According to a recent report from Web3 market strategy consulting firm DeSpread report, the Korean crypto space will be populated by roughly 6 million investors, comprising more than 10% of the entire population.

Centralized Exchanges (CEX) appear to be the choice for most of these enthusiasts, according to the report. This massive influx of investors indicates a growing trust and interest in crypto, making South Korea a crucial player in global digital finance.

Dominance Of Korean Crypto-Centralized Exchanges

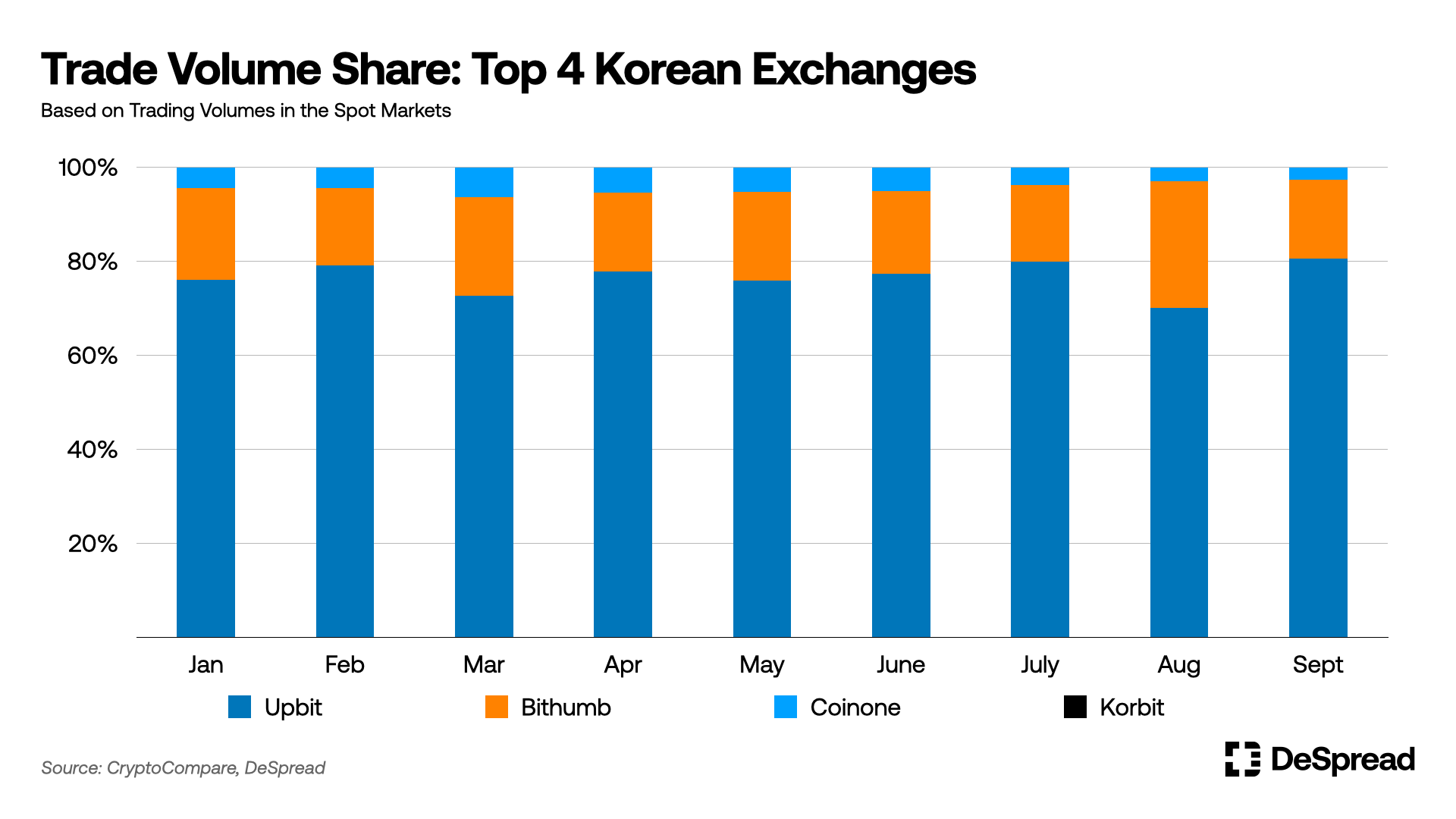

Against the backdrop of a worldwide slump in crypto trading volumes, Korean Centralized Exchanges (CEXs) tell a different story. Four pivotal players, Upbit, Bithumb, Coinone, and Korbit, seem to be driving this momentum, together accounting for 10% of the global trading volume.

This feat places them ahead of Coinbase, the second-largest exchange globally, in trading volumes. Upbit, in particular, leads the pack, registering a trading volume of $36 billion in February alone and securing 80% of the Korean market.

Following Upbit is Bithumb, capturing between 15% to 20%, while Coinone and Korbit trail with market shares of 3-5% and lower than 1%, respectively.

A Dive Into Altcoin Preferences

Investment trends often serve as a window into investor psychology. A closer look at Korean CEXs reveals a distinctive penchant for altcoins. As disclosed in the report, the investment space in the South Korean market stands in sharp contrast to platforms like Coinbase, which institutional investors predominantly influence. The report noted:

Unlike Upbit, where individual investors dominate, Coinbase’s trading volume is driven by institutional investors.

