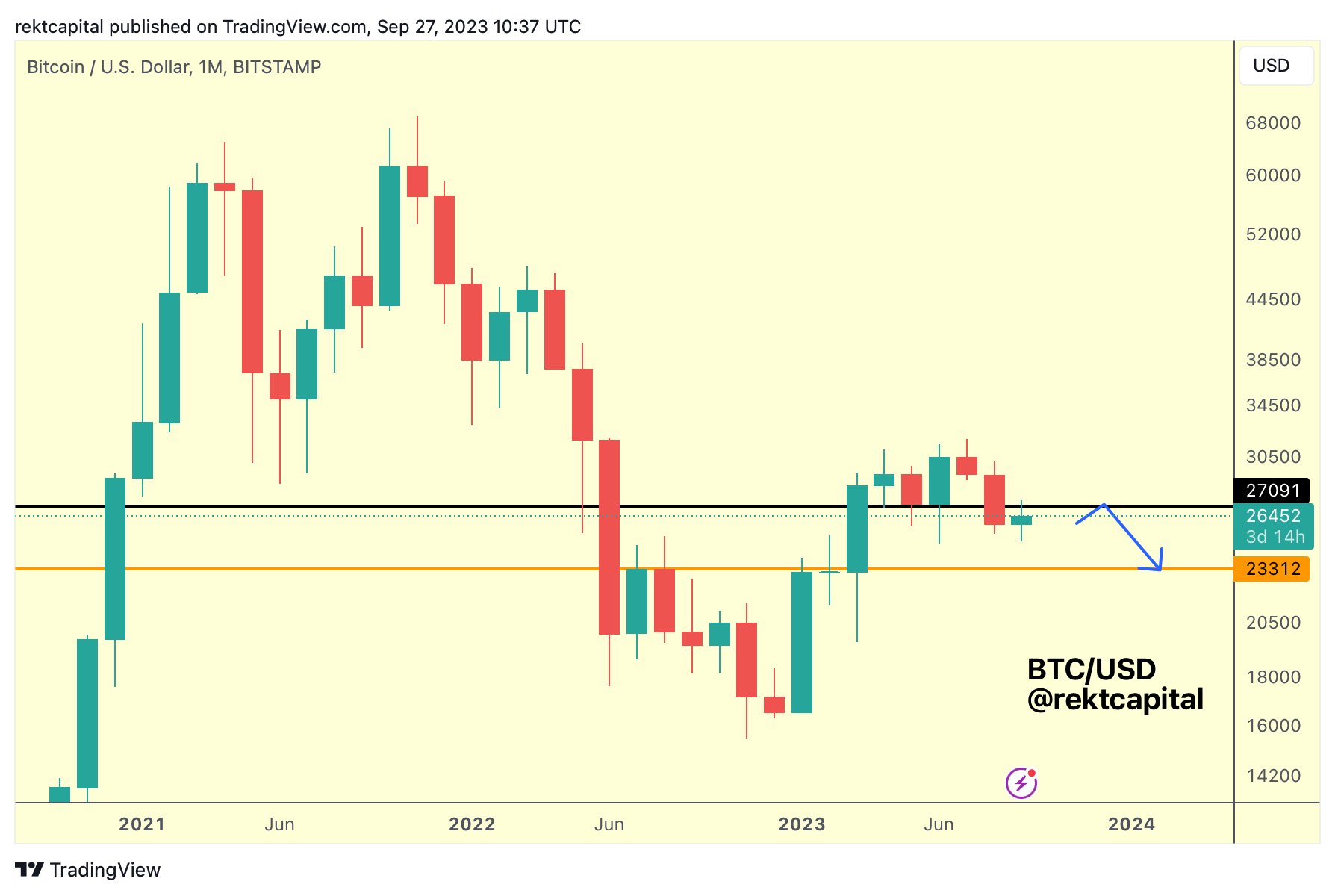

Renowned crypto analyst Rekt Capital has recently highlighted the pivotal nature of the Bitcoin price’s imminent monthly candle close. In a statement via X (formerly Twitter), he detailed that Bitcoin has tagged the $27,000 monthly level from the underside, meaning it is acting as resistance for the time being.

He explained that “the upcoming monthly candle close is just around the corner. Bitcoin needs to monthly close above $27,091 for this to be a fake-breakdown. Otherwise, the breakdown will be technically confirmed.”

To give this statement some historical context, the preceding month – August – saw a significant development for the flagship cryptocurrency. BTC registered a bearish monthly candle close, finishing below approximately $27,150. This data point, according to Rekt Capital, effectively confirmed it as lost support.

Reflecting on this development at the time, the analyst had conveyed that it is possible BTC could surge to $27,150, “maybe even upside wick beyond it this September. But that would likely be a relief rally to confirm $27150 as new resistance before dropping into the ~$23000 region. $23000 is the next major Monthly support now that ~$27150 has been lost.”

