Quick Take

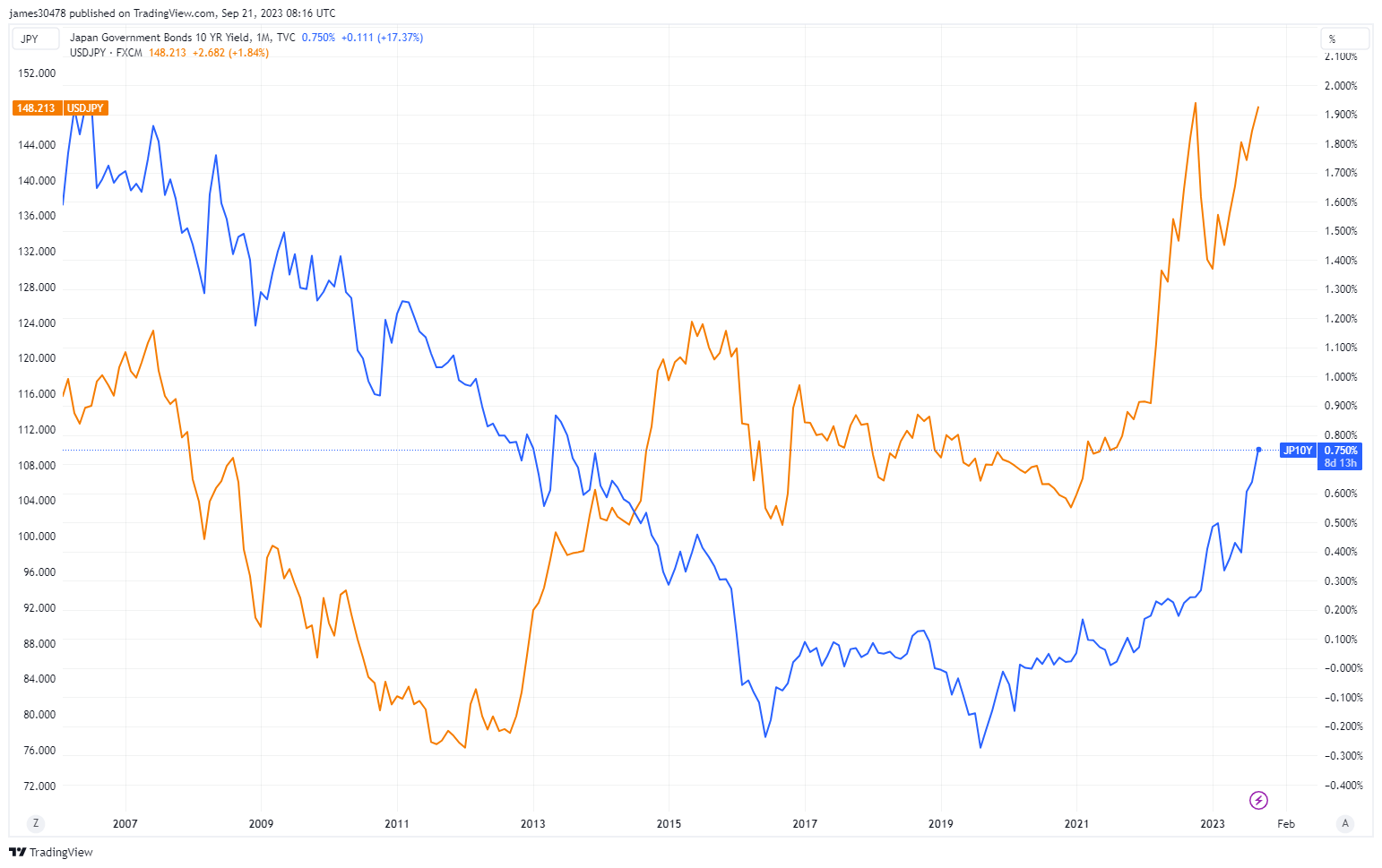

As Japan contends with a depreciating yen and rising 10-year bond yields, its economy stands at a unique crossroads. The yen’s fall to a 148-year-to-date low against the US dollar brings with it a mixed bag of economic implications.

On the flip side, a weaker yen can potentially boost Japanese exporters by making their products more competitive globally. However, it also threatens to raise import costs, potentially fueling inflation and affecting those with foreign currency holdings or debts.

Simultaneously, the 10-year Japanese government bond yield has reached its highest level since 2013, indicating that investors may be demanding a higher return for holding these securities. This could reflect concerns about Japan’s fiscal health, expectations about future inflation, or tighter monetary policy. The increase in yields, while reflecting investor sentiment, also poses a challenge by potentially raising the government’s borrowing costs.

The Bank of Japan (BoJ) now faces the intricate task of maintaining currency stability and keeping yields low amidst a high public debt environment. Complicating the task further is the Yen-dollar carry trade, which could intensify the pressure on the yen as the interest rate difference between Japan and the US widens. .

The post Japan’s economy on the brink as yen stumbles to 148-year low, bond yields soar appeared first on CryptoSlate.