The United States Securities and Exchange Commission (SEC) has once again deferred its decisions regarding multiple proposals for spot Bitcoin exchange-traded funds (ETFs) from leading financial institutions, including BlackRock. This move by the SEC precedes an impending government shutdown, which is anticipated to influence the functioning of the country’s financial regulators and other federal agencies.

James Seyffart, a Bloomberg ETF analyst, has been actively providing updates on the situation through his X (formerly Twitter) account. Among the firms mentioned in Seyffart’s tweets, BlackRock, Bitwise Invest, Invesco, and Galaxy Digital have already received delay orders from the SEC.

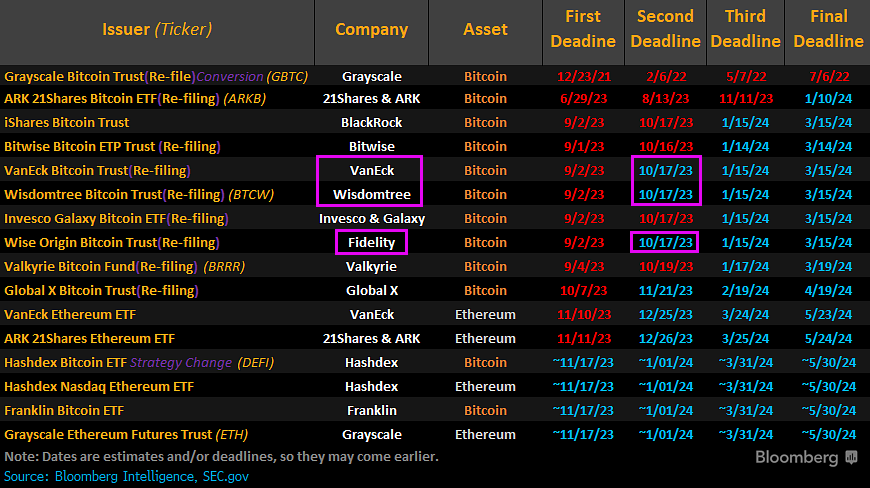

Seyffart predicts that the remaining applications from WisdomTree, VanEck, and Fidelity will likely be postponed today as well, especially given the looming possibility of a government shutdown. He stated, “Okay. Guessing the SEC is done for the night. We’re expecting the other 3 Bitcoin ETF delay orders tomorrow before the government shut down.”

While many market participants were expecting responses from the SEC by mid-October, the advanced delays—two weeks ahead of the anticipated second deadline—have been attributed to the potential US government “shutdown” set to occur on Oct. 1. With the House and Senate yet to reach a consensus on various funding bills, the urgency to avoid a shutdown has intensified.

SEC’s Official Reasoning For Delaying The Bitcoin ETFs

The SEC has raised several concerns and considerations over the proposed spot Bitcoin ETFs. Among them, there are legal and policy issues that the proposal has brought up, which require more in-depth analysis. The SEC is also focused on ensuring that national securities exchange rules are designed robustly to prevent fraudulent and manipulative acts. This is done to ensure the protection of investors and the public interest.

Furthermore, the SEC has expressed apprehensions about the liquidity, transparency, and susceptibility of the bitcoin markets to manipulation. They’re keen to understand the relationship between the Bitcoin spot market and the CME Bitcoin futures market, exploring how one might influence the other.

An additional factor being considered is the surveillance-sharing agreement that the Exchange intends to have with Coinbase, Inc. The SEC is questioning the effectiveness of such an agreement in deterring malicious practices.

The regulator also argued that Bitcoin, due to its geographically diverse and continuous trading nature, could be vulnerable to price manipulation. Therefore, the SEC is seeking feedback on this particular claim to determine its validity. Lastly, the SEC is inviting comments that address the adequacy of the statements made by the Exchange in support of their proposal.

Industry Comments

Scott Johnsson, a finance lawyer at Davis Polk, also offered his insights into the situation. He stated, “The wiggle room for the SEC to further deny spot BTC ETF is MUCH smaller than I think many realize.” Drawing attention to a particular precedent, he added, “People thinking they can just reimagine a completely new and unrelated theory have not read the Grayscale ruling closely enough.”

Johnsson also alluded to the looming government shutdown and its potential impact, remarking, “SEC will have ‘skeletal staff’ in a shutdown (Gary says 7-8%). Absent a petition for rehearing tomorrow re: Grayscale case and before the shutdown, we might be able to infer that it likely won’t be coming at all? Or perhaps odds drop significantly. They clearly are trying to get their house in order for an extended break.”

With another set of deadlines for these applications approaching in mid-January, further delays are a possibility. However, the SEC must finalize its decision by mid-March.

Eric Balchunas, another ETF analyst at Bloomberg, previously estimated a 75% chance of a Bitcoin spot ETF being approved by the end of 2023. Thus, this prediction, if the three missing delays also come in today, will not come true. But the probability increases to 95% by the end of 2024. He argues that the US Court of Appeals’ decisive ruling in favor of Grayscale against the SEC is a major factor in this optimistic projection.

At press time, BTC traded at $26,996, up 2.1% in the last 24 hours.