Further citing Coinbase’s Q2 shareholder letter, DeSpread noted:

Institutional investors account for approximately 85% of Coinbase’s total trading volume. They tend to pursue portfolio stability, which is why trading in BTC and ETH, which boast the highest market capitalization among cryptocurrencies, occupies a relatively high proportion.

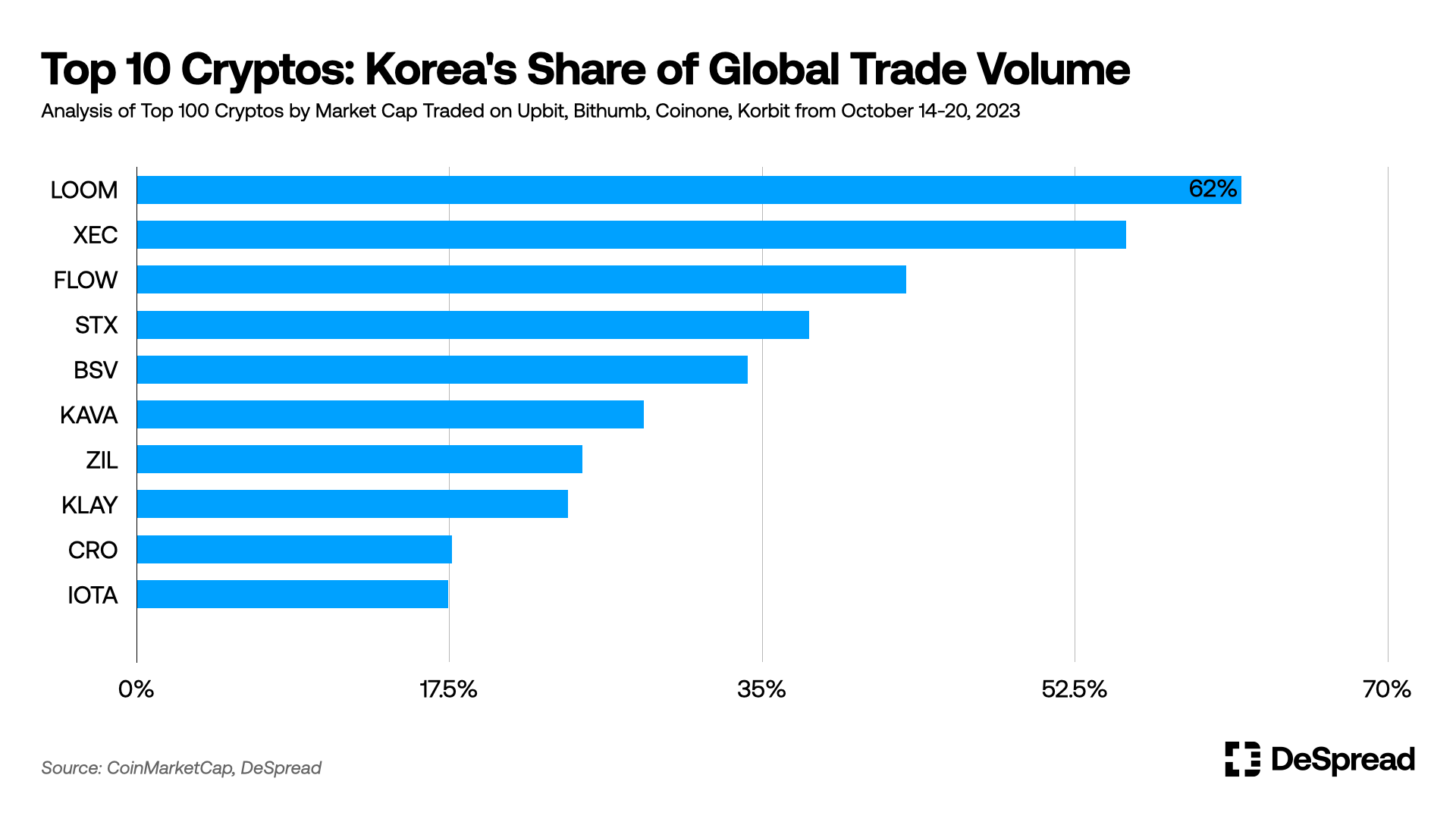

Data extracted from market reports further underlines this trend, highlighting Loom Network ($LOOM) with a trading dominance of 62%.

Following closely are eCash ($XEC) at 55% and Flow ($FLOW) at 43%. Other notable mentions include Stacks ($STX) and Bitcoin SV ($BSV), which also enjoy considerable attention with trading ratios of 37% and 34%, respectively.

Notably, while Bitcoin is the top crypto with the largest market capitalization, it is evident that the asset is not interesting to South Korean investors. Regardless, Bitcoin has continued to thrive, recording nearly 20% in the past week.

However, Bitcoin has seen quite a retracement from its previous gains that brought the asset to trade as high as $35,000. At the time of writing, Bitcoin trades for $35,027 with no significant movement in the past 24 hours.

Featured image from Unsplash, Chart from TradingView