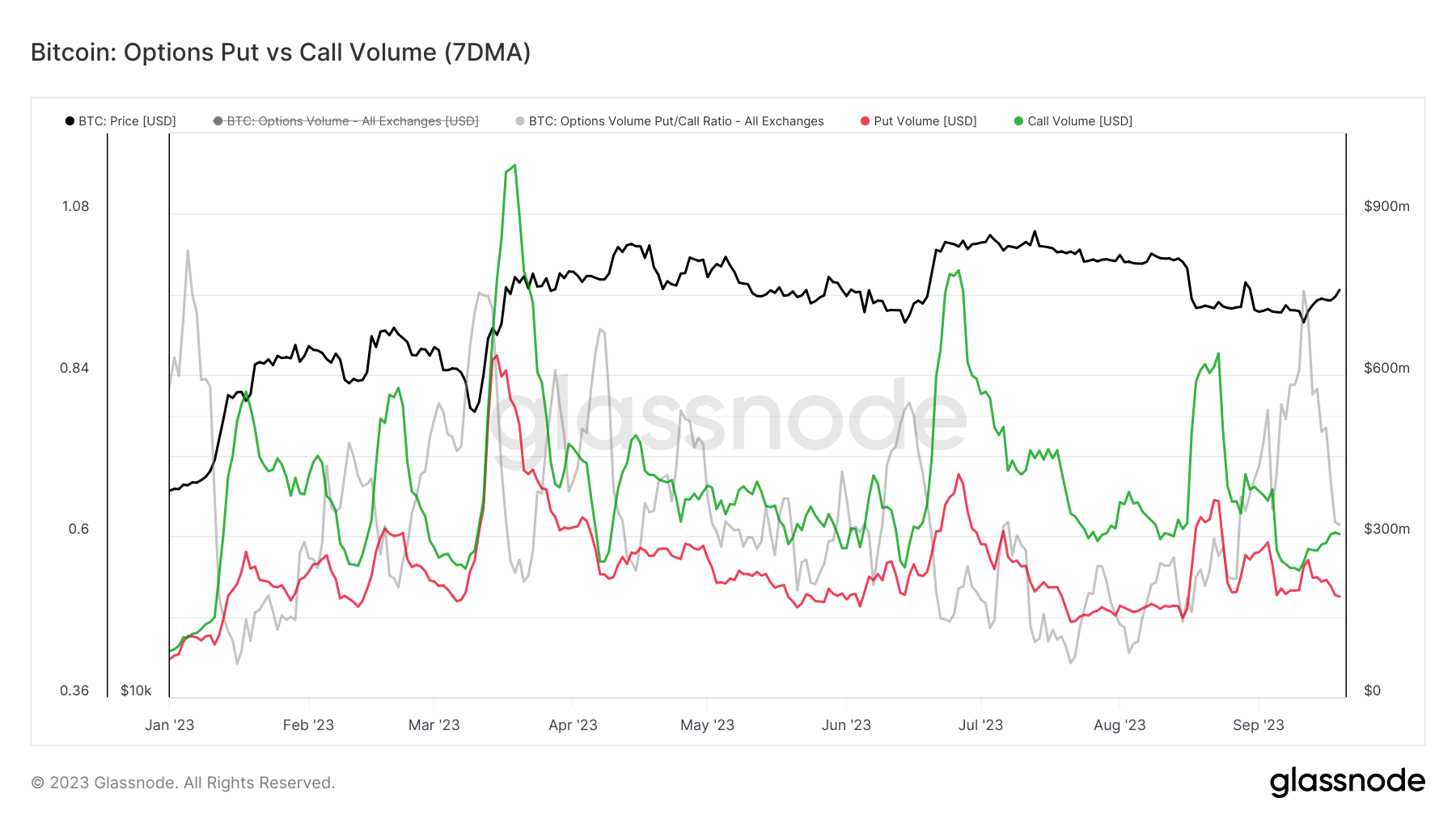

Recent data analysis reveals a noteworthy divergence within the Bitcoin options market. The volume of Put (red) and Call (green) options is displaying a material deviation, with a put/call ratio presently at 0.61.

This split signifies a shift in the market sentiment, where traders are seemingly leaning more towards call options with over $300 million in volume, compared to the puts volume, which is currently around $188 million.

This disparity indicates a potential bullish sentiment among market participants. However, the lower put/call ratio suggests that there is still a substantial number of traders hedging against potential price pullbacks, thereby illuminating the inherent volatility and risk that underpin the cryptocurrency market.

These diverging volumes in call and put options represent a complex narrative of optimism tempered with caution, reflective of the evolving dynamics in the Bitcoin options market.

The post Bitcoin options market sees bullish shift amid rising call options volume appeared first on CryptoSlate.