Quick Take

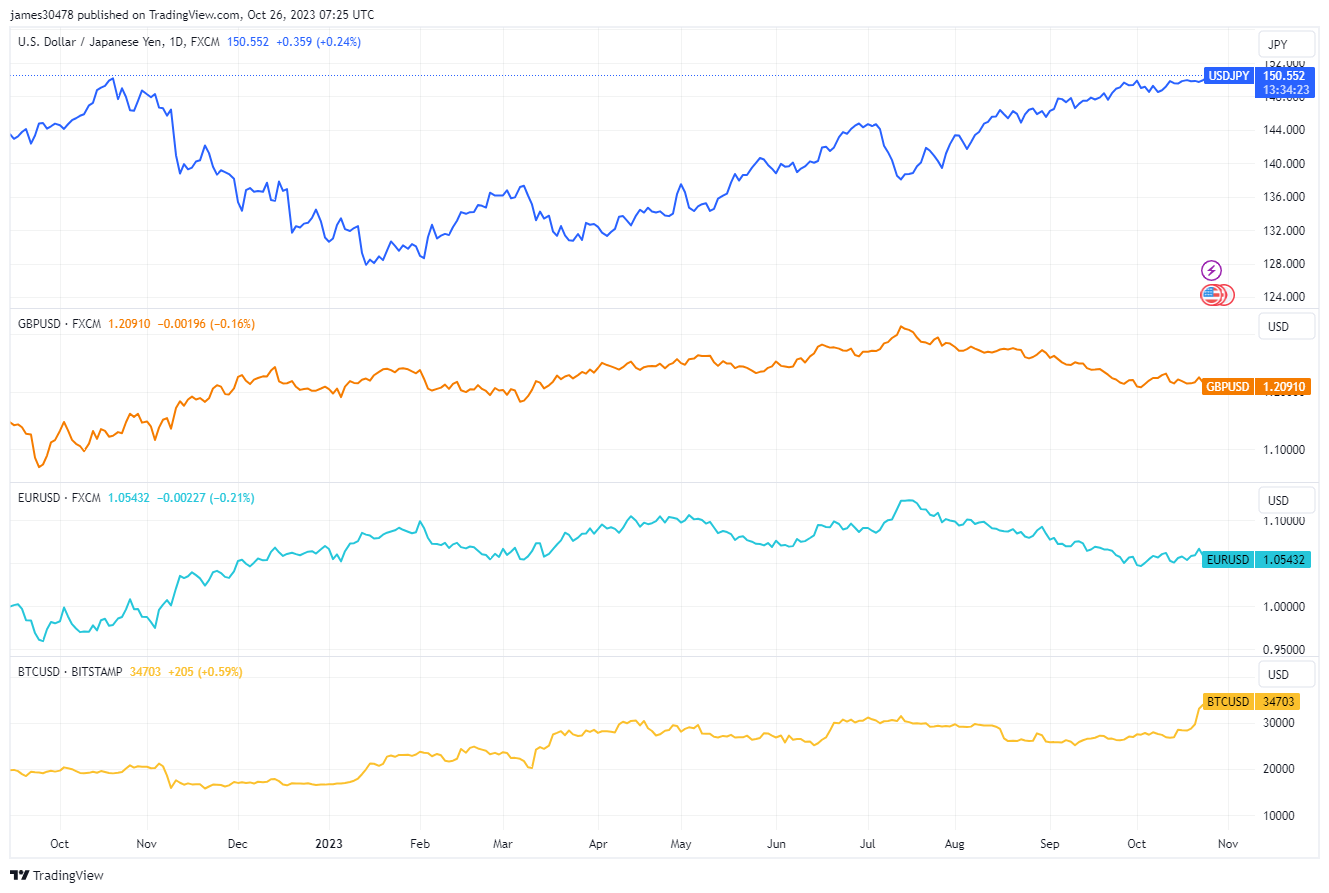

As Bitcoin records a year-to-date high of $35,000, turmoil stirs in traditional currencies.

The Japanese Yen has breached the 150 threshold, a level identified by some as critical for the Bank of Japan (BOJ) to shore up the Yen.

Paradoxically, repeated attempts to stabilize the Yen could have further implications, forcing the BOJ into a precarious position of selling U.S. bonds.

This action could inadvertently surge U.S. yields, already at a 5% high for the U.S. 10-year bonds.

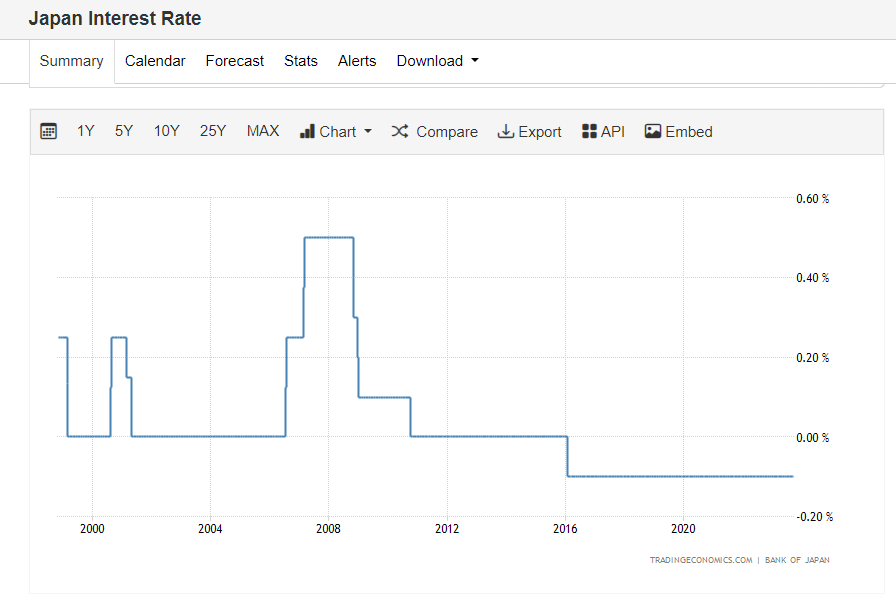

With the BOJ’s interest rate decision looming at the end of October, the world is watching. The rate, standing at -0.1% since 2016, could have profound implications for the Yen Carry Trade if increased.

In the meantime, the GBP has hit a low of 1.20 against the dollar, surrendering all gains from this year, and the Euro is wrestling with a 1.05 rate against the dollar. As the market braces for the Euro’s interest rate decision expected later today, a pause could thrust the currency to parity against the dollar.

The post Rising Bitcoin and unstable Yen means BOJ faces stiff decisions appeared first on CryptoSlate.