The Maker token, MKR, has managed to break the $1,500 level with a sharp 15% rally as on-chain data shows MKR has seen high address activity recently.

Maker Has Outperformed Top Coins With 15% Rally In Past Week

While giants like Bitcoin have struggled recently, MKR has proven to be different as the coin has observed an impressive run of bullish momentum. Following the latest leg up in the asset’s rally, it has surged past the $1,500 level, a feat it hasn’t replicated since May 2022, almost a year and a half ago now.

Related Reading: Bitcoin Bearish Signal: Long-Term Holders Deposit To Exchanges

The below chart shows what the asset’s recent rally has looked like:

Out of the top 100 cryptocurrencies by market cap, only Chainlink (LINK) and Curve (CRV) have seen better returns than Maker’s 15% gains during the past week.

Even these two assets haven’t seen bullish momentum as consistent as MKR in the past month, though, as MKR’s superb 42% profits in the period notably outshine theirs.

Maker Active Addresses Have Hit A 10-Week High

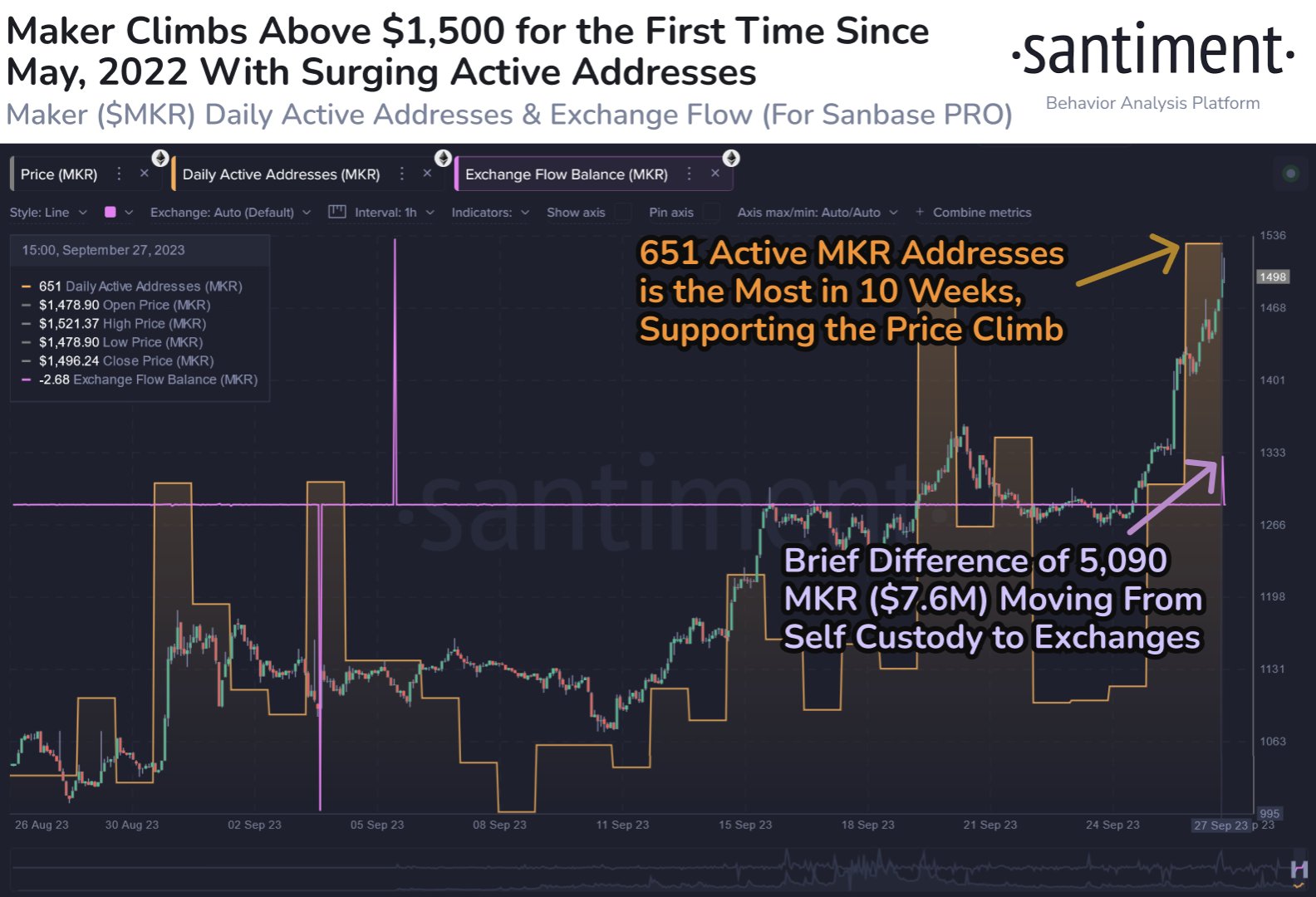

According to data from the on-chain analytics firm Santiment, this sharp run in MKR has come alongside a surge in the cryptocurrency’s “active addresses” metric.

This indicator keeps track of the daily total number of unique Maker addresses that are taking part in some kind of transaction activity on the blockchain. This metric’s value can simply be looked at as the amount of traffic that the network is receiving every day.

When the indicator has high values, it means that a large number of users are participating in the trading activity of the asset. Such a trend implies that interest in the coin is high currently.

Now, here is a chart that shows how the active addresses metric has changed for MKR during the past month:

From the graph, it’s visible that the Maker active addresses have climbed up alongside the rally in the asset’s price. After the latest increase in the indicator, its value has hit 651, which is the highest observed in around 10 weeks.

Generally, for any surge to be sustainable, it requires continued participation from a large amount of traders. Rallies that aren’t accompanied by a sufficient rise in user activity usually run out of steam before long.

Since the latest Maker surge has seen an increasing number of addresses becoming active, signs could be looking good for its sustainability. As the price continues its run, though, some investors might be tempted to harvest the high profits that they have amassed.

In the same chart, Santiment has also attached the data for the exchange netflow, which shows that some inflows of $7.6 million just have occurred towards centralized exchange platforms, implying that profit-taking may already be beginning.

This is a relatively modest amount, but the analytics firm warns that inflows can be something to be cautious about, as they could lead towards at least a temporary top in the price.