Quick Take

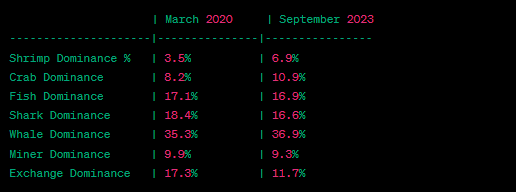

From March 2020 to September 2023, the landscape of Bitcoin entity balance dominance witnessed a notable shift. The ‘shrimp’ class, entities holding less than 1 Bitcoin, saw their dominance rise from 3.5% to 6.9%, indicating a growing number of small-scale investors. Similarly, ‘crab’ entities holding 1-10 Bitcoins surged from 8.2% to 10.9%, reinforcing this trend.

A slight decrease was observed among ‘fish’ entities (10-1000 Bitcoins) from 17.1% to 16.9%, and a more significant drop among ‘sharks’ (1000-10000 Bitcoins) from 18.4% to 16.6%. However, the ‘whale’ entities holding over 10,000 Bitcoins increased their dominance from 35.3% to 36.9%, suggesting a continued concentration of wealth at the higher end.

Both mining and exchange entities saw their dominance reduce, with miner dominance dropping from 9.9% to 9.3% and exchange dominance plummeting from 17.3% to 11.7%. This indicates a reduction in their relative sell pressure over time.

These shifts in balance dominance reflect the dynamic Bitcoin market where smaller investors are increasing, yet the vast wealth remains concentrated among the larger entities.

The post Shrimp and whales surge ahead in shifting Bitcoin balance landscape appeared first on CryptoSlate.