Is Bitcoin Following Historical Patterns?

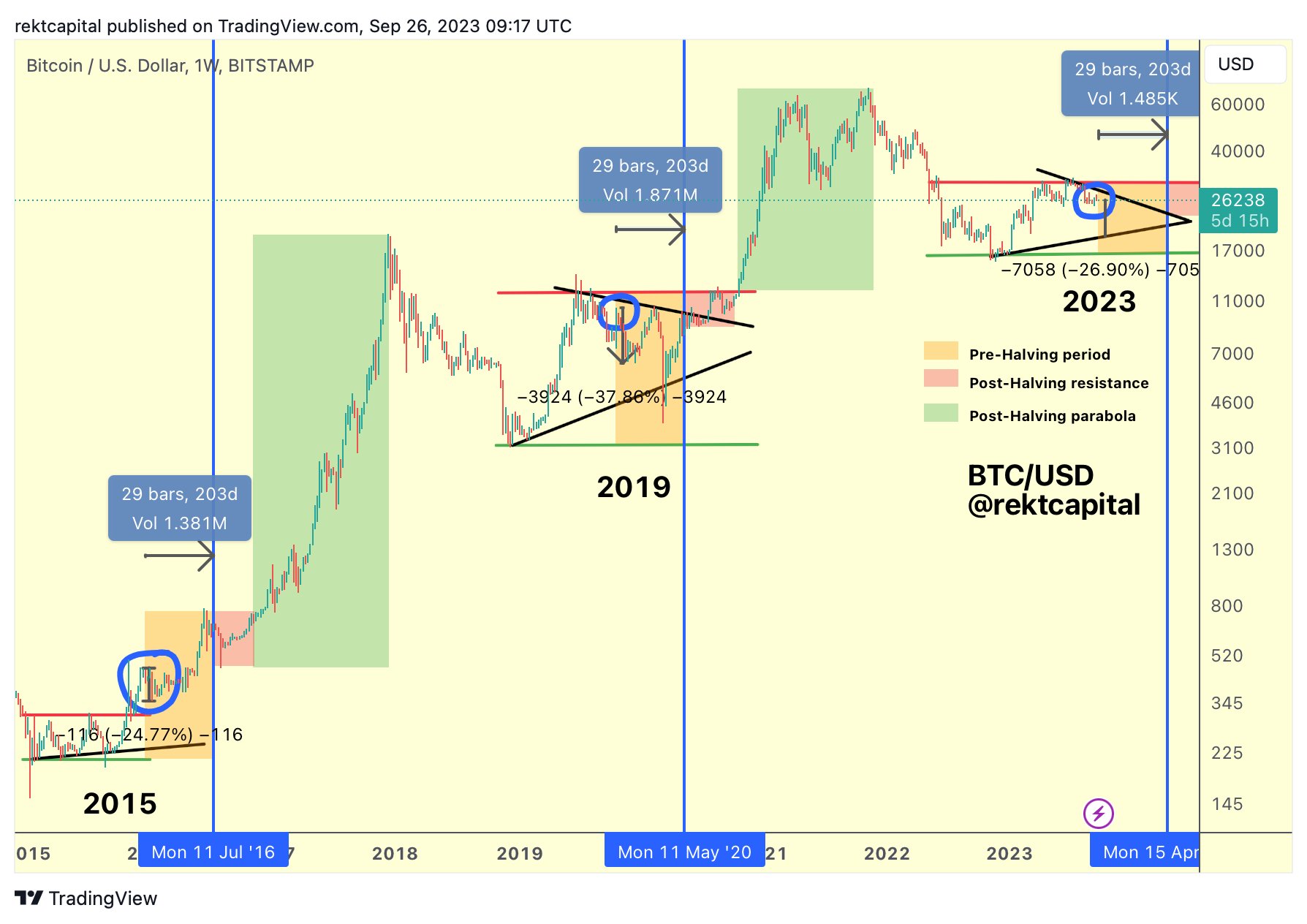

Rekt Capital’s observations about Bitcoin aren’t made in isolation but are deeply rooted in Bitcoin’s historical price and cycle behaviors. Drawing parallels to previous patterns, he had previously shed light on Bitcoin’s tendencies around 200 days before a halving event.

“At this same point in the cycle (~200 days before the halving): In 2015, Bitcoin retraced -24% within a re-accumulation range, but price consolidated for months going into the halving. In 2019, Bitcoin retraced -37% as part of a downtrend that continued for months going into the halving.”

