Among the countries across the globe vying for dominance in the evolving crypto market, the United Kingdom has recently made its mark.

The recent influx in crypto activity in the UK, according to a study by Chainlaysis, comes in the wake of increased regulations targeting the digital currency and stablecoin sectors.

The study highlighted the UK’s soaring ascent in the global digital currency space. The island nation, known for its financial hubs and bustling urban centers, has kept pace with its peers and surpassed many.

UK: A Dominant Player In Central, Northern, And Western Europe

The new report from the blockchain analytics giant, Chainalysis, sheds light on the UK’s noteworthy strides in the digital currency arena. Released on October 18, Chainalysis’s 2023 Geography of Cryptocurrency details the activities of various regions, with a particular chapter dedicated to Central, Northern, and Western Europe (CNWE).

According to the data, CNWE is the second-largest global crypto economy, trailing only North America. This European region was responsible for roughly 17.6% of global crypto transaction volume from July 2022 to June 2023. During this period, it recorded an estimated transaction value of $1 trillion.

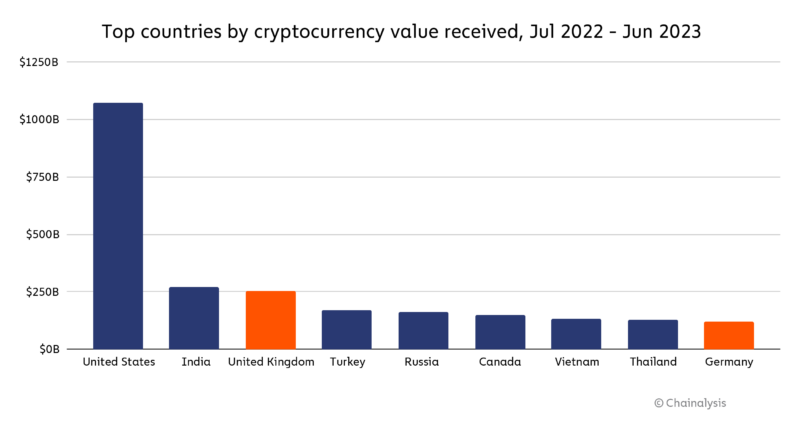

The UK, however, steals the spotlight within CNWE. Topping the region’s digital currency economies list, the country is now third globally in transaction volumes, following the US and India closely.

With an estimated $252.1 billion in digital currency transactions last year, the UK showcases its dominant role in shaping the European crypto narrative.

Other Notable Players In The CNWE Region

The Chainalysis report further delves into other key players in the CNWE region. Countries like Germany and Spain aren’t far behind, registering crypto transactions of around $120 billion and $110 billion in the past year.

This robust activity underscores the region’s importance in the broader digital currency sphere, with nations such as France, the Netherlands, Italy, Switzerland, and Sweden playing significant roles.

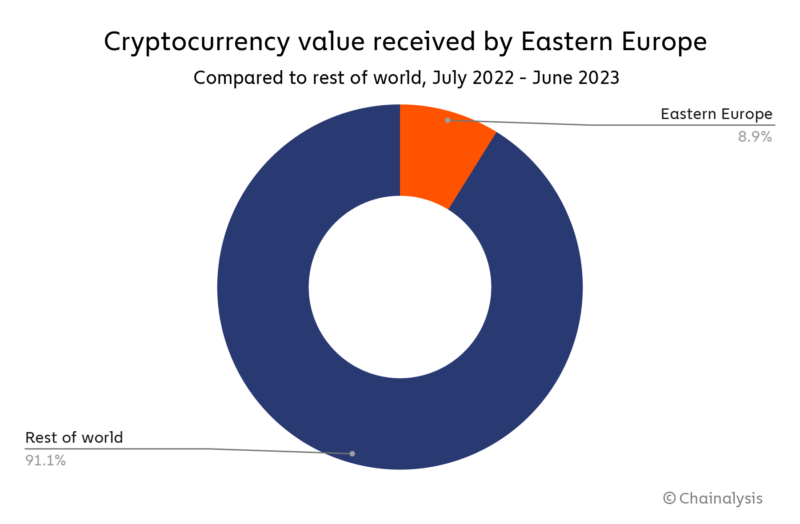

Furthermore, Chainalysis’s exploration of Eastern Europe’s crypto scene reveals interesting insights. Emerging as the fourth-largest digital currency market, this region saw $445 billion in crypto transactions from July 2022 to June 2023, making up 8.9% of the worldwide transaction volume.

Aside from the European region, Chainlalysis has also recently reported that Nigeria has continued to record a spike in crypto usage. According to the analytics firm, Nigeria’s digital currency transactions swelled 9% year-over-year, reaching $56.7 billion between July 2022 and June 2023.

Featured image from Unsplash, Chart from TradingView