Data from Santiment shows that several altcoins have registered an increase in address activity, which may make them worth keeping an eye on.

Bitcoin Cash & Other Altcoins Have Observed A Rise In Active Addresses

As explained by the on-chain analytics firm Santiment in a new post on X, some alts are seeing rising activity despite the cooldown that the overall cryptocurrency sector has observed in the past couple of days.

The indicator of interest here is the “daily active addresses,” which keeps track of the total number of unique addresses of any given coin that are interacting on the blockchain in some way every day. The metric accounts for both senders and receivers.

By “unique,” what’s meant here is that any address participating in transaction activity on the blockchain is only counted once, regardless of how many transfers it may be involved in.

This restriction helps provide a more accurate representation of the actual activity on the network, as just a few addresses making hundreds of transactions can’t skew the metric by themselves.

When the value of the indicator is high, it means that there are a large number of unique addresses taking part in transaction activity right now. Such a trend implies the blockchain is receiving a high amount of traffic currently.

On the other hand, low values imply not many users are interacting with the network, a possible sign that interest in trading the cryptocurrency is low at the moment.

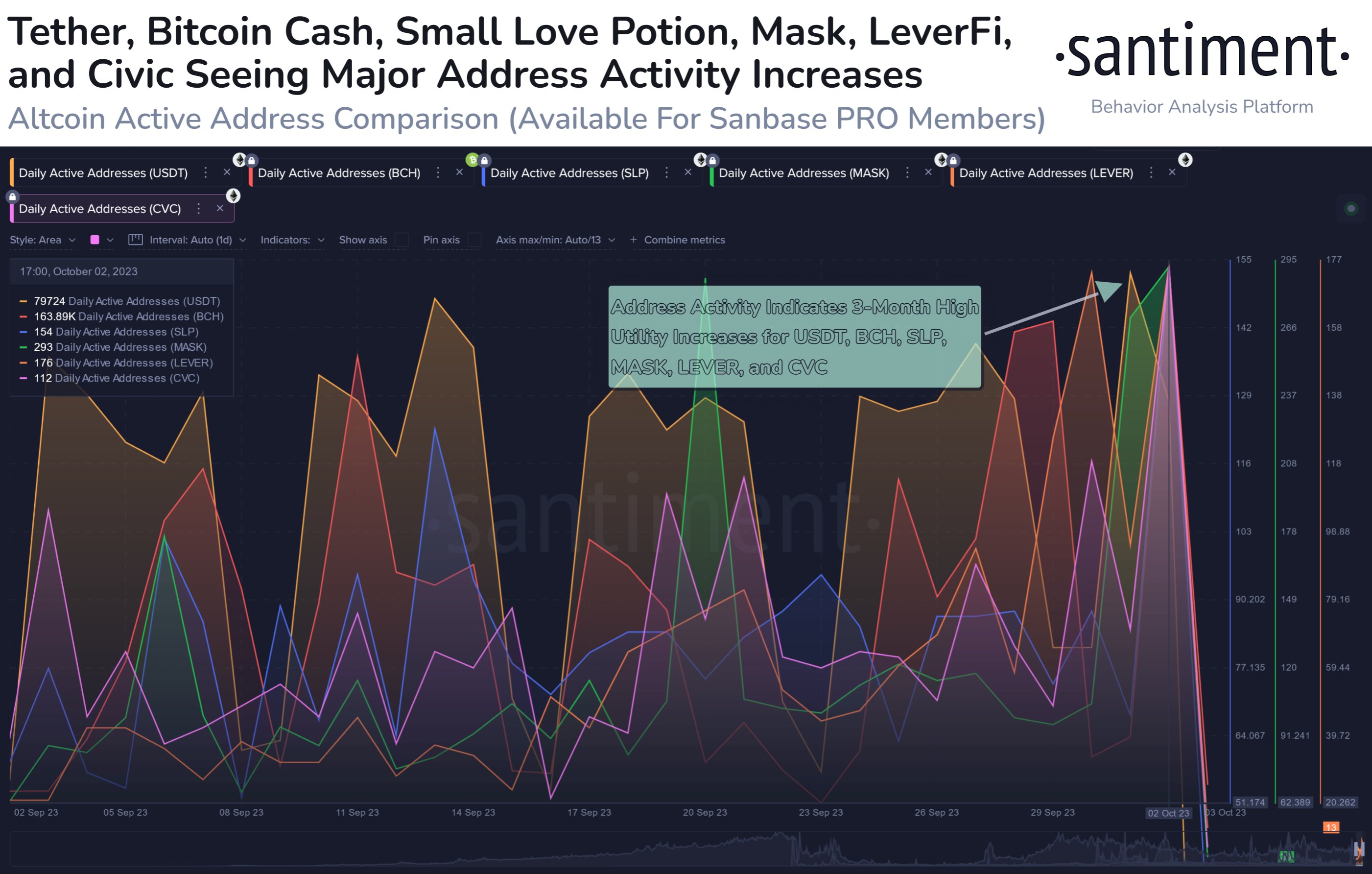

Now, here is a chart that shows the trend in the daily active addresses for several different altcoins over the past month:

As displayed in the above graph, the daily active addresses indicator has observed a sharp surge in the past couple of days for the altcoins listed here: Bitcoin Cash (BCH), Small Love Potion (SLP), Mask (MASK), LeverFi (LEVER), and Civic (CVC).

According to Santiment, these latest highs in the metric correspond to the highest levels that these cryptocurrencies have witnessed in around three months. Such high activity naturally suggests that there is a lot of interest in these coins among investors right now.

Most of these are small-cap coins, though, but there is one among them that has a very notable standing in the rest of the market: BCH. The 16th-ranked asset in the sector has registered a decline in the last two days, much like the wider sector, but the asset’s active addresses have remained high in number.

Usually, high address activity is a good sign for rallies, as a large amount of active trader pool means that the move has a higher probability of finding the fuel it needs to keep itself going.

Interestingly, besides these altcoins, the largest stablecoin in the sector, Tether (USDT), has also seen the indicator shoot up during this period. Investors use stablecoins for storing their value in a more secure form and for buying into other assets, so the high address activity can potentially be a sign that some moves are taking place in the background.

BCH Price

Bitcoin Cash had earlier surged past the $250 mark, but with the latest drawdown, the altcoin has plunged to $230.