These historical retracements at a similar juncture have given rise to two essential insights, as stated by Rekt Capital. First, an immediate retracement has occurred at this same point in the cycle. Second, a repeated retrace of between -24% to -37% in 2023 would lead Bitcoin to retest its macro higher low, possibly pushing its price under the $20,000 threshold.

The analyst didn’t stop there. Accentuating the ideal accumulation phases for investors, he noted, “The best time to accumulate Bitcoin was in late 2022 near the bear market bottom. The second best time to accumulate Bitcoin is upon a deeper retracement in the pre-halving period.”

Shifting the focus to potential future outcomes, Rekt Capital made an intriguing speculation about the potential of BTC’s price movement post-halving: “If ~$31000 was the top for 2023. Then the next time we see these prices will be months from now, just after the halving. Only difference between now and then? In this pre-halving period, BTC could still retrace from here. But after the halving, BTC would break out much higher from current prices.”

To summarize, the upcoming monthly candle close for Bitcoin could have profound implications for the asset’s short-to-mid-term trajectory. All eyes will now be on whether BTC manages to close above or below the critical $27,150 mark – an indicator that could either confirm a technical breakdown or prevail over a historically untypical price rally.

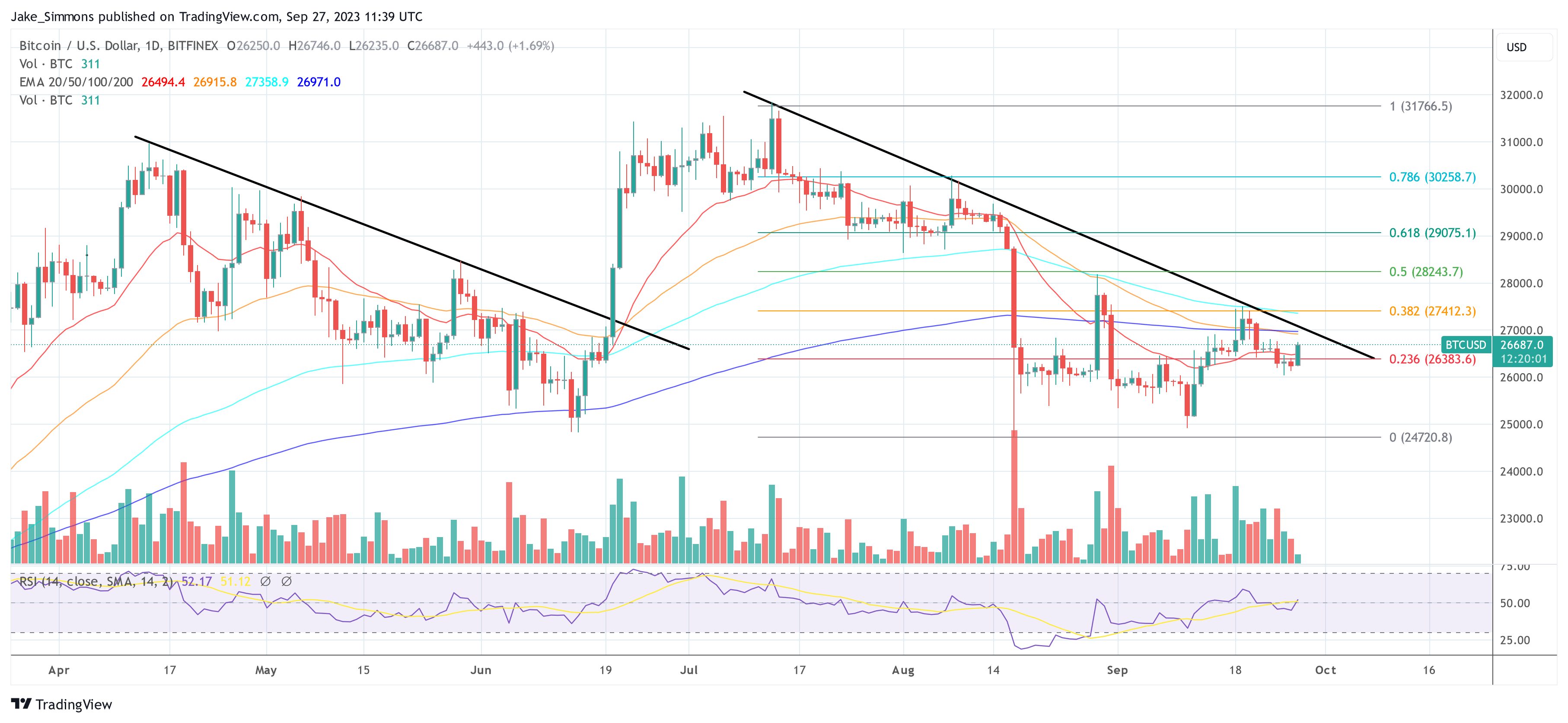

At press time, BTC stood at $26